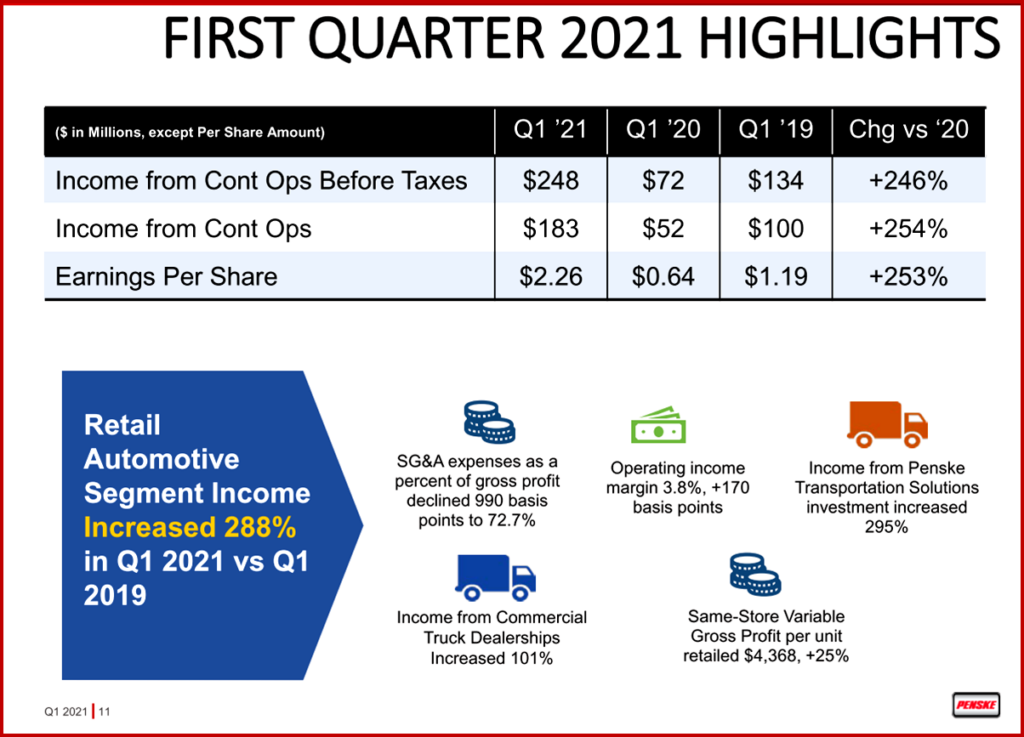

Penske Automotive Group, Inc. (NYSE:PAG) today reported the highest Q1 revenue, income from continuing operations, and earnings per share in company history. For the three months ended March 31, 2021, the company reported a 253.7% increase in income from continuing operations attributable to common shareholders to $182.5 million and a 253.1% increase in related earnings per share to $2.26. This compares to income from continuing operations attributable to common shareholders of $51.6 million, or $0.64 per share in the prior year, which was affected by the Covid pandemic. Foreign exchange positively impacted earnings per share by $0.05 in the first quarter of 2021. Total revenue increased 15.3% to $5.8 billion from $5.0 billion in 2020.

Penske Automotive Group, Inc. (NYSE:PAG) today reported the highest Q1 revenue, income from continuing operations, and earnings per share in company history. For the three months ended March 31, 2021, the company reported a 253.7% increase in income from continuing operations attributable to common shareholders to $182.5 million and a 253.1% increase in related earnings per share to $2.26. This compares to income from continuing operations attributable to common shareholders of $51.6 million, or $0.64 per share in the prior year, which was affected by the Covid pandemic. Foreign exchange positively impacted earnings per share by $0.05 in the first quarter of 2021. Total revenue increased 15.3% to $5.8 billion from $5.0 billion in 2020.

