The Ally Financial board of directors has declared that its Fixed Rate Cumulative Mandatory Convertible Preferred Stock, Series F-2, will pay the U.S. Department of the Treasury $134 million, or $1.125 per share.

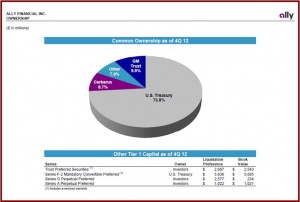

Treasury, via taxpayers, currently holds about 74% of Ally common equity, and $5.9 billion in mandatory convertible preferred securities, which have a dividend rate of 9%, after a more than a $17 billion bailout. Ally Financial, the owner of Ally bank and formerly known as GMAC, became insolvent because of its reckless home mortgage lending practices, resulting in a controversial taxpayer subsidized bailout after the housing bubble peaked in 2006 and subsequently burst.

A quarterly dividend payment was also declared on Ally’s Fixed Rate Cumulative Perpetual Preferred Stock, Series G, of $45 million, or $17.50 per share, and is payable to shareholders of record as of 1 May 2013. Additionally, a dividend payment was declared on Fixed Rate/Floating Rate Perpetual Preferred Stock, Series A, of $22 million, or $0.53 per share, and is payable to shareholders of record as of May 1, 2013.

Including the latest ativan dividend payments on the Series F-2 Preferred, the bank holding company will have paid a total of $6 billion to the U.S. Treasury since February 2009. This includes preferred stock dividends, interest payments and proceeds received by the U.S. Treasury in its sale of Ally trust preferred securities.

Ally Financial leads all auto lending firms in the U.S. because the taxpayer-owned company extended credit on 1.5 million new and used vehicles through franchised and independent dealers last year.

Ally Financial reported 2012 net income of $1.2 billion, compared to a loss of $157 million during 2011. The pre-tax loss in 2012 totaled $419 million, compared to pre-tax income of $11 million in the prior year. Ally’s total equity was $20.0 billion at Dec. 31, 2012, compared to $18.8 billion at the prior quarter’s end.

Read AutoInformed on: