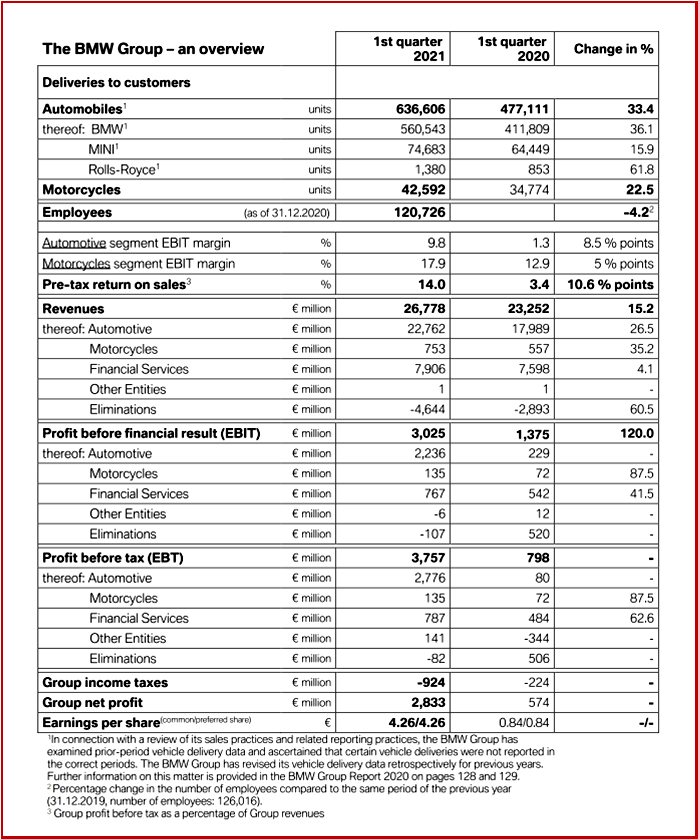

The BMW Group set a new record for first-quarter deliveries with an increase of 33.4% to 636,606 units compared to the previous year in 2020 of 477,111. Q1 financial results showed a return in booming automotive segments of 9.8% EBIT. Demand for electrified vehicles – plug-in hybrids and fully electric – contributed to sales performance, with deliveries more than doubling compared to the same quarter one year earlier with a total of 70,207 electrified vehicles delivered to customers during the three-month period (2020: 30,692 units; +128.7%), including 14,161 units of the fully electric BMW iX3, BMW i3 and MINI Cooper SE models (2020: 6,457 units; +119.3%).

Improved revenues and earnings of €4.26 per share were driven by a combination of higher sales volume figures across all regions of the world, particularly in China, and higher selling prices. Helpful effects also came from the sharp rise in prices of used vehicles, causing revenues from the sale of previously leased vehicles to rise, above all in the USA where the Biden Administration economy is soaring. Group revenues grew by 15.2% to €26,778 million (2020: €23,252 million; +18.9% adjusted for currency factors).

Click to Enlarge.

The improved financial result also contributed to earnings growth. The Group’s share of the profit in the Chinese joint venture BMW Brilliance Automotive amounting to €503 million (2020: €162 million) as well as positive effects on interest rate hedges and individual investments. This helped a significant improvement in the first-quarter financial result, which turned around from a net negative amount of €577 million to a net positive amount of €732 million.

Group profit before tax improved to € 3,757 million (2020: € 798 million). The EBT margin for the Group came in at 14.0% (2020: 3.4%). Group net profit amounted to € 2,833 million (2020: € 574 million).

“Profitability is a key aspect of our transformation journey. Our operational strength enables us to manage the move towards a world of digitally connected, sustainable mobility. With this aim in mind, we are investing specifically in low-emission drivetrain systems and attractive, highly innovative products and equipment. Furthermore, we continue to streamline our processes and structures in order to boost performance,” said Dr Nicolas Peter, Member of the Board of Management of BMW AG, Finance in Munich on Friday.