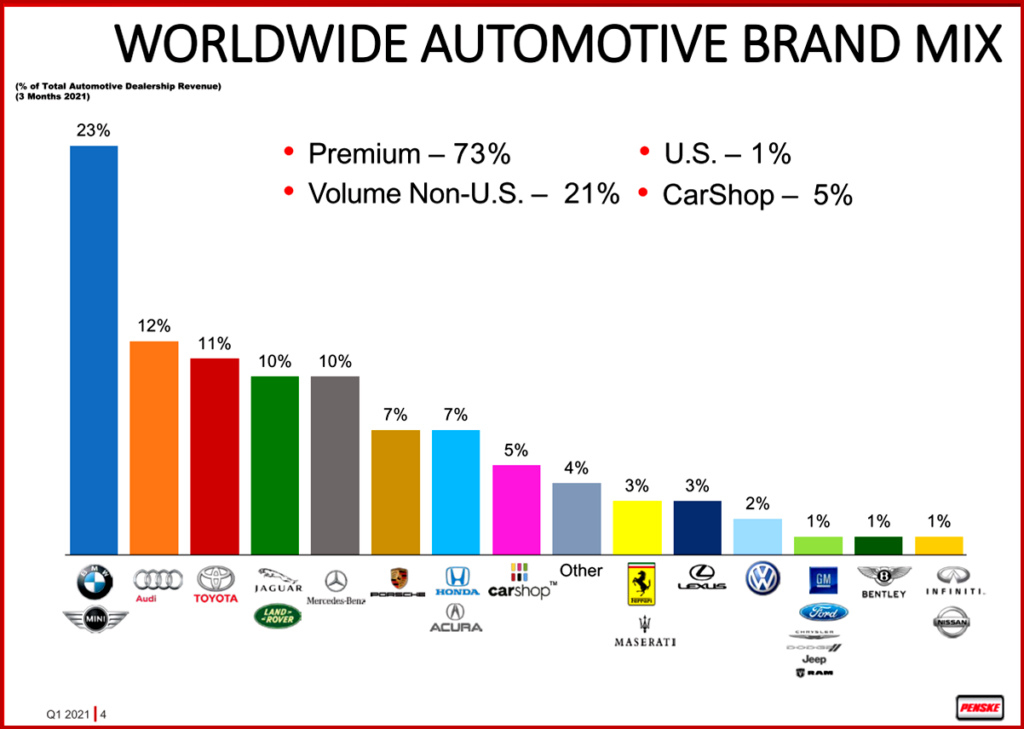

Penske – as a diversified international transportation services company – is a good leading indicator of the overall health of the transportation sectors with the caveat that it is heavily biased toward luxury brands.

“We had outstanding performance across our business during the first quarter. I am particularly pleased with the continued expense discipline driving a 990-basis point improvement in selling, general and administrative expense as a percent of gross profit,” said Chairman Roger Penske.”

“We had outstanding performance across our business during the first quarter. I am particularly pleased with the continued expense discipline driving a 990-basis point improvement in selling, general and administrative expense as a percent of gross profit,” said Chairman Roger Penske.”

“Despite our dealership showrooms being closed in the U.K. for the entire first quarter due to COVID restrictions, we used our online tools to deliver 40,000 new and used vehicles in the U.K. market. Importantly, new same-store units in the U.K. increased 7.8% compared to the U.K. market, which declined 12%.” Penske continued. “Further, our commercial truck dealerships improved their profitability by 101% while the earnings from our investment in Penske Transportation Solutions increased 295% demonstrating the strength of the company’s diversified business model.”

Retail Automotive

New and Used retail automotive same-store unit sales increased 5.5%

- New +18.8%: U.S. +25.5%; U.K. +7.8%

- Used -3.6%: U.S. +14.5%; U.K. -18.2%

Retail automotive same-store revenue and gross profit increased 19.2%

- Retail automotive same-store variable gross profit per unit retailed increased 25.3%

Penske Automotive Group operates seventeen CarShop Used Vehicle SuperCenters in the U.S. and U.K. During Q1, the company renamed its U.S.-based Used Vehicle SuperCenters from CarSense to CarShop to align with the existing eleven U.K.-based CarShop Used Vehicle SuperCenters, forming one global CarShop brand.

- For the three months ended March 31, 2021, retail unit sales decreased by 30.1% to 11,395 while revenue decreased by 20.6% to $242.6 million, principally due to a 43% decline in used unit sales in the U.K. as a result of COVID-related government-mandated showroom closures, partially offset by a 25% increase in used unit sales in the U.S. during the quarter.

