The U.S. auto industry, to reach historically reasonable sales rates needs buyers from all but the lowest FICO pools.

Mirroring a trend in many consumer lending categories, the auto loan delinquency rate declined significantly this July in a year-over-year comparison. Equifax’s latest monthly National Consumer Credit Trends Report released today reported that the auto loan delinquency rate for more than 60 days declined 35% in dollars.

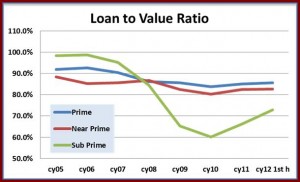

CNW Research also has good news for automakers and their stockholders. Its latest Loan-to-Value Ratio data show a rise, especially for sub-prime borrowers. Banks are once again chasing auto loans because of low repossession rates and a minimum of late-payers. In the hay day of sub-prime lending, those with the lowest acceptable FICO score (the credit rating in industry jargon) had LV ratios in the near-100% range.

As the Republican-induced Great Recession deepened, largely unregulated banks were requiring larger down payments for everyone. Even so called Prime borrowers saw banks expecting upwards of 20% down for an auto loan . Sub-Prime borrowers were forced to put 40% down. In 2011 and the first half of this year, those loan to value ratios have increased although not nearly to the pre-recession levels. The cheap money is still going to Wall Street speculators not to working people.

“The auto industry, to reach any historically reasonable sales levels must have customers from all but the lowest FICO pools,” according to CNW.

Equifax noted that along with the improving delinquency rates is the rise in new credit, which increased 13% from year-to-date in May 2011 ($305 billion) to May 2012 ($348 billion). The highest new credit increase was seen with bank credit cards (21% versus the same period a year ago), which went from $58.1 billion through May 2011 to $72.9 billion through May 2012. (The U.S. Treasury is printing money of course at unsustainable levels in attempt to head off another recession or worse. polls show a majority Americans favor taxing the wealthy, reducing military spending, and expanding rather than cutting Social Security and Medicare as a way to deal with the deficit.)

All is not well with the jobless recovery though as anyone outside of bickering, ineffective Washington can observe. In a shameful contrast to overall improvements in consumer repayments, student loan delinquencies and write-offs have increased significantly during the past 12 months unemployment is at epidemic levels among younger age groups:

- Write-off rates among student loans increased more than 29% month-to-month from June-July 2012.

- Student loan 60-day delinquency rates increased more than 14% year-to-year from July 2011-2012.

- Student loan balances increased $58.5 billion year-over-year from July 2011-2012.

- The total number of student loans has increased nearly 24% from July 2011 (89 million) to July 2012 (116 million).

- At $9.3 billion, student loan write-offs year-to-date through July 2012 is 10% higher than same time a year ago ($8.4 billion).

- Severe derogatory balances, the major component of write-offs, on student loans year-to-date through July 2012 ($7.3 billion) are 14% higher than same time a year ago ($6.3 billion).

“Consumers continue to improve their credit management, through higher monthly payments on card accounts, refinancing of existing mortgage debt at lower rates, and lower delinquency rates pretty much across the board,” said Equifax Chief Economist Amy Crews Cutts. “Growth in total credit is consistent with the overall improvement in the economy – slow, but steady – with the exception of mortgage debt which is declining overall.”