This is a “wait until next year” record that has investors and analysts leery because Ford has 16 launches planned for 2015, that it says will result in higher revenue and improved operating margin.

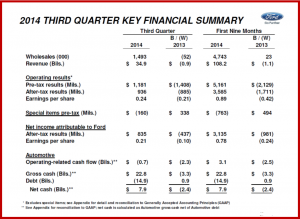

Ford Motor Company (NYSE:F) today said it earned a net profit of $835 million during Q3 of 2014 from sales of 1.493 million vehicles, which was a decline of 3%. Ford Q3 3 revenue declined 2% to $34.9 billion. Third quarter pre-tax profit of was $1.2 billion, a decrease of $1.4 billion compared with a year ago. After-tax earnings per share of 24 cents down from 45 cents a year ago, excluding special items. It was Ford Motor’s 21st consecutive profitable quarter.

North America and Asia Pacific were profitable, but pre-tax results were lower than a year ago for all of Ford’s Automotive business units except Middle East & Africa. Ford Credit delivered better results than a year ago.

During Ford Q3 operating margin was a mere 2.5%, a decrease of 4.5 percentage points from a year ago. Automotive pre-tax profit of $686 million was $1.5 billion lower than a year ago.

During the quarter, Ford began producing the new 2015 Ford Mustang, refreshed Expedition and Lincoln Navigator in North America; new Ka and F-350 and F-4000 in South America; and Lincoln MKZ and MKC for China.

There were higher warranty costs from ongoing quality and safety recall problems, as well the tooling costs for the upcoming 2015 F-Series pickup truck that hasn’t shipped yet. Ford continues to take charges for its European operations, which lost $439 million.

This is definitely “a wait until next year” record that has investors and analysts leery because Ford has 16 launches planned for 2015, that it says will result next year in higher revenue, improved operating margin and the company pre-tax profit of $8.5 billion to $9.5 billion.

Guidance was unchanged from the Ford’s late September adjustment down to a 2014 pre-tax profit of about $6 billion, excluding special items, which pummeled the stock. Ford common took another beating by ending the day at $13.78 per share, a whopping 4.3% drop.

Ford’s Automotive operating-related cash flow was negative $700 million in the third quarter. Ford said unfavorable changes in working capital, including the effects of the five weeks of downtime in the quarter at the Dearborn Truck Plant as the company transitions to the all-new F-150, as well as supplier parts shortages.

In Q4, Ford said working capital changes are expected to be positive. The company ended Q3 with Automotive gross cash of $22.8 billion, exceeding debt by $7.9 billion, with Automotive liquidity of $33.6 billion.

During Q3, Ford declared a dividend of $0.125 per share on the company’s outstanding Class B and common stock and paid about $500 million in dividends. Ford also completed the previously announced share repurchase program.