Click for more analysis.

“It is clear there has been some recent slowdown in the market, but it depends where you look. Some brands are doing considerably better than others, with the likes of MG and Tesla standing out as strong performers in 2023,” the respected consultancy GlobalData said today.

AutoInformed has not been among the naysayers. Consider this from Carlos Tavares, CEO of Stellantis (full story here at AutoInformed.com: Stellantis Posts Record 2023 Results – €18.6B Net). In Tavare’s view, EV adoption is mostly driven by the “alignment of four different stars.”

1. The first star is the Clean Energy Star. “We need to clean energy. Whatever you do in terms of CO2 emission reduction you need to start with clean energy.”

2. Assuming that we have the clean energy, the second star is that we need to have a “visible and highly dense charging network, which means a charging network where you don’t need to look for the charging spot. It needs to be there when you go to the shopping mall; when you go to the supermarket; when you go to the restaurant; when you go to gym – in the parking lots of those services.”

3. The third star is the product itself. The product needs to be enjoyable with acceleration and range and all the things that make the product simply appealing. “I think we are there…I can tell with 42 years of automotive experience, the BEV products are better products, if we solve the inconvenience of range or the inconvenience of not finding always the charging that we’d like to find. So that’s the third star.”

4. The 4th star is affordability. “I would say that on the first three stars, some progress is being made on clean energy. Some progress, probably not enough, is being made on the density of the charging network. The products are here, and the products are coming. We need to bring affordability… We’ll keep on working on reducing the costs of the EV technology.

“So when those four stars are going to align? Things are going to move and they will move faster and they will move eventually very, very fast. We have a big stimulation coming. It’s the Chinese offensive. It’s a big stimulation for us to go faster in aligning those four stars.

“When I was asked the question this morning, if we are going to take any decision like some of our US competitors in terms of slowing down, what we are doing in electrification and my answer is crystal clear. No, we keep it flat out because we believe that the education of the citizens and the education of the consumer about the urgency of contributing to fixing the global warming issue is going to grow. The fact that we are already seeing that we are above 1.5° of global warming much sooner than what we had predicted. So the public opinion is going to push in that direction. Whatever happens, you may have some bumps on the road, some slowdowns on the road, but anyway it’s going to move – so we keep it flat out in the execution of the move forward plan,” Tavares said.

GlobalData Observations and Opinions

• The charging infrastructure and BEV versus Internal Combustion Engine (ICE)/hybrid prices are still headwinds.

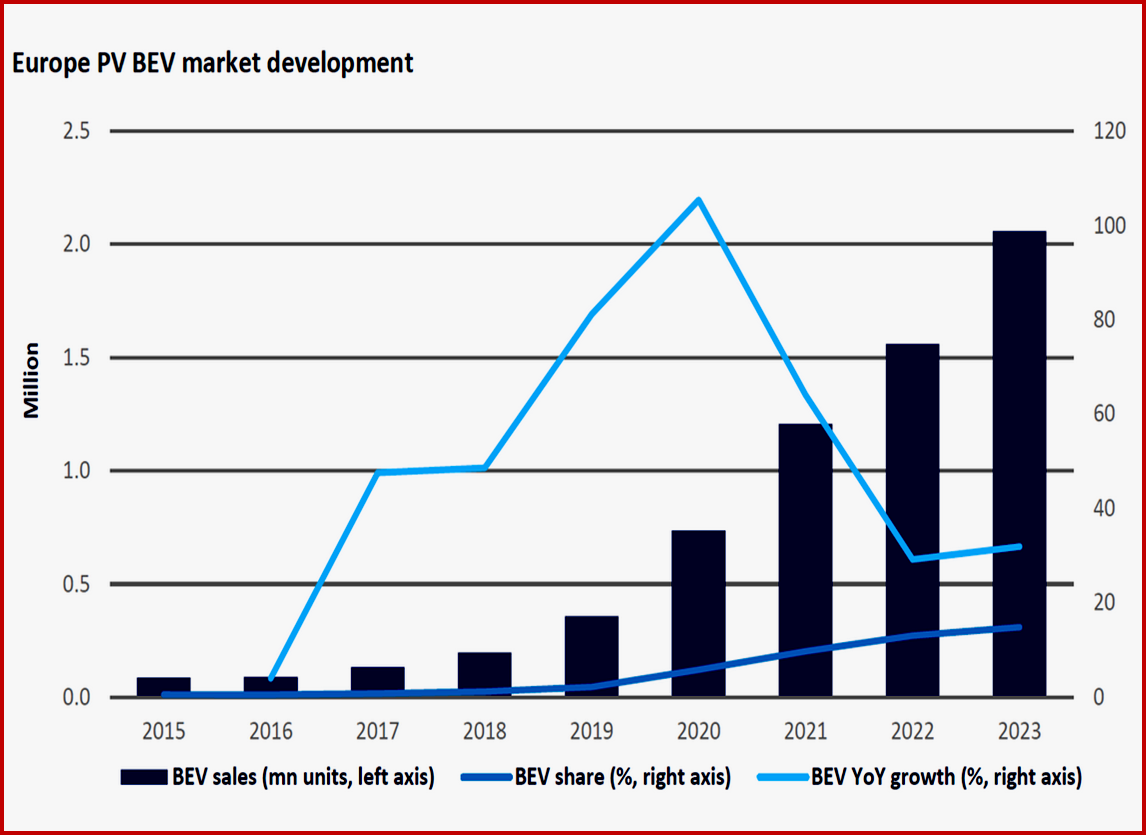

• It was to be expected that the levels of growth seen from 2019 to 2021 would ease, not least because the buyers to whom BEVs are most attractive (wealthy, multiple-car households with off-road charging facilities) have been somewhat satisfied.

• In addition, adoption rates for new technologies will tend to rise and fall over time as the use case for them doesn’t grow uniformly but develops in a series of steps leading ultimately to near-100% penetration.

• The market over the last few years has been demand-driven whereas prior to that point, fleet CO2 targets were a big factor in the high BEV growth rates see the chart.

• For some OEMs at least, the medium-term plan for BEV build set in late 2022 or early 2023 was over-ambitious, especially given the economic headwinds faced by many consumers which are only reaching the peak of their influence now due to the lagged impact of rising interest rates, and the car replacement cycle.