Retail Commercial Truck Dealerships

For the three months ended March 31, 2021, earnings before taxes increased 101% to $27.5 million compared to $13.7 million in the same period last year, return on sales was 6.3%, and fixed cost absorption was 125%. The 101% increase in earnings before taxes was principally driven by an increase in used truck unit sales coupled with improved gross margin from new and used truck sales.

On April 13, 2021, the company announced that it had completed its acquisition of Kansas City Freightliner (“KCFL”) which is expected to add approximately $450 million in annualized revenue and increase our medium and heavy-duty commercial truck dealership count to 29 locations throughout the U.S. and Canada.

Penske Transportation Solutions Investment

Penske Transportation Solutions (“PTS”) is a leading provider of full-service truck leasing, truck rental, contract maintenance, and logistics services. The company has a 28.9% ownership interest in PTS and accounts for its ownership interest using the equity method of accounting. For the three months ended March 31, 2021, the company recorded $53.7 million in earnings compared to $13.6 million for the same period last year. The 295% increase in the first quarter was principally driven by improved operating results across PTS’ full-service leasing, rental, and logistics and a reduction in operating expenses.

Corporate Development and Liquidity

As noted Penske bought “KCFL” in April 2021. In addition, in January, it opened the second Porsche dealership in the Washington D.C. market, which is expected to generate $50 million in annualized revenue. We also have an Audi dealership under construction in Southern California and a Honda dealership under construction in Texas. Both are expected to open by the end of the year and collectively generate approximately $100 million in annualized revenue.

Penske expects to open two CarShop Used Vehicle SuperCenter locations in the second quarter and an additional two locations by the end of 2021. In a defensive move against CarMax, Penske is targeting 40 locations, 150,000 in unit sales, and $100 million of earnings before taxes in the CarShop Used Vehicle SuperCenter operations by the end of 2023.

“As we look out across the next three years, we are targeting organic and acquisition growth, coupled with operating efficiencies to drive income from continuing operations before taxes to at least $1 billion by the end of 2023 which compares to $708 million last year,” the company said in an earnings presentation.

As of March 31, 2021, Penske Group had available liquidity under its various credit agreements of approximately $1.1 billion. Approximately $171 million remains available to repurchase shares under the company’s existing share repurchase program.

Penske Automotive Group (NYSE: PAG) announced today that it has entered the Charlotte, North Carolina market area with the acquisition of Mercedes-Benz of South Charlotte. The acquisition is expected to add $150 million in annualized revenues.

Mercedes-Benz of South Charlotte represents Penske Automotive Group’s 26th world-wide dealership for the Mercedes-Benz brand. The South Charlotte location was originally founded in 2006 and expands the Company’s operations to a new market area which is ranked as one of the largest population growth areas in the United States. The dealership includes over 70,000 square feet of facilities, including 50 service bays, to meet the growing demands of this new market for the Company.

“With the completion of this acquisition, Penske Automotive Group has now added over $700 million in expected annualized revenue to its operations this year as the company drives to its target goal of achieving $1 billion in earnings before taxes in 2023,” said President Rob Kurnick. 06/04/2021

Penske Automotive Group, Inc., (NYSE:PAG) today 5/25 announced that it intends to offer $500 million aggregate principal amount of fixed rate Senior Subordinated Notes due 2029 (the “2029 Notes”), subject to market and other customary closing conditions, pursuant to an effective shelf registration statement filed with the Securities and Exchange Commission (“SEC”).

The company intends to use the net proceeds of this offering to redeem its $500 million 5.5% Senior Subordinated Notes due 2026. In the interim, we intend to repay amounts outstanding under our U.S. credit agreement, to repay various floor plan debt, and for general corporate purposes. Robert H. Kurnick is Penske Automotive Group President – editor

Penske Automotive Group, Inc. (NYSE:PAG), a diversified international transportation services company, today said its Board of Directors has increased the Company’s dividend by 2.3% to $0.44 per share. The dividend is payable June 2, 2021, to shareholders of record on May 24th, 2021.

“We are pleased to offer our shareholders an increase in the quarterly dividend,” said Penske Automotive Group President, Robert H. Kurnick. “Our business achieved record results in the first quarter and our cash flow remains strong. With this increase, the annualized dividend increases to $1.76 per share representing a yield of approximately 2%.”