The Group’s research and development expenditures were €1,287 million (2020: € 1,324 million; -2.8%), slightly lower than one year earlier, with costs arising in the first quarter 2021 primarily for electrification and digitization as well as for preparing the production ramp-up of the BMW iX The increase in revenues caused the R&D ratio to fall to 4.8% (2020: 5.7%). At 22.6%, the capitalization rate was also lower than one year earlier (2020: 28.4%).

Sales Growth for all BMW Group Brands

Higher sales volume in the first quarter 2021 resulted in increases in Automotive segment revenues and earnings. Worldwide deliveries of BMW brand vehicles totaled 560,543 units (2020: 411,809 units; +36.1%). The figure included contributions from the successful BMW 5 Series and BMW 3 Series, both of which recorded year-on-year growth of more than 40%. The popular X-family models were also in high demand during the three-month period.

At 74,683 units, MINI brand sales were 16% higher than one year earlier (2020: 64,449 units; +15.9%). Demand for the MINI Countryman was high, with deliveries up by more than one third (+35.9%) as well as for the John Cooper Works models (+20.5%).

Rolls-Royce Motor Cars delivered 1,380 ultra-luxury automobiles to customers, the highest number ever achieved in a single quarter (2020: 853 units; +61.8%), with China, the USA and the Asia-Pacific region the biggest contributors to this growth.

Deliveries Up in All Major Regions

In Europe, the number of vehicles delivered by the BMW Group rose by 8.1% to 239,018 units (2020: 221,024 units) despite the adverse effects of the coronavirus pandemic. Customers in Germany took delivery of 62,696 units (2020: 66,004 units; -5.0%) and customers in the UK 42,413 units (2020: 44,474 units; -4.6%). In other countries and regions of Europe such as France, Italy and northern Europe, the BMW Group recorded double-digit sales volume growth year on year.

Deliveries to customers in the Americas region rose to 96,352 units (2020: 82,078 units; +17.4%) as markets continued to pick up, notably in the USA, where sales were up by more than one fifth to 78,067 units (2020: 64,956 units; +20.2%).

In Asia, the BMW Group delivered a total of 287,697 units, up by 77% on the same quarter last year and a new all-time high (2020: 162,940 units; +76.6%). Sales figures for China nearly doubled year-on-year, up 98% to 230,193 units (2020: 116,577 units; +97.5%), partly reflecting the weaker performance one year earlier.

Automotive Segment Records High Revenue Growth

Segment revenues totaled €22,762 million in the first quarter (2020: € 17,989 million; +26.5%, currency-adjusted +30.4%), driven primarily by the continued upward trend in sales volume. In addition, positive product mix effects due to higher sales of the X5 and X6, among other models, as well as improved pricing boosted revenues. Revenues generated with the Chinese joint venture BMW Brilliance Automotive also rose year-on-year.

Segment EBIT amounted to €2,236 million (2020: € 229 million) and segment profit before tax to €2,776 million (2020: € 80 million). The EBIT margin came in at 9.8% and was within the desired long-term target range (2020: 1.3%).

Free cash flow generated by the Automotive segment increased to €2,522 million, mainly reflecting improved earnings before tax and continued rigorous working capital management.

Financial Services

In total, 489,066 new credit financing and leasing contracts were signed with retail customers during the first quarter 2021, up by a solid 8.8% compared to one year earlier (2020: 449,687 contracts), mainly due to the sharp rise in credit financing business (+15.2%), particularly in China. The total volume of new credit financing and leasing contracts concluded with retail customers increased by 9.1% to €15,351 million (2020: € 14,075 million).

Revenues generated by the Financial Services segment in the first quarter increased slightly to €7,906 million (2020: € 7,598 million; +4.1%) due to positive effects from business with end-of-contract leasing vehicles.

Earnings improved at a higher rate, largely due to the improved risk situation on the one hand and higher marketing revenues from the sale of returned lease vehicles on the other, particularly on the US market, with segment profit before tax rising to €787 million (2020: € 484 million; +62.6%). The Financial Services segment makes provision on an ongoing and comprehensive basis to take account of significant business risks. Current assessments confirm that residual value and credit risks are appropriately covered, BMW claimed.

Forecast Volatile

“The coronavirus pandemic will continue to influence the course of business for the BMW Group throughout the current financial year − both directly and indirectly. Vaccination measures being taken worldwide should, however, have a positive effect on the situation and increasingly reduce the adverse impact of the pandemic on global economic growth.

“Nevertheless, negative consequences for the BMW Group cannot be ruled out in the further course of the year.

“Furthermore, rising raw materials prices could have a dampening impact on earnings going forward. In light of the current dynamic environment, the BMW Group reaffirms its outlook for the full year, expecting business performance continuing to develop positively. New models and digital services covering various aspects of individual mobility are likely to ensure that demand remains buoyant. Group profit before tax is therefore predicted to rise significantly during the outlook period,” BMW said.

The Automotive segment is expected to record a solid year-on-year increase in the number of BMW, MINI and Rolls-Royce brand vehicles delivered to customers. The segment’s EBIT margin is projected to improve significantly on the previous year’s figure and come in at the upper end of the forecast range between 6 and 8%, with segment RoCE also improving significantly. Segment free cash flow is likely to exceed € 4 billion over the year as a whole.

In the Financial Services segment, the Return on Equity (RoE) is forecast to come in at the upper end of the range between 12% and 15%.

The Motorcycles segment is expected to record a solid increase in deliveries to customers. The EBIT margin is predicted to lie within a target range of 8% to 10%, enabling the segment to record a significantly higher level of RoCE than one year earlier.

The BMW Group also reaffirmed its forecast for non-financial performance indicators. The proportion of women in management functions is expected to increase slightly. At the same time, the BMW Group is targeting a further significant reduction in the carbon emissions generated by its new vehicle fleet. According to current forecasts, carbon emissions per vehicle produced are likely to fall moderately.

The Group’s targets for the year are to be met with a slightly smaller workforce. Ongoing uncertainty – particularly regarding the further course of the corona pandemic, macroeconomic and political developments as well as international trade and customs policies – could have a negative impact on economic conditions in many regions. These eventualities could hold down growth and thereby have a further significant impact on the business performance of the BMW Group.

“The first quarter shows that our global business model is a successful one, even in times of crisis. We remain firmly on track for continued sustainable, profitable growth,” claimed Oliver Zipse, Chairman of the Board of Management of BMW AG, in Munich. “Our strategy is based on retaining a keen focus on providing attractive high-tech products that are destined to shape the changing world of mobility going forward. With this clear vision, we are already developing the next major technological leaps that will continue to fascinate our customers ten years from now.”

BMW Group Q1 – Record Deliveries of 637,000, up 33%

The BMW Group set a new record for first-quarter deliveries with an increase of 33.4% to 636,606 units compared to the previous year in 2020 of 477,111. Q1 financial results showed a return in booming automotive segments of 9.8% EBIT. Demand for electrified vehicles – plug-in hybrids and fully electric – contributed to sales performance, with deliveries more than doubling compared to the same quarter one year earlier with a total of 70,207 electrified vehicles delivered to customers during the three-month period (2020: 30,692 units; +128.7%), including 14,161 units of the fully electric BMW iX3, BMW i3 and MINI Cooper SE models (2020: 6,457 units; +119.3%).

Improved revenues and earnings of €4.26 per share were driven by a combination of higher sales volume figures across all regions of the world, particularly in China, and higher selling prices. Helpful effects also came from the sharp rise in prices of used vehicles, causing revenues from the sale of previously leased vehicles to rise, above all in the USA where the Biden Administration economy is soaring. Group revenues grew by 15.2% to €26,778 million (2020: €23,252 million; +18.9% adjusted for currency factors).

