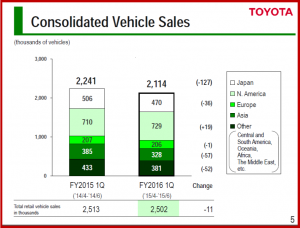

Toyota Motor posted a 10% rise in net profit to ¥646.3 billion for the Japanese Q1, but if it was not for the weak yen (¥121:$1) Toyota’s profits would have dropped. During April-June 2014, Toyota’s average exchange rate was ¥102:$1. Consolidated vehicle sales for the first quarter totaled 2,114,000 units, a decrease of 127,285 units compared to the same period last fiscal year.

On a consolidated basis, net revenues for the period totaled ¥6.98 trillion, an increase of 9.3%. Operating income increased from ¥692.7 billion to ¥756.0 billion, while income before income taxes was ¥845.2 billion. Net income increased from ¥587.7 billion to ¥646.3 billion. Operating income increased by ¥63.2 billion. Major factors contributing to the increase included currency fluctuations of ¥145.0 billion and cost reduction efforts of ¥60.0 billion.

“Operating income increased by ¥63.2 billion compared to the same period of the last fiscal year. Favorable foreign exchange rates and cost reduction efforts were main positive factors, while decreased vehicle sales and increased expenses to support initiatives for enhancing competitiveness were negative factors,” said TMC Managing Officer Tetsuya Otake.

- In Japan, vehicle sales totaled 469,971 units, a decrease of 35,856 units. Operating income increased by ¥109.8 billion to 475.8 billion.

- In North America, vehicle sales totaled 728,813 units, an increase of 18,404 units. Operating income, excluding the impact of valuation gains/losses from interest rate swaps, increased by ¥1.4 billion to ¥151.1 billion.

- In Europe, vehicle sales totaled 206,374 units, a decrease of 1,107 units, while operating income decreased by ¥3.0 billion to ¥7.8 billion.

- In Asia, vehicle sales totaled 328,602 units, a decrease of 56,774 units, while operating income decreased by ¥10.2 billion to ¥100.0 billion.

- In other regions (including Central and South America, Oceania, Africa and the Middle East), vehicle sales totaled 380,240 units, a decrease of 51,952 units, while operating income increased by ¥3.9 billion to ¥38.0 billion.

- Financial services operating income decreased by ¥28.0 billion to ¥70.1 billion, including a loss of ¥26.6 billion in valuation gains/losses from interest rate swaps. Excluding valuation gains/losses, operating income increased by ¥14.7 billion to ¥96.8 billion.

For the fiscal year ending March 31, 2016, TMC revised its consolidated vehicle sales forecast from 8.9 million units to 8.95 million units, in consideration of the latest sales trends worldwide.

TMC also revised its consolidated financial forecasts for the fiscal year. Based on an exchange rate assumption of ¥117 to the U.S. dollar and ¥127 to the euro, TMC now forecasts consolidated net revenue of ¥27.8 trillion, operating income of ¥2.8 trillion, income before income taxes of ¥2.98 trillion and net income of ¥2.25 trillion.