Click for more GlobalData.

North America

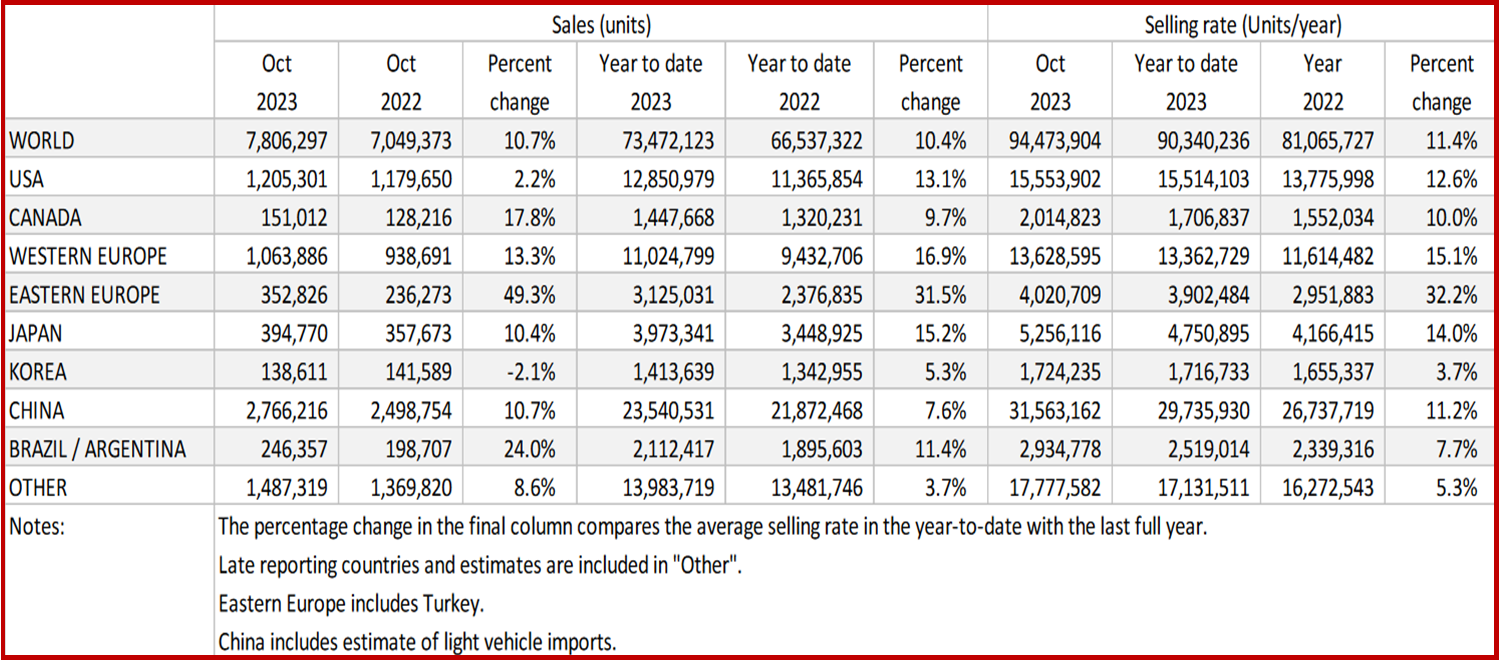

The US LV market grew by 2.2% YoY in October, to 1.2 million units, while the selling rate decelerated slightly, to 15.6 million units/year, down from the 15.8 million units/year recorded in September. As the UAW strikes were ongoing throughout October, there was some impact on the Detroit 3 OEMs, preventing more substantial growth.

In addition, transaction prices remain extremely high, though the figure declined slightly in October, by US$120 to US$45,644. Meanwhile, incentives barely increased last month, up by a mere US$10 MoM, to $1,847. Dealers had little reason to entice customers as the strikes reduced inventory in some cases.

In October Canadian LV sales reached 151,000 units, an increase of 17.8% YoY, as well as marking the third month in a row where sales have been above the 150k unit level. The selling rate in October was 2.0 million units/year, the highest monthly rate since September 2020, up from the 1.8 million units/year reported in September.

In Mexico, sales increased by 24.8% YoY, to 113.2k units. The selling rate dropped to 1.38 million units/year in October, down from the 1.48 million units/year reported in September.

Europe

The Western Europe LV selling rate rose to 13.6 million units/year in October from 13.1 million units/year in September, following a raw monthly registration figure of 1.1 million units (+13.3% YoY). The region continues to exhibit double-digit YoY growth as supply constraints fade and deliveries recover. Growth is expected to continue through 2024, albeit at a slower rate. YTD the region has grown 16.9% YoY with total sales at 11 million units.

The East European LV selling rate rose to 4.0 million units/year in October from an upwardly adjusted September figure of 3.9 million units/year. The raw monthly registration figure saw growth of 49.3% YoY to reach 353k units, helped largely by strong recovery in Russia, surpassing 101k units (+109% YoY). The YTD figure is up 31.5% YoY with 3.1 million in sales.

About GlobalData

GlobalData says that “4000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.” J.D. Power is also part of GlobalData. Inquiries at customersuccess.automotive@globaldata.com.