Click to Enlarge.

The improved financial result also contributed to earnings growth. The Group’s share of the profit in the Chinese joint venture BMW Brilliance Automotive amounting to €503 million (2020: €162 million) as well as positive effects on interest rate hedges and individual investments. This helped a significant improvement in the first-quarter financial result, which turned around from a net negative amount of €577 million to a net positive amount of €732 million.

Group profit before tax improved to € 3,757 million (2020: € 798 million). The EBT margin for the Group came in at 14.0% (2020: 3.4%). Group net profit amounted to € 2,833 million (2020: € 574 million).

“Profitability is a key aspect of our transformation journey. Our operational strength enables us to manage the move towards a world of digitally connected, sustainable mobility. With this aim in mind, we are investing specifically in low-emission drivetrain systems and attractive, highly innovative products and equipment. Furthermore, we continue to streamline our processes and structures in order to boost performance,” said Dr Nicolas Peter, Member of the Board of Management of BMW AG, Finance in Munich on Friday.

The Group’s research and development expenditures were €1,287 million (2020: € 1,324 million; -2.8%), slightly lower than one year earlier, with costs arising in the first quarter 2021 primarily for electrification and digitization as well as for preparing the production ramp-up of the BMW iX The increase in revenues caused the R&D ratio to fall to 4.8% (2020: 5.7%). At 22.6%, the capitalization rate was also lower than one year earlier (2020: 28.4%).

Sales Growth for all BMW Group Brands

Higher sales volume in the first quarter 2021 resulted in increases in Automotive segment revenues and earnings. Worldwide deliveries of BMW brand vehicles totaled 560,543 units (2020: 411,809 units; +36.1%). The figure included contributions from the successful BMW 5 Series and BMW 3 Series, both of which recorded year-on-year growth of more than 40%. The popular X-family models were also in high demand during the three-month period.

At 74,683 units, MINI brand sales were 16% higher than one year earlier (2020: 64,449 units; +15.9%). Demand for the MINI Countryman was high, with deliveries up by more than one third (+35.9%) as well as for the John Cooper Works models (+20.5%).

Rolls-Royce Motor Cars delivered 1,380 ultra-luxury automobiles to customers, the highest number ever achieved in a single quarter (2020: 853 units; +61.8%), with China, the USA and the Asia-Pacific region the biggest contributors to this growth.

Deliveries Up in All Major Regions

In Europe, the number of vehicles delivered by the BMW Group rose by 8.1% to 239,018 units (2020: 221,024 units) despite the adverse effects of the coronavirus pandemic. Customers in Germany took delivery of 62,696 units (2020: 66,004 units; -5.0%) and customers in the UK 42,413 units (2020: 44,474 units; -4.6%). In other countries and regions of Europe such as France, Italy and northern Europe, the BMW Group recorded double-digit sales volume growth year on year.

Deliveries to customers in the Americas region rose to 96,352 units (2020: 82,078 units; +17.4%) as markets continued to pick up, notably in the USA, where sales were up by more than one fifth to 78,067 units (2020: 64,956 units; +20.2%).

In Asia, the BMW Group delivered a total of 287,697 units, up by 77% on the same quarter last year and a new all-time high (2020: 162,940 units; +76.6%). Sales figures for China nearly doubled year-on-year, up 98% to 230,193 units (2020: 116,577 units; +97.5%), partly reflecting the weaker performance one year earlier.

Automotive Segment Records High Revenue Growth

Segment revenues totaled €22,762 million in the first quarter (2020: € 17,989 million; +26.5%, currency-adjusted +30.4%), driven primarily by the continued upward trend in sales volume. In addition, positive product mix effects due to higher sales of the X5 and X6, among other models, as well as improved pricing boosted revenues. Revenues generated with the Chinese joint venture BMW Brilliance Automotive also rose year-on-year.

