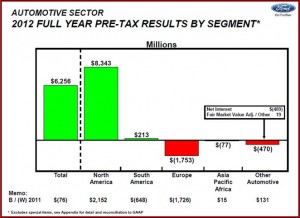

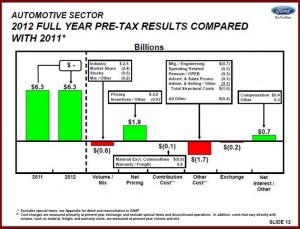

Ford Motor Company today reported a 2012 full year pre-tax profit of $8 billion because of strong sales results from North America and resulting revenue from Ford Credit. Ford sold 5.7 million vehicles globally during the year. Full year pre-tax profit at $1.41 per share, and net income of $5.7 billion, or $1.42 per share, were each lower than a year ago, though.

Fourth quarter pre-tax profit was $1.7 billion, or $0.31 per share, an increase of $577 million from 2011. Ford now has posted a pre-tax profit for 14 consecutive quarters. Fourth quarter net income was $1.6 billion, or $0.40 per share.

Ford remains heavily dependent on the slowly recovering North American auto market, where it earned $8.3 billion, with an operating margin of 10% on sales of 2.8 million vehicles during 2012. Because of Ford’s 2012 financial performance, the company will make profit sharing payments to 45,800 U.S. hourly employees of $8,300 each. Ford expects similar North American results in 2013, with perhaps a profit increase if the pickup truck market – where it is the sales leader – continues to recover.

Ford Europe lost a breathtaking $1.8 billion, with an operating margin of -6.6% on sales of 1.35 million vehicles. The loss was much higher than Ford had forecast and the result of the continuing deterioration of the European economy, which is outpacing Ford’s efforts to trim costs. Ford now expects full year 2013 results for Europe to be a loss of about $2 billion, compared to prior guidance of a loss about equal to 2012. The European market is now tracking sales volumes last seen in 1995. Ford said it expects the European market to hit bottom this year at about 13-14 million units. Worrisome is the pushing back of the launch of the New Mondeo until 2014 in an attempt to trim costs.

Ford Asia Pacific Africa also posted a full year loss of $77 million, even though it sold more than 1 million vehicles for the first time and recorded $10 billion in revenue, both records. For 2013, Ford expects Asia Pacific Africa to breakeven, as investments in new plants – seven are under construction – and products will offset market growth, particularly in China where total vehicle sales are expected to top 21 million. Ford predicts that its volume and revenue growth in the region will accelerate, helped by the launch of the all-new Kuga, Mondeo, EcoSport, and refreshed Fiesta across the region, as well as the launch of Mondeo and Explorer in China.

In South America pre-tax profit was $213 million, substantially lower than a year ago on sales of 498,000 vehicles. For 2013, Ford expects its South America results to break even. The competitive environment and currency risks across the region, especially in Venezuela with a huge devaluation pending, are expected sap profits. In addition, government actions to incentivize local production and balance trade are increasing trade frictions between South American countries and with Mexico. A trade war appears to be well underway.

As part of Ford’s previously announced plan to fund its pension obligations, the company made $3.4 billion in cash contributions in 2012 to its worldwide plans, $2.3 billion higher than 2011. This included $2 billion of discretionary contributions. In 2012, Ford settled $1.2 billion of its pension obligations as part of the voluntary lump sum payout program for salaried retirees, which began in the second half of 2012 and continues through 2013. For 2013, cash contributions to pension plans are expected to be about $5 billion globally, including discretionary contributions of about $3.4 billion. Ford still has $18.7 billion in debt it owes to its underfunded pension plans.