Click for more.

This reset of Stellantis’ business resulted in charges of approximately €22.2 billion, excluded from AOI, for the second half of 2025, including cash payments of approximately €6.5 billion, which are expected to be paid over the next four years.

1. €14.7 billion related to re-aligning product plans with customer preferences and new emission regulations in the U.S., largely reflecting significantly reduced expectations for BEV products:

Includes write-offs related to cancelled products of €2.9 billion and impairment of platforms of €6.0 billion, primarily due to significantly reduced volume and profitability expectations.

Includes approximately €5.8 billion in projected cash payments over the next four years, relating to both cancelled products as well as other ongoing BEV products whose volumes are now expected to be considerably below prior projections.

2. €2.1 billion related to the resizing of the EV supply chain:

€2.1 billion of charges, including a total of approximately €0.7 billion in cash payments expected to be paid over the next four years, related to steps of rationalizing battery manufacturing capacity.

3. €5.4 billion related to other changes in the Company’s operations:

€4.1 billion due to a change in estimate for contractual warranty provision, resulting from the reassessment of the estimation process, taking into account recent increases in cost inflation and a deterioration in quality, as a result of operational choices, which did not deliver the expected quality performance, now being reversed by the new management team.

€1.3 billion of other charges, including restructuring primarily related to already communicated workforce reductions in Enlarged Europe.

“The Company has taken the vast majority of decisions required to correct direction, particularly related to aligning our product plans and portfolio with market demand, which are reflected in the amounts accrued,” Stellantis said

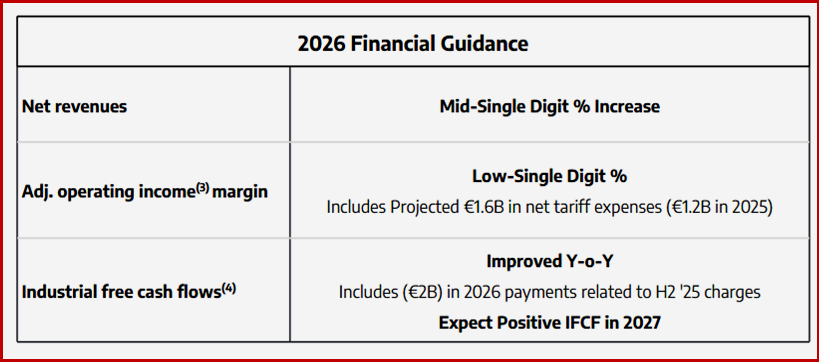

Preliminary financial information for the Second Half 2025 (1): Second half 2025 Net revenues and Industrial free cash flows improved compared to the first half of 2025, consistent with the Company’s latest financial guidance. However, results were negatively impacted by specific items, including the change in estimate for contractual warranties, and other items, resulting in AOI margin for the second half of 2025 finishing below the guided low-single digit range.

Inevitable STLA Footnotes

1. Final figures will be provided in our H2 2025 Results. Analysts should interpret these numbers with the understanding that they are preliminary and subject to change.

2. Adjusted Operating Income/(Loss) excludes from Net profit/(loss) adjustments comprising restructuring and other termination costs, impairments, asset write-offs, disposals of investments and unusual operating income/(expense) that are considered rare or discrete events and are infrequent in nature, as inclusion of such items is not considered to be indicative of the Company’s ongoing operating performance, and also excludes Net financial expenses/(income) and Tax expense/(benefit).

Unusual operating income/(expense) are impacts from strategic decisions, as well as events considered rare or discrete and infrequent in nature, as inclusion of such items is not considered to be indicative of the Company’s ongoing operating performance. Unusual operating income/(expense) includes, but may not be limited to: impacts from strategic decisions to rationalize Stellantis’ core operations; facility-related costs stemming from Stellantis’ plans to match production capacity and cost structure to market demand, and convergence and integration costs directly related to significant acquisitions or mergers.

3. Adjusted Operating Income/(Loss) Margin is calculated as Adjusted operating income/(loss) divided by Net revenues.

4. Industrial Free Cash Flows is our key cash flow metric and is calculated as Cash flows from operating activities less: (i) cash flows from operating activities from discontinued operations; (ii) cash flows from operating activities related to financial services, net of eliminations; (iii) investments in property, plant and equipment and intangible assets for industrial activities, (iv) contributions of equity to joint ventures and minor acquisitions of consolidated subsidiaries and equity method and other investments; and adjusted for: (i) net intercompany payments between continuing operations and discontinued operations; (ii) proceeds from disposal of assets and (iii) contributions to defined benefit pension plans, net of tax. The timing of Industrial free cash flows may be affected by the timing of monetization of receivables, factoring and the payment of accounts payables, as well as changes in other components of working capital, which can vary from period to period due to, among other things, cash management initiatives and other factors, some of which may be outside of the Company’s control. In addition Industrial free cash flows is one of the metrics used in the determination of the annual performance for eligible employees, including members of the Senior Management.

Industrial available liquidity is calculated as total cash, cash equivalents and financial securities plus undrawn committed credit lines available to Industrial activities.