Segment EBIT amounted to €2,236 million (2020: € 229 million) and segment profit before tax to €2,776 million (2020: € 80 million). The EBIT margin came in at 9.8% and was within the desired long-term target range (2020: 1.3%).

Free cash flow generated by the Automotive segment increased to €2,522 million, mainly reflecting improved earnings before tax and continued rigorous working capital management.

Financial Services

In total, 489,066 new credit financing and leasing contracts were signed with retail customers during the first quarter 2021, up by a solid 8.8% compared to one year earlier (2020: 449,687 contracts), mainly due to the sharp rise in credit financing business (+15.2%), particularly in China. The total volume of new credit financing and leasing contracts concluded with retail customers increased by 9.1% to €15,351 million (2020: € 14,075 million).

Revenues generated by the Financial Services segment in the first quarter increased slightly to €7,906 million (2020: € 7,598 million; +4.1%) due to positive effects from business with end-of-contract leasing vehicles.

Earnings improved at a higher rate, largely due to the improved risk situation on the one hand and higher marketing revenues from the sale of returned lease vehicles on the other, particularly on the US market, with segment profit before tax rising to €787 million (2020: € 484 million; +62.6%). The Financial Services segment makes provision on an ongoing and comprehensive basis to take account of significant business risks. Current assessments confirm that residual value and credit risks are appropriately covered, BMW claimed.

Forecast Volatile

“The coronavirus pandemic will continue to influence the course of business for the BMW Group throughout the current financial year − both directly and indirectly. Vaccination measures being taken worldwide should, however, have a positive effect on the situation and increasingly reduce the adverse impact of the pandemic on global economic growth.

“Nevertheless, negative consequences for the BMW Group cannot be ruled out in the further course of the year.

“Furthermore, rising raw materials prices could have a dampening impact on earnings going forward. In light of the current dynamic environment, the BMW Group reaffirms its outlook for the full year, expecting business performance continuing to develop positively. New models and digital services covering various aspects of individual mobility are likely to ensure that demand remains buoyant. Group profit before tax is therefore predicted to rise significantly during the outlook period,” BMW said.

The Automotive segment is expected to record a solid year-on-year increase in the number of BMW, MINI and Rolls-Royce brand vehicles delivered to customers. The segment’s EBIT margin is projected to improve significantly on the previous year’s figure and come in at the upper end of the forecast range between 6 and 8%, with segment RoCE also improving significantly. Segment free cash flow is likely to exceed € 4 billion over the year as a whole.

In the Financial Services segment, the Return on Equity (RoE) is forecast to come in at the upper end of the range between 12% and 15%.

The Motorcycles segment is expected to record a solid increase in deliveries to customers. The EBIT margin is predicted to lie within a target range of 8% to 10%, enabling the segment to record a significantly higher level of RoCE than one year earlier.

The BMW Group also reaffirmed its forecast for non-financial performance indicators. The proportion of women in management functions is expected to increase slightly. At the same time, the BMW Group is targeting a further significant reduction in the carbon emissions generated by its new vehicle fleet. According to current forecasts, carbon emissions per vehicle produced are likely to fall moderately.

The Group’s targets for the year are to be met with a slightly smaller workforce. Ongoing uncertainty – particularly regarding the further course of the corona pandemic, macroeconomic and political developments as well as international trade and customs policies – could have a negative impact on economic conditions in many regions. These eventualities could hold down growth and thereby have a further significant impact on the business performance of the BMW Group.

“The first quarter shows that our global business model is a successful one, even in times of crisis. We remain firmly on track for continued sustainable, profitable growth,” claimed Oliver Zipse, Chairman of the Board of Management of BMW AG, in Munich. “Our strategy is based on retaining a keen focus on providing attractive high-tech products that are destined to shape the changing world of mobility going forward. With this clear vision, we are already developing the next major technological leaps that will continue to fascinate our customers ten years from now.”

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.