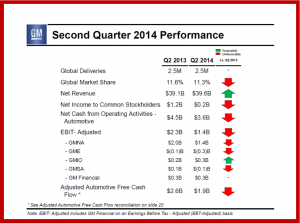

General Motors Company (NYSE: GM) today announced Q2 net income for GM common stockholders of $200 million, or $0.11 per diluted share. One year earlier, GM earned $1.2 billion or $0.75 per diluted share. GM delivered 2.5 million vehicles during Q2, the same as one year ago in a recovering market. GM’s global market share was down -0.3% at 11.3%.

GM’s slowly improving operating performance – earnings before interest and tax adjusted (EBIT) were $1.4 billion and included the cost of -$1.2 billion in recall-related costs and -$0.2 billion in restructuring costs was whacked by charges. All told, there was a pre-tax net loss from special items of $1.3 billion, or $0.47 per diluted share, and costs of $1.2 billion pre-tax for recall-related repairs, or $0.44 per diluted share. All told a loss -$0.91 per share.

GM is taking a $900 million non-cash pre-tax special charge in Q2 for the estimated costs of future possible recalls for up to the next 10 years on 30 million GM vehicles on the road today. A special charge of $400 million was taken for the GM ignition switch compensation program. GM said this is the best estimate of the amounts that may be paid to claimants. It guess-timated the total cost could increase by approximately $200 million.

“Our underlying business performance in the first half of the year was strong as we grew our revenue on improved pricing and solid new vehicle launches,” said GM CEO Mary Barra. This statement is laughable if you look at the operating results in Q2. Only GMIO improved year-over-year. North America and China were bright spots. Europe and South America remain troublesome.

- GM North America reported EBIT-adjusted of $1.4 billion, which included the impact of $1.0 billion in recall-related costs in the quarter. This compared with EBIT-adjusted of $2.0 billion in the second quarter of 2013, which included the effect back then of $0.1 billion in recall-related costs in the quarter.

- GM Europe reported an EBIT-adjusted of $(0.3) billion, which includes $0.2 billion for restructuring costs. This compares with $(0.1) billion of EBIT-adjusted in the second quarter of 2013. GM claims that Europe will breakeven by mid-decade.

- GM International Operations reported EBIT-adjusted of $0.3 billion, compared to $0.2 billion in the second quarter of 2013.

- GM South America reported EBIT-adjusted of $(0.1) billion, compared with EBIT-adjusted of $0.1 billion in the second quarter of 2013.

- GM Financial earnings before tax was $0.3 billion for the quarter, compared to $0.3 billion in the second quarter of 2013.

Earnings before interest and tax (EBIT) adjusted was $1.4 billion and included as noted the impact of $1.2 billion in recall-related costs and $0.2 billion in restructuring costs. This compares to the second quarter of 2013, when the company recorded EBIT-adjusted of $2.3 billion, which included a charge of $0.2 billion for recalls and $0.1 billion in restructuring costs.

Net revenue in the second quarter of 2014 was $39.6 billion, compared to $39.1 billion in the second quarter of 2013. In the first six months of 2014, revenue rose to $77 billion, up from $76 billion in the same period a year ago.

Cash Flow and Liquidity

For the quarter, automotive cash flow from operating activities was $3.6 billion and automotive free cash flow adjusted was $1.9 billion. GM ended the quarter with total automotive liquidity of $38.8 billion. Automotive cash and marketable securities was $28.4 billion compared with $27.0 billion for the first quarter of 2014.