Click to Enlarge.

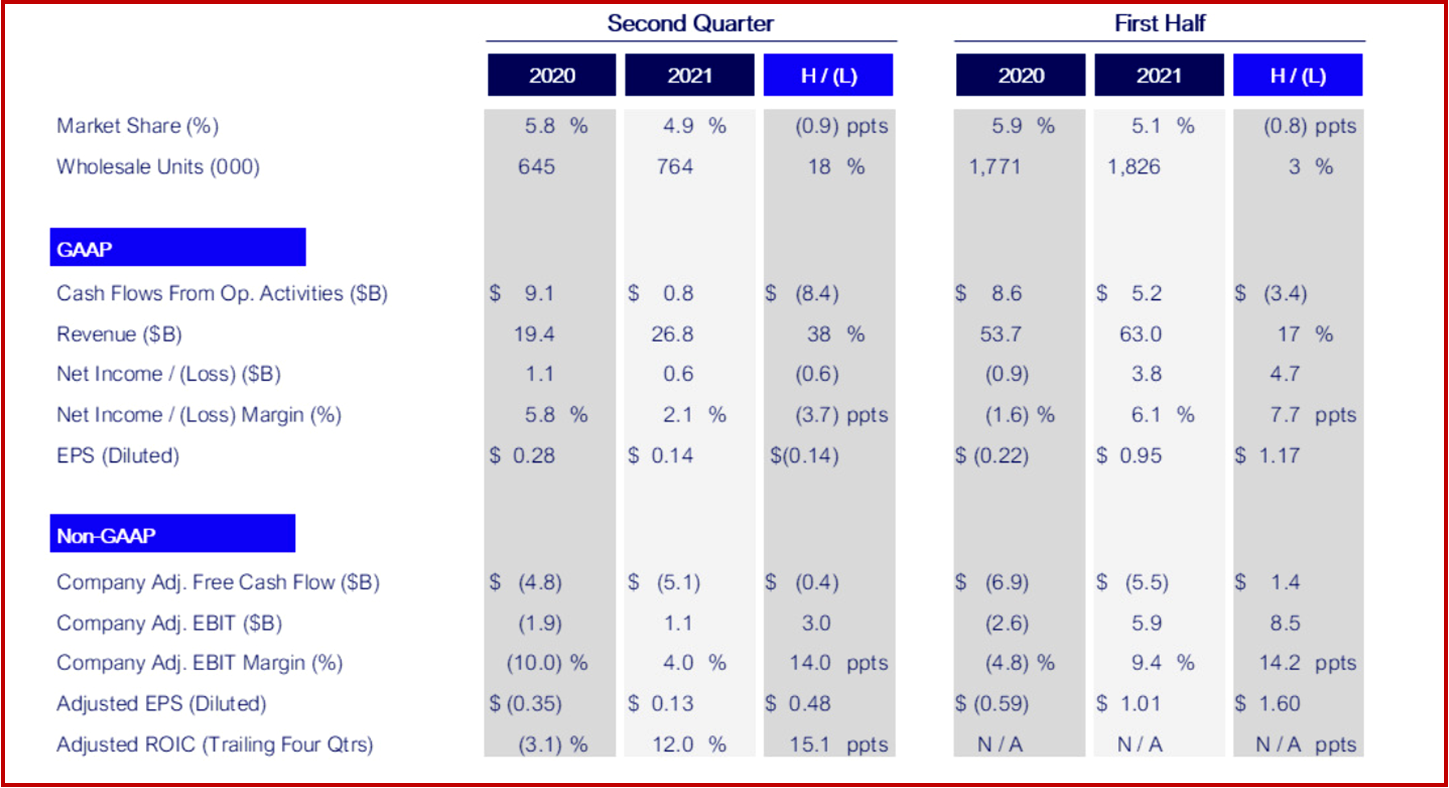

Lawler said that Ford has raised its expectation for full-year adjusted EBIT by about $3.5 billion, to between $9 billion and $10 billion. Volume is expected to increase by about 30% sequentially from the first to the second half of the year, driving an improvement in market factors net of production costs.

But – big BUT – the volume benefit is anticipated to be offset by higher commodity costs, investments in the Ford+ plan and lower earnings by Ford Credit, among other factors, with second-half adjusted EBIT lower than in the first half. The half-to-half comparison is also affected by a $902 million non-cash gain on Ford’s investment in Rivian that was booked in first-quarter 2021.

Ford has lifted its target for full-year adjusted free cash flow to between $4 billion and $5 billion, supported by expected favorable second-half working capital as vehicle production increases with anticipated improvement in availability of semiconductors.