Click to enlarge.

Stellantis Financials at a Glance

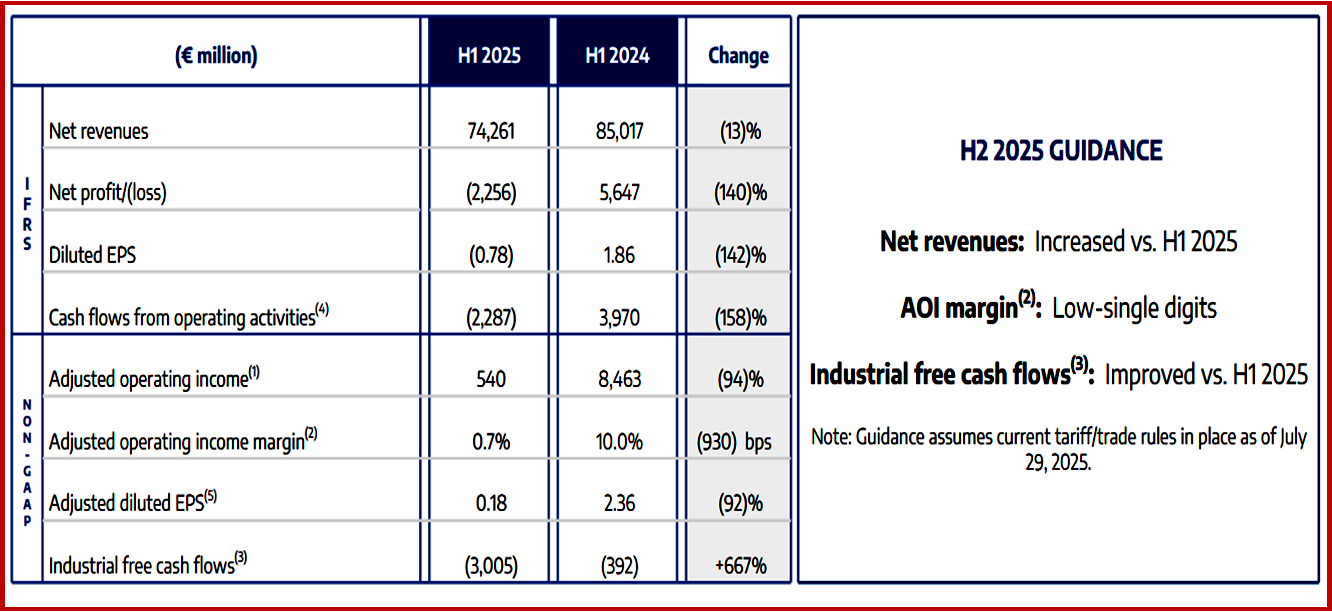

• Net revenues of €74.3 billion, down 13% compared to H1 2024 chiefly driven by Y-o-Y declines in North America and Enlarged Europe, partially offset by growth in South America.

• Net loss of (€2.3) billion, including €3.3 billion of net charges excluded from Adjusted operating income(footnote 1), down compared to H1 2024 Net Profit of €5.6 billion. AOI (Automotive Operating Income see footnote 1) of €0.5 billion, with AOI margin( footnote 2) of 0.7%, below prior year levels of €8.5 billion and 10.0%, respectively.

• Industrial free cash flows (footnote 3) of -€3 billion, as the meager AOI was more than offset by CapEx and R&D expenditures in H1 2025

• Total industrial available liquidity at 30 June 2025 was €47.2 billion.

• Total inventories of 1.2 million units (Company inventory of 298 thousand units) at June 30, 2025, +1% compared with year-end 2024.

• H1 2025 saw sequential improvement in Shipments, Net revenues, AOI (1) and Industrial free cash flows (3) compared to H2 2024, realizing benefits from an expanded product lineup, revitalized marketing, and strong inventory discipline.

• Stellantis re-established financial guidance and forecasts continued sequential improvement in H2 2025.