Click to Enlarge chart.

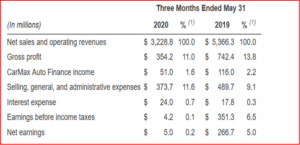

CarMax (NYSE:KMX), the nation’s largest retailer of used cars, today reported weak results for the first quarter ending May 31, 2020. Net sales and operating revenues declined 39.8% to $3.23 billion. Net earnings declined 98.1% to $5.0 million and net earnings per diluted share declined 98.1% to $0.03. Nonetheless CarMax stock is up ~12% year-to-date at ~$92/share, even though used car sales are projected to decline. It’s part of the mania on tech stocks that thinks the companies are invincible.

The current quarter’s results included $122.0 million in a CarMax Auto Finance (CAF) provision for loan losses, which included an increase of $84.0 million, or $0.38 per diluted share, based on an estimate of lifetime losses on existing loans resulting from the Corona virus related turmoil and worsening economic factors. Net earnings per diluted share for the current quarter also included a one-time benefit of $0.18 in connection with the receipt of settlement proceeds in a class action lawsuit. CarMax Q1 2021 – Net Sales Drop 40% to $3.2B

“CarMax spent approximately $30 million supporting associates impacted by the Coronavirus, store closures and furloughs. This included providing associates with at least 14 days of pay continuity upon store closure or quarantine, along with continuing medical benefits for associates who were furloughed,” said Bill Nash, president and chief executive officer. “Our associates are crucial to our culture and our long history of success. While the furlough was a difficult decision, we’re pleased to have called back more than 85% of these associates,” added Nash.

As of May 31, 2020, CarMax had $658.0 million in cash and cash equivalents on hand and $1.08 billion of unused capacity on its revolving credit, compared with $58.2 million and $997.3 million, respectively, as of February 29, 2020. Total long-term debt, excluding non-recourse notes payable, declined to $1.71 billion as of May 31, 2020, compared with $1.79 billion as of February 29, 2020.

Nash said he is encouraged by recent trends experienced in late May and June. Used unit sales have continued to gain strength, web traffic is up year-over-year and reaching new highs and leads to Customer Experience Centers have returned to pre-Coronavirus levels.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

CarMax Q1 2021 – Net Sales Drop 40% to $3.2B

Click to Enlarge chart.

CarMax (NYSE:KMX), the nation’s largest retailer of used cars, today reported weak results for the first quarter ending May 31, 2020. Net sales and operating revenues declined 39.8% to $3.23 billion. Net earnings declined 98.1% to $5.0 million and net earnings per diluted share declined 98.1% to $0.03. Nonetheless CarMax stock is up ~12% year-to-date at ~$92/share, even though used car sales are projected to decline. It’s part of the mania on tech stocks that thinks the companies are invincible.

The current quarter’s results included $122.0 million in a CarMax Auto Finance (CAF) provision for loan losses, which included an increase of $84.0 million, or $0.38 per diluted share, based on an estimate of lifetime losses on existing loans resulting from the Corona virus related turmoil and worsening economic factors. Net earnings per diluted share for the current quarter also included a one-time benefit of $0.18 in connection with the receipt of settlement proceeds in a class action lawsuit. CarMax Q1 2021 – Net Sales Drop 40% to $3.2B

“CarMax spent approximately $30 million supporting associates impacted by the Coronavirus, store closures and furloughs. This included providing associates with at least 14 days of pay continuity upon store closure or quarantine, along with continuing medical benefits for associates who were furloughed,” said Bill Nash, president and chief executive officer. “Our associates are crucial to our culture and our long history of success. While the furlough was a difficult decision, we’re pleased to have called back more than 85% of these associates,” added Nash.

As of May 31, 2020, CarMax had $658.0 million in cash and cash equivalents on hand and $1.08 billion of unused capacity on its revolving credit, compared with $58.2 million and $997.3 million, respectively, as of February 29, 2020. Total long-term debt, excluding non-recourse notes payable, declined to $1.71 billion as of May 31, 2020, compared with $1.79 billion as of February 29, 2020.

Nash said he is encouraged by recent trends experienced in late May and June. Used unit sales have continued to gain strength, web traffic is up year-over-year and reaching new highs and leads to Customer Experience Centers have returned to pre-Coronavirus levels.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.