Chrysler Group today reported its preliminary Q3 2013 results, including net income of $464 million, an increase of 22% from $381 million in the same quarter a year earlier. The third quarter marks the Company’s ninth consecutive quarter of positive net income. Net income for the first nine months of 2013 totaled more than $1.1 billion. Net revenue was $17.6 billion for the third quarter of 2013, up 13.5% from $15.5 billion for the same period last year, mostly from an increase in vehicle shipments, including the Jeep Grand Cherokee and Ram pickup trucks in North America. However, the failure to ship new Jeep Cherokee models – in production since June, but without certification and just now shipping – severely hurt results. Net revenue totaled $50.9 billion for the first nine months of 2013 for the Fiat controlled automaker that U.S. taxpayers lost $2.9 billion on a bankruptcy reorganization that allowed Fiat to take control.

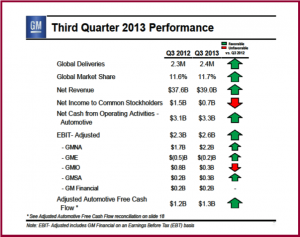

General Motors Company today (NYSE: GM) today said Q3 net income to common stockholders was $700 million or $0.45 per share, down from $1.5 billion or $0.89 per fully diluted share a year ago. Good, perhaps excellent, improvements in operating performance during the quarter was trumped by large losses from special items and incremental tax expenses. Net income was hurt by a net loss from special items of $900 million or $0.51 per fully diluted share, including $800 million related to the repurchase of 120 million shares of Preferred Series A Stock, which ultimately will reduce interest payments going forward. Results were also hurt by incremental tax expense of $500 million or $0.29 per fully diluted share in the quarter compared to the third quarter of 2012.

The raw GM numbers are misleading. GM is slowly but surely getting back to fighting shape. Even GM Europe during Q3 increased revenue year-over-year for the first time in two years in the moribund market. Moreover, even with stock buybacks and special charges GM’s automotive free cash flow was a healthy $1.3 billion.

Nevertheless, U.S. Taxpayers will lose almost $10 billion on financing a bankruptcy reorganization, according to the latest U.S. Treasury report. Why Treasury isn’t holding GM stock instead of dumping hundreds of millions of shares is a question AutoInformed has raised more than once. By 2015 GM will once again be the powerhouse it was in 1960. Then you sell.

Both the Chrysler and GM results were significantly less than Ford Motor Company’s Q3 profit of $2.6 billion, which was based largely on sales and financing in North America with some contributions from other regions. This was $426 million higher than a year ago. Third quarter earnings per share of $0.45 was $0.05 per share higher than a year ago. Succession worries, huge unfunded pension liabilities an over dependence on North America, and dreadful quality problems at Ford have many observers leery. This is keeping Ford stock in the $17 range even though the stock is paying a 2% dividend and has significant growth potential during the next 5 years. (Read Infotainment Defects Growing in Latest Auto Reliability Data, Another Lawsuit Filed against Ford EcoBoost V6 Engines, NHTSA Opens Ford EcoBoost Investigation for Stalling)

“We increased our third quarter global deliveries by 5.5% and grew our global market share by one-tenth of a point,” said GM CEO Dan Akerson. “Net revenue increased by $1.4 billion and EBIT adjusted was up 15% to $2.6 billion. This $300 million increase was driven by higher earnings in North America and South America, a small increase in China and a smaller loss in Europe and another very solid quarter for GM Financial. GM Financial, I would like to point out, has now surpassed $2 billion in cumulative pre-tax earnings since we acquired the company in the second half of 2010.”