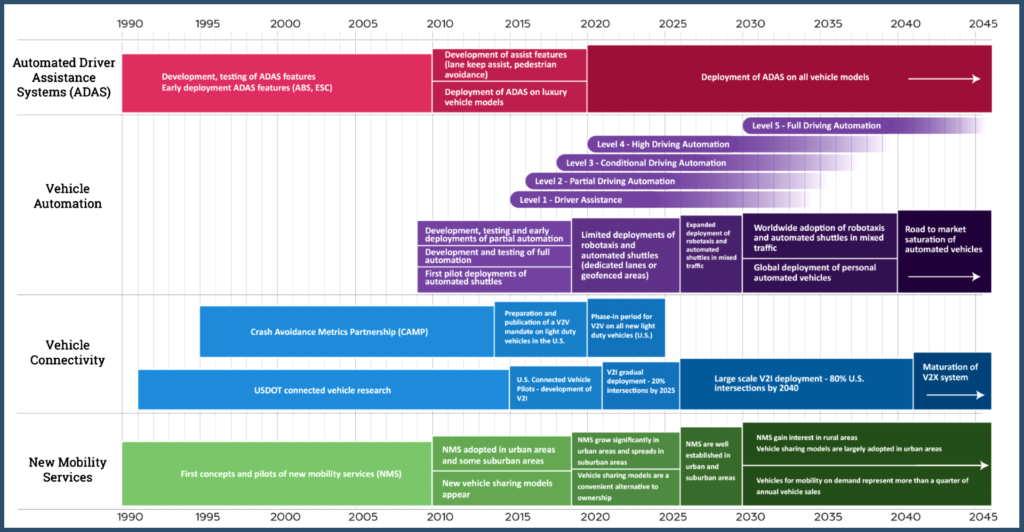

The Center for Automotive Research notes the automotive industry is changing at a record rate with vehicle technologies such as automated driver assist systems (ADAS), connected and automated vehicles (CAV), and advanced powertrains. These have the clout to transform both the product and therefore the industry.

Thus, a new acronym – automated, connected, and electric (ACE) automotive technologies that in laughable jargon “will enable new mobility paradigms, new companies, and new business and revenue models that have the potential to alter the way consumers interact with vehicles.” Perhaps humorous but also serious since taken together, these new vehicle technologies – and unknown ones – and new mobility services are key to advancing the “shared economy.”

The industry debate is whether the ACES transition is happening sooner or later. Nowhere is this more apparent than at the Los Angeles Auto Trade Show that used to be known as the Los Angeles Auto Show. Substantial amounts of exhibit space and presentations are devoted to exploring the edges of a largely submerged iceberg that sees vendors attempting to sell automakers subsystems of Automated, Connected, and Electric technologies.

Traditionally, in what was for a long, long time essentially blacksmithing business, auto vehicle technology trends happened slowly with some so-called “step-function advancements” due to unpredictable innovation. CAR says that “success in this environment usually relies on a variety of seemingly unrelated inputs, which are difficult to determine in advance.”

Thus, CAR’S conundrum – looking forward, how will the industry merge connected, automated and electric vehicle technologies to form different vehicle and new transportation paradigms? ACE technologies can exist as stand-alone advancements, as some do now, but when combined, advancements may fulfill what?

CAR says with uncharacteristic hype from a respected academic institution, ACE will fulfill “the loftiest technology expectations. In a few decades, it is likely that people will no longer make the distinction between the three areas, and will see ACE technologies as one thing.”

CAR notes that many see Tesla as a leader in electric vehicle deployment, and the company is also very aggressive in implementing conditional automated driving technologies. Tesla’s combination of real and, in AutoInformed’s view, perceived technology leadership has given the company a distinctive marketing position, and real-world learning – some of them deadly – from conditional automated driving. Well, yes, but Tesla is unprofitable and using fuel economy regulatory credits that are about to run out. However, it is creating some public excitement, and maybe changing consumer expectations.

Follow the Hype Leader

From a market positioning opportunity, many companies are enviously looking at Tesla. CAR notes that these companies have made ACE technologies a part of their vision for market success.

- Volkswagen, for example, is proactively positioning the VW Buzz—their re-imagining of the VW microbus—as an ACE game-changer for the company. The Buzz is VW’s star candidate for testing how the consumer might react to ACE technology innovations.

- Smart CEO Annette Winkler said during her introduction of the Smart Vision EQ Fortwo concept vehicle, “The smart vision EQ Fortwo is our vision of future urban mobility; it is the most radical car sharing concept car of all: fully autonomous, with maximum communication capabilities, friendly, comprehensively personalisable and, of course, electric”. The paths of CAV and battery electric vehicle (BEV) technologies are merging, and the resulting fusion may further enable the sharing economy.

- General Motors recently built 130 Chevrolet Bolts with automated technology for on-road testing.

- Maven, GM’s car-sharing business, also relies on the (non-automated) fully-electric Chevy Bolt. While Cadillac is GM’s leading brand to deploy conditional automated driving technologies, the Bolt is the company’s showcase for testing fully-automated driving and new mobility ideas.

- Lyft and Uber are players who see the opportunity for real cost savings when they can eliminate the driver. Once the need for a driver is gone, the vehicle will have to charge itself. For that, BEVs provide a more viable pathway.

- Qualcomm, Plugless Power and others are working to develop and deliver inductive charging which may enable cars to refuel (recharge) without any driver intervention.