Click for more.

“We delivered a meaningful increase in segment operating income relative to the second quarter in an industry environment that continued to be marked by global trade disruption,” said Mark Stewart, chief executive officer and president. “This growth underscores our strong product portfolio and the consistency of our execution under the Goodyear Forward plan, both of which we expect to support further acceleration in our earnings during the fourth quarter.”

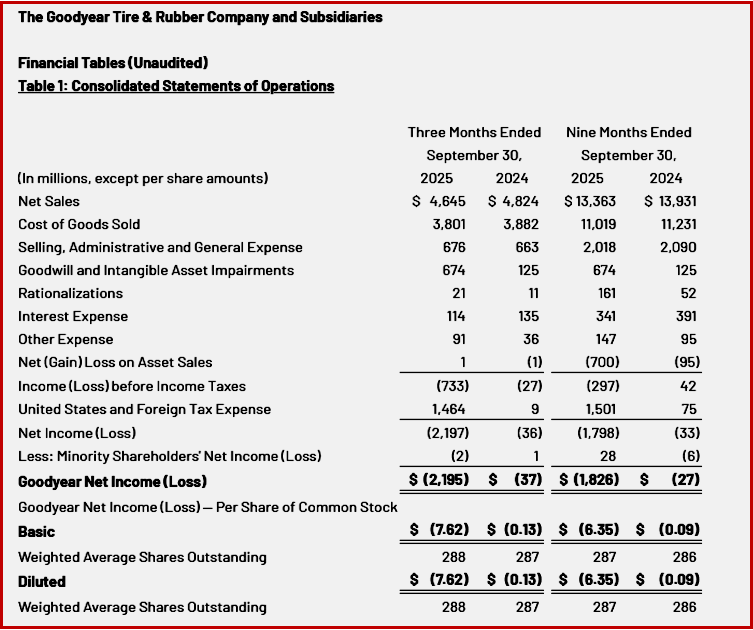

Goodyear’s Q3 2025 net sales were $4.6 billion, with tire unit volumes totaling 40 million. The third quarter of 2025 included several significant items, including a non-cash deferred tax asset valuation allowance of $1.4 billion, a non-cash goodwill impairment charge of $674 million and, on a pre-tax basis, rationalization charges of $21 million and Goodyear Forward [the restructuring plan in standard English – Autocrat] costs of $8 million. Including these items, Goodyear net loss was $2.2 billion ($7.62 per share) compared to Goodyear net loss of $37 million (13 cents per share) a year ago.

The third quarter of 2024 included, on a pre-tax basis, Goodyear Forward costs of $25 million and rationalization charges of $11 million. Goodyear Forward costs are comprised of advisory, legal and consulting fees and costs associated with planned asset sales.