Click to enlarge.

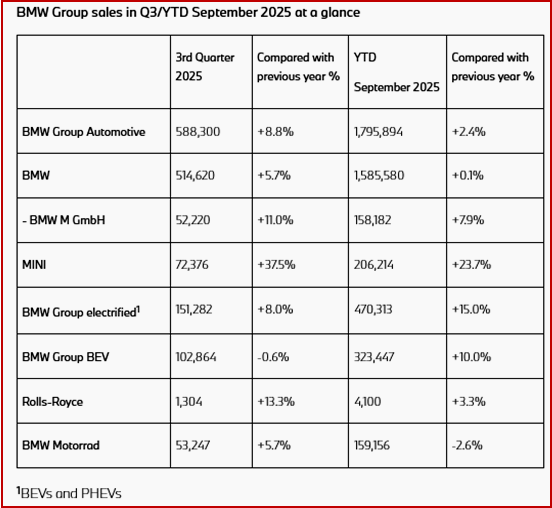

“The BMW Group reported a slight sales increase for the year to the end of September. The strong sales performance in Europe and the Americas, as well as for the MINI brand, is particularly encouraging. Demand for our wide range of electrified vehicles also remains strong,” said Jochen Goller, member of the Board of Management of BMW AG responsible for Customer, Brands, Sales.

“The BMW Group delivered volume growth year to date September in the European and Americas regions, however, the targeted volume growth in China remained below expectations. On this basis, the BMW Group decided to reduce volume expectations for the Chinese market in the fourth quarter. Additionally, the impact of a significant reduction of commissions from local Chinese banks in connection with the brokering of financial and insurance products to end customers requires financial support to strengthen dealer profitability,” BMW said.

“Furthermore, some of the assumptions on tariff reductions made at the time of its half year reporting have not been fully realized to date. In this context the BMW Group continues, however, to maintain the assumption that the EU implement the agreement with the US on reduction of tariffs from 10% to 0% on the import of vehicles and auto parts into the EU effective 1 August. Accounting for these additional factors weighing on profit, the Auto EBIT margin for 2025 will remain in the guided corridor of 5% to 7%, more specifically in the range of 5% to 6%,” BMW said.

The BMW outlook for the 2025 financial year is adjusted as follows:

• RoCE in Segment Automotive is expected in the corridor from 8% to 10% (previously: 9% to 13%).

• Group Earnings before Tax is expected to decline slightly (previously: on same level as previous year.

“Contrary to assumptions made to date, the BMW Group now assumes that reimbursements of customs duties from the American and German authorities totaling a high three-digit million figure will not be received in 2025 but only paid in 2026. Considering these reimbursements and the impact on profit outlined above, free cashflow in Segment Automotive for the year 2025 is expected to be above €2.5bn (previously above €5bn).