Low Interests rates and good trade-in prices should translate to increased sales particularly for the Detroit Three.

Auction prices for full-size pickup trucks are up 7% for the first four months of 2013, according to the May edition of the NADA Used Car Guide.

Contributing to the higher values for used, full-size pickups is supply and demand. The supply of full-size pickups up to 8-years-old declined by 17% from 2007 to 2012, and will fall by an additional 8% on an annual basis in 2013, NADA predicts. As a result, trade-in prices of full-size pickup trucks have increased 28% from 2007 to 2012.

NADA said that wholesale prices for all segments of used vehicles up to 8-years-old dropped by -1.7% in April. Compact and mid-size cars led the decline with prices falling by a combined average of -2.1%. Used prices for full-size pickups slipped only – 0.5% in April.

“The recovery of home values and increased residential construction, stabilizing gasoline prices and a decline in late-model supply have resulted in higher trade-in values for full-size pickups,” said Jonathan Banks of NADA.

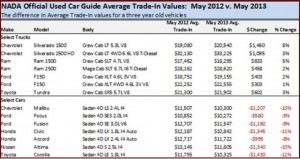

As an example, the average trade-in value for a 3-year-old Chevrolet Silverado 1500 Crew Cab LT 5.3-liter 2wd is $20,540, up $1,460 or 8%. Last year, the value of a 3-year-old Silverado was $19,080. The same trend is in evidence at all brands of full-size pickups.

“The late-model, used supply of full-size pickups has yet to recover from the dramatic fall off in new-vehicle sales caused by the economic recession,” Banks said.

New housing starts totaled 781,000 in 2012, and the National Association of Home Builders estimates that housing starts will jump to at least 1 million units in 2013. Home prices are also on the rise, up 8.7% over the first two months of 2013 compared to the same period a year ago, according to the S&P/Case-Shiller 20-City Composite Home Price Index

The increase in home prices should continue to increase demand for full-size pickups, particularly those used most frequently in construction, such as lower-priced 2-wheel drive, regular cab trucks with V6 engines.

“The low rate of depreciation for full-size pickups means that consumers will find themselves in a favorable equity position if they trade-in their used pickups for a new or newer pre-owned one,” Banks said. “There is little evidence to suggest that consumer demand for full-size pickups will diminish in the near-term. We expect prices in the segment to remain above average for the remainder of the year.”