Click for more.

Price Wars Intensify

“JV brands, primarily focusing on ICE vehicles, felt the squeeze in market share and were compelled to retaliate. Beijing Hyundai and GM Buick were quick to respond; Hyundai reduced the starting price of the new Elantra from CNY99,800 (US$13,800) to CNY75,800 (US$10,500), and Buick offered discounts of up to CNY65,000 (US$9,000) per vehicle. Even brands that were initially slow to react eventually joined the pricing war. Nissan lowered the Sylphy’s price to CNY69,800 (US$9,600), and Volkswagen’s Bora model, a competitor in the same segment, also saw a price drop to CNY68,000 (US$9,400), with a special emphasis on its ‘NEV value retention rate, indicating a highly competitive market.

“The premium segment was not spared from the price reductions, with Cadillac’s CT5 officially announcing a price cut of CNY70,000 (US$9700). German luxury brands like Mercedes-Benz and BMW also joined the trend, with BMW’s iX1 seeing the highest reduction of nearly CNY150,000 (US$20,700). The entry price for BMW’s i3 and iX3 was set at CNY200,000 (US$27,600), while the Mercedes-Benz EQA and EQB models went below the CNY200,000 (US$27,600) mark.

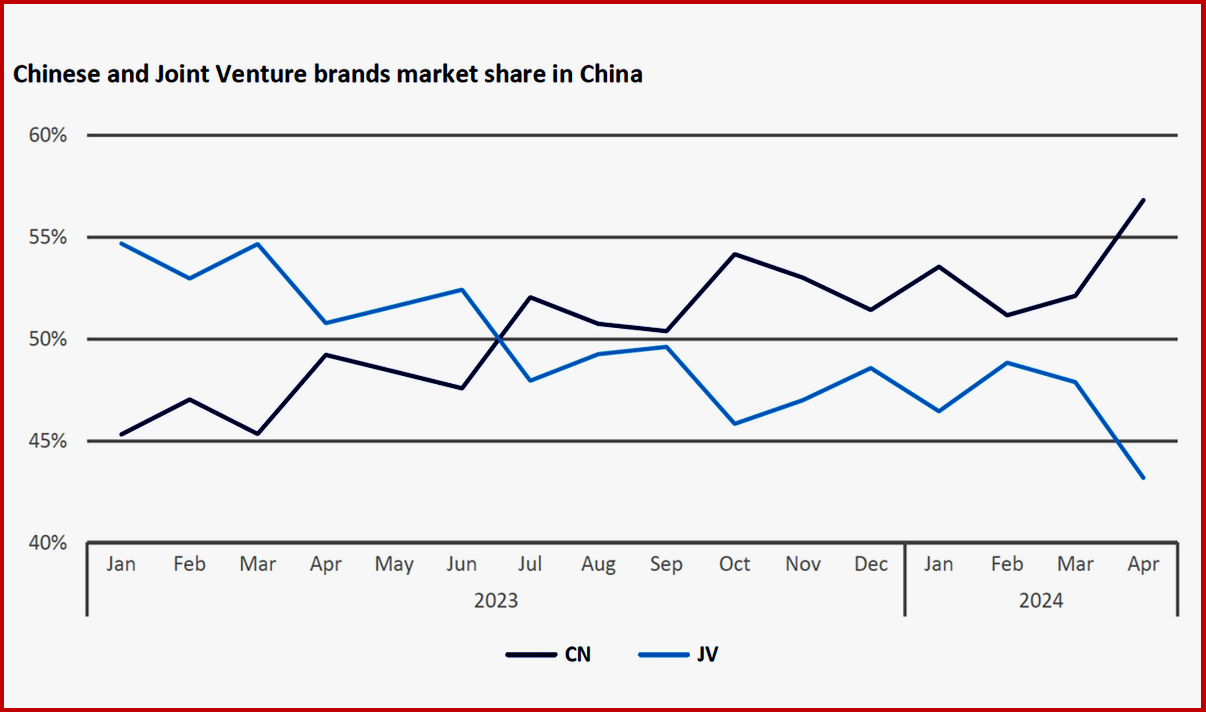

“These price reductions have accelerated the industry’s consolidation, with JV brands facing the dual challenge of shrinking market share and increased competition from new car-making forces. The impact of the price war is pushing the automotive industry into a phase of intense competition and potential market realignment,” said Zhang.