Q3 Summary

Sales: Combined retail and wholesale used vehicle unit sales were 320,256, an increase of 5.8% from the prior year’s third quarter.

• Total retail used vehicle unit sales increased 5.4% to 184,243 compared to the prior year’s third quarter. Comparable store used unit sales increased 4.3% from the prior year’s third quarter.

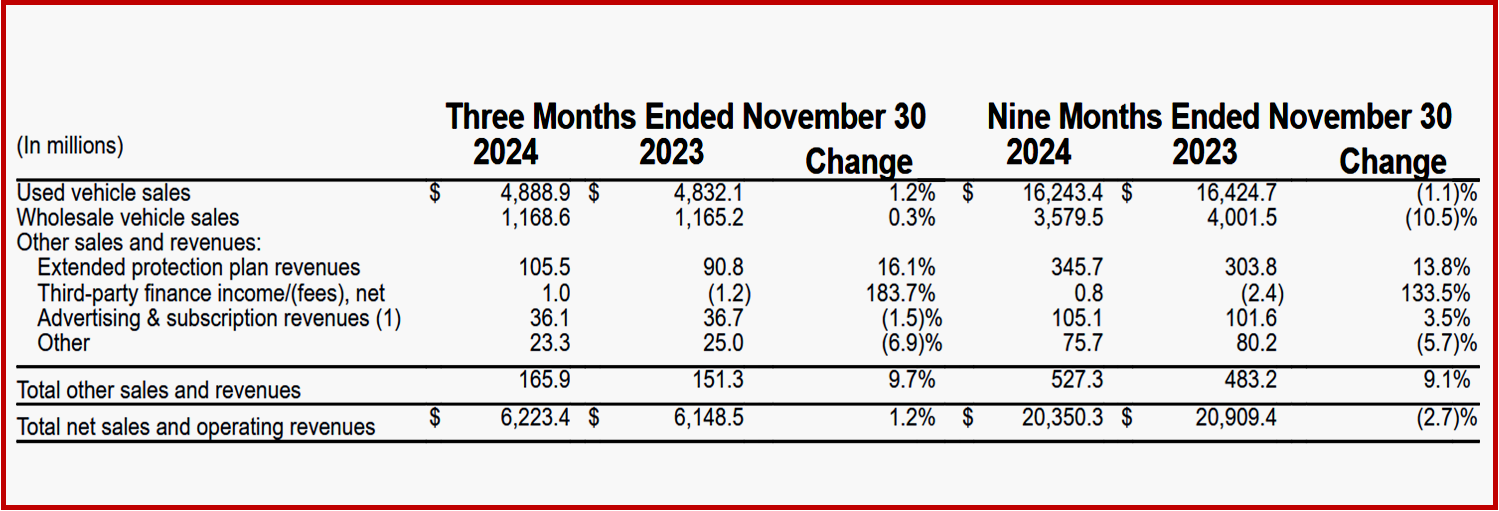

• Total retail used vehicle revenues increased 1.2% compared with the prior year’s third quarter, driven by the increase in retail used units sold, partially offset by the decrease in average retail selling price, which declined approximately $1,100 per unit or 3.9%.

Total wholesale vehicle unit sales increased 6.3% to 136,013 versus the prior year’s third quarter.

• Total wholesale revenues increased 0.3% compared with the prior year’s third quarter, driven by the increase in wholesale units sold, partially offset by the decrease in the average wholesale selling price of approximately $500 per unit or 5.7%.

• CarMax bought 270,000 vehicles from consumers and dealers, up 7.9% compared to last year’s third quarter. Of these vehicles, 237,000 were bought from consumers and 33,000 were bought through dealers, an increase of 4.1% and 46.7%, respectively, from last year’s third quarter.

Other sales and revenues increased by 9.7% compared with the third quarter of fiscal 2024, representing an increase of $14.6 million, primarily reflecting an increase in EPP revenues resulting from stronger margins.

Online retail sales (2) accounted for 15% of retail unit sales, compared to 14% in the third quarter of last year. Revenue from online transactions (3) , including retail and wholesale unit sales, was $2.0 billion, or approximately 32% of net revenues, up from 31% in last year’s third quarter.

Gross Profit

• Total gross profit was $677.6 million, up 10.6% versus last year’s third quarter. Retail used vehicle gross profit increased 6.8% and retail gross profit per used unit was $2,306, in line with last year’s third quarter.

• Wholesale vehicle gross profit increased 12.3% versus the prior year’s third quarter. Gross profit per unit increased $54 from the prior year’s third quarter to $1,015.

• Other gross profit increased 24.6% primarily reflecting growth in EPP revenues resulting from stronger margins as well as service gross profit driven by cost coverage measures, increased efficiencies, and positive retail unit growth.

SG&A

• Compared with the third quarter of fiscal 2024, SG&A expenses increased 2.8% or $15.8 million to $575.8 million, primarily driven by an increase in compensation and benefits due to year-over-year corporate bonus accrual dynamics. Partially offsetting this was a decrease in advertising expenditure due to timing.

• SG&A as a percent of gross profit decreased 640 basis points to 85.0% in the third quarter compared to 91.4% in the prior year’s third quarter, driven by the growth in gross profit and ongoing cost management efforts in the stores and customer experience centers.

CarMax Auto Finance (4)

• CAF income increased 7.6% to $159.9 million driven by growth in CAF’s net interest margin percentage and average managed receivables. This quarter’s provision for loan losses was $72.6 million compared to $68.3 million in the prior year’s third quarter.

• As of November 30, 2024, the allowance for loan losses of $478.9 million was 2.70% of ending managed receivables, down from 2.82% as of August 31, 2024. The allowance for loan losses was down from 2.92% a year ago, due to the effect of the previously disclosed tightening of CAF’s underwriting standards.

• CAF’s total interest margin percentage, which represents the spread between interest and fees charged to consumers and our funding costs, was 6.2% of average managed receivables, up from the prior year’s third quarter but consistent with this year’s second quarter. After the effect of 3-day payoffs, CAF financed 43.1% of units sold in the current quarter, down slightly from 44.0% in the prior year’s third quarter. CAF’s weighted average contract rate was 11.2% in the quarter, down from 11.3% in the third quarter last year.

Share Repurchases

• During the third quarter of fiscal year 2025, we repurchased 1.5 million shares of common stock for $114.8 million. As of November 30, 2024, we had $2.04 billion remaining available for repurchase under the outstanding authorization.