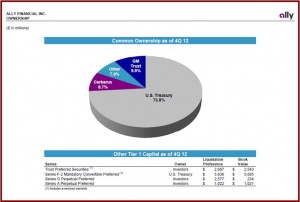

The U.S. Treasury, via taxpayers, currently holds about 74% of Ally common equity, and $5.9 billion in mandatory convertible preferred securities, which have a dividend rate of 9%, after a more than a $17 billion bailout. Ally has repaid Treasury $5.8 billion thus far.

Ally Financial today reported 2012 net income of $1.2 billion, compared to a loss of $157 million during 2011. The core pre-tax loss in 2012 totaled $419 million, compared to core pre-tax income of $11 million in the prior year. Ally’s total equity was $20.0 billion at Dec. 31, 2012, compared to $18.8 billion at the prior quarter’s end.

“Our focus remains on delivering strong results from our leading franchises, completing our strategic transformation, gaining additional efficiencies in the business and repaying the U.S. Treasury investment,” said Ally Chief Executive Officer Michael A. Carpenter.

The U.S. Treasury, via taxpayers, currently holds about 74% of Ally common equity, and $5.9 billion in mandatory convertible preferred securities, which have a dividend rate of 9%, after a more than a $17 billion bailout. Ally has repaid Treasury $5.8 billion thus far.

Excluding costs to restructure the company, as well as ResCap’s financial results prior to deconsolidation at the time of its bankruptcy filing, total impairment of Ally’s $442 million equity interest in ResCap, the taxpayer owned company had pre-tax income of$1.1 billion in 2012 and $865 million in 2011. This includes a $750 million charge for the ResCap home mortgage bankruptcy filing.

Ally’s net income of $1.4 billion for the fourth quarter of 2012, compared to a net of $384 million in Q3 and a net loss of $206 million for Q4 of 2011. The company reported core pre-tax income of $19 million in the fourth quarter of 2012, compared to core pre-tax income of $341 million in the prior quarter and a core pre-tax loss of $172 million in the comparable prior year period. (Core pre-tax income/loss reflects income from continuing operations before taxes and original issue discount (OID) amortization expense primarily from bond exchanges.)

Q4 charges were significant: a $94 million pension expense through lump-sum buy-outs and annuity placements for former subsidiaries; a $148 million charge incurred for the early prepayment of Federal Home Loan Bank (FHLB) debt, which will reduce Ally’s funding costs; and $46 million in legal, advisory fees, and other expenses related to the ResCap bankruptcy and sale of Ally’s international operations mostly to General Motors.

Excluding these charges for, core pre-tax income for Q4 was $308 million compared to core pre-tax income of $379 million for Q3 of 2012.

See: