A good performance, but the auto business isn’t getting any easier for owner Fiat as the EU and competition are increasing costs and depressing margins.

Chrysler Group’s full-year 2012 net income improved more than eight-fold to $1.7 billion, up from $183 million a year ago. The positive result came from rising global sales of 2.2 million vehicles, up 18% from 2011. Net revenue for the year was $65.8 billion, up 20% from $55.0 billion in 2011; fourth-quarter revenue was up 13% to $17.2 billion. Overall, Chrysler Group sales were up 21% during 2012. The outlook for 2013 is also positive with an increases in sales (+200,000 to 300,000 units), net revenue ($72 to $75 billion billion), and operating profit (+5% or $3.8 billion) projected.

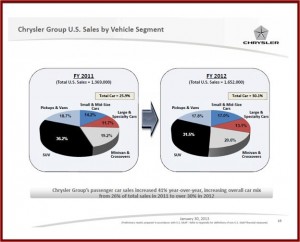

The strong results came mostly from North America with growing sales of Ram trucks and Jeeps, where CEO Sergio Marchionne is hoping to offset huge losses primarily incurred in the EU by the parent company Fiat Group, which lost more than €1 billion during 2012 without Chrysler’s contribution tallied in.

Marchionne says he will merge the two Groups by 2015. However, he surprised analysts by changing his business plan forecast for Chrysler, slashing free cash flow from $3 billion to only $1 billion for 2014, with 2013 at about half of the $2.2 billion 2012 generated, a result of Chrysler’s changing market mix and a nod to competition from the Japanese and Koreans in the U.S . He needs the cash to develop new products for both Groups – more than $4 billion in capital expenditures annually – while shoring up Fiat’s foundation. How he does this is problematic since it could result in an attempt to strip the assets of Chrysler to save Fiat.

Marchionne is therefore restrained from updating his business plan beyond 2014 because there is a troublesome, thus far, unresolved issue surrounding the disposition of large amount of stock – 41.5% of Chrysler – sitting in the so-called VEBA or the health care plan that the UAW owns. The UAW wants to have an IPO and take the recovering company public, and thinks the stock should be valued on Chrysler’s performance not Fiat’s. Fiat asserts that the securities should be valued on Fiat’s overall performance.

The matter is in front of a Delaware court for clarification. How these securities are valued and sold, publicly or privately, could drastically affect Fiat’s balance sheet, and its capital expenditure options in the future. To put it politely, Fiat Group does not have unrestricted access to cash on the open markets, and it doesn’t own enough of Chrysler for a full takeover.

“I don’t see the future of Fiat and Chrysler