Ally Financial leads all auto lending firms because the taxpayer-owned company extended credit on 1.5 million new and used vehicles through franchised and independent dealers last year.

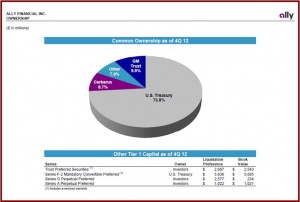

The U.S. Treasury, via taxpayers, currently holds about 74% of Ally common equity, and $5.9 billion in mandatory convertible preferred securities, which have a dividend rate of 9%, after a more than a $17 billion bailout. Ally has repaid Treasury $5.8 billion thus far, and looks good for the balance.

The data from Experian* and Ally show that during 2012 used vehicle financing and leasing made up 46% of Ally’s auto contracts, up from 14% three years ago in the trough of the Great Recession.

“With nearly $39 billion in consumer auto financing and $32.5 billion in commercial auto assets outstanding at the end of 2012, Ally’s support for the U.S. auto industry remains as strong as ever,” said Bill Muir, president of Ally Financial, a bank holding company. “We now have business relationships with nearly 15,000 dealers across the country, and our comprehensive product offerings are unmatched in the marketplace.”

See:

- Taxpayer Owned Ally Financial Earns $1.2 Billion in 2012

- Ally Financial Declares Dividends on Preferred Stock

- U.S. Treasury Appoints Well-Known Ex Auto Finance Execs Gerald Greenwald and Henry Miller to Ally Board of Directors

- Ally Financial Sells Its Canadian Auto Financing Business

- Ally Financial to Sell Mexican Insurance Business

* Experian Automotive reports Department of Motor Vehicles registration information from 46 states. Four states do not report the financing source: Wyoming, Delaware, Rhode Island and Oklahoma.