It will be years before Ford earns a substantial return on its investments in India and China. It is also vulnerable to more downturns in Europe.

The Board of Directors of Ford Motor Company declared a Q3 dividend of $0.10 per share on the company’s outstanding family-controlled Class B and common stock. This is the same dividend paid in the first and second quarters of 2013 and double the amount paid in the same quarter last year. The third quarter dividend is payable on Sept. 3, 2013 to shareholders of record on Aug. 2, 2013.

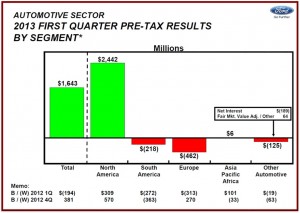

Ford reported a Q1 2013 pre-tax profit of $2.1 billion based almost entirely on positive results in North America where the car and light truck market is recovering. Q2 results are pending.

Net income for the first quarter of $1.6 billion, or 40 cents per share, was $215 million higher than a year ago. The company sold 1.5 million vehicles globally during the first three months of the year, an increase of 140,000 compared to Q1 of 2012 with 110,000 coming from North American sales.

Operating margin was only 5.2% or about half that of leading automakers. The mid-decade outlook is “an 8% to 10% margin, which as I mentioned a number of times in the past is a very, very strong margin in the automotive business on a consistent basis,” said Alan Mulally, Ford president and CEO on the Q1 results conference call with reporters.

The profit of 41 cents per share was $147 million lower than a year ago as results in Asia were weak because of ongoing expansion; weaker still in South America because of currency problems in Venezuela and Argentina, as well as competition; and frankly disastrous in Europe where Ford has not been able to stop a flood tide of red ink for decades.

The Number Two U.S. automaker is projecting a loss of $2 billion this year in Europe, while sticking to its previous assertion that it will earn a total company Pre-Tax Operating Profit of $2.1 billion. Consistent with prior guidance, the company expects its full year operating effective tax rate to be similar to 2012, which was 32%. It will be years before the company earns a substantial return on its ongoing investments in India and China. Ford is also vulnerable to further downturns in Europe, and a reversal of the recovery in the United States.

Read AutoInformed on: