Click to enlarge.

BMW Group confirms full-year guidance

The International Monetary Fund (IMF) has revised its forecasts for global economic growth downwards to 2.8% in April 2025: Current trade conflicts and the associated potential rise in inflation, as well as uncertainty among businesses and consumers, could weigh on global growth. According to sector forecasts, the global automotive markets are likely to see slight growth.

• The BMW Group expects demand to rise in many markets in 2025, driven by a stabilizing inflation and further moderate interest rate cuts. In the USA, permanent tariffs could be reflected in rising inflation.

• The guidance published in the BMW Group Report 2024 in March 2025 includes all tariff increases that had taken effect by 12 March 2025. Due to the volatile developments and ongoing negotiations, the potential impact of tariffs in the current financial year can only be estimated, based on assumptions. The BMW Group expects some of the tariff increases to be temporary, with reductions from July 2025. The forecast also includes mitigating measures to offset the impact of higher tariffs.

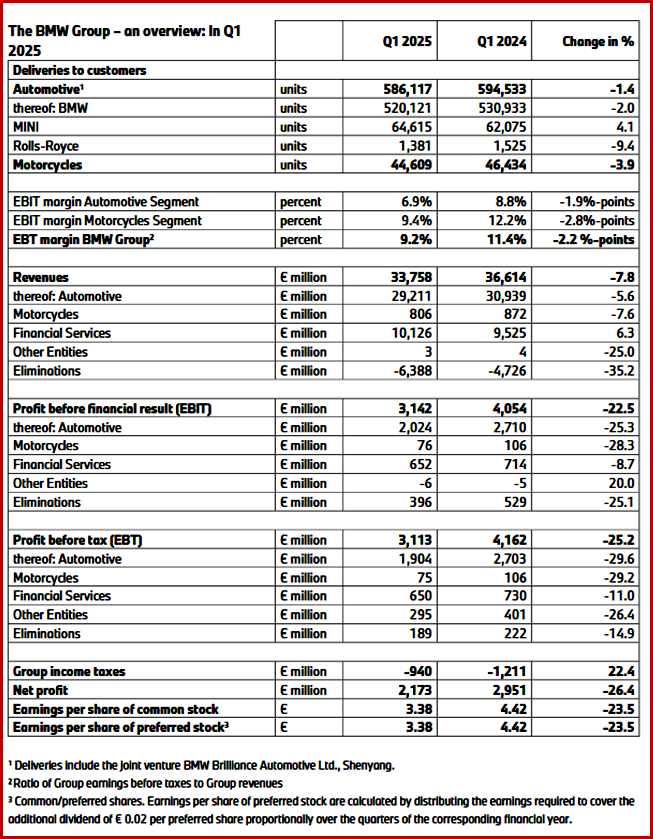

• Given the sustained demand for its attractive premium vehicles, the BMW Group is able to confirm its guidance for the year. The company anticipates slight sales growth, with fully-electric vehicles contributing to a slightly higher share of deliveries. Due to the factors mentioned above, Group earnings before tax are expected to be on a par with the previous year.**The EBIT margin for the Automotive Segment is forecast to be within the range of 5.0-7.0%, with an RoCE of between 9-13%.

• In the Financial Services Segment, RoE is projected to be between 13-16%.

• In the Motorcycles Segment, a slight increase in sales and an EBIT margin within the range of 5.5-7.5%are forecast, with an RoCE of 13-17%

• The above targets will be achieved with the current number of employees.