Click to enlarge.

Full-Year 2025 Outlook

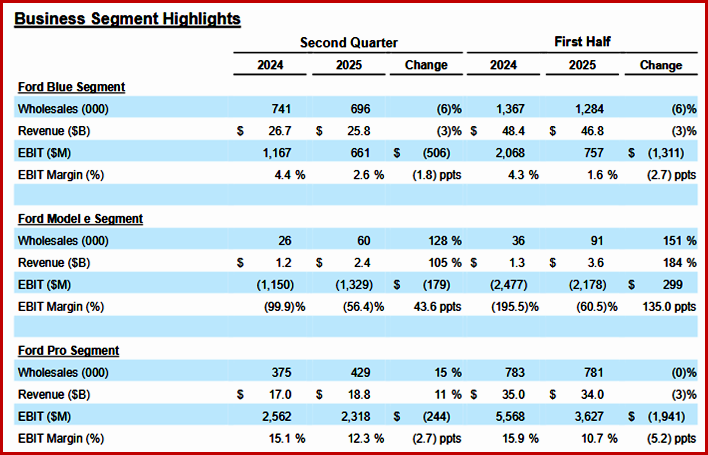

Ford now foresees full-year adjusted EBIT of $6.5 billion to $7.5 billion, which includes a net tariff-related headwind of about $2 billion. Ford said it will produce $3.5 billion to $4.5 billion in adjusted free cash flow, with capital expenditures of ~$9 billion. In February, Ford Motor initially provided adjusted EBIT guidance for the year of $7.0 billion to $8.5 billion and then withdrew that guidance in May due to tariff-related uncertainty.

“The company’s updated guidance reflects the strong underlying first half performance across Ford Blue, Ford Model e, Ford Pro and Ford Credit, and continued improvement in cost. The net tariff-related headwind of about $2 billion reflects a $3 billion gross adverse adjusted EBIT impact, offset partially by $1 billion of recovery actions. The company is only providing a Total Company outlook for the remainder of the year,” Ford said in its earnings release.

*“We are not satisfied with the current level of recalls or the number of vehicles impacted. We are working to reduce the cost of these recalls,” said Kumar Galhotra. chief operating officer of Ford Motor Company. Warranty is the largest component of our competitive cost gap. This is a major cost opportunity for us. There are 2 warranty costs investors should focus on. The first is warranty coverage. This is the expected cost to cover our bumper-to-bumper and powertrain warranties. Coverages make up about 60% of our total warranty costs. As the quality of our vehicles improves, the cost of coverage per vehicle should come down. In fact, we are already seeing this improvement. Our latest 0 and 3 months in service metrics are tracking towards our strongest performance in over 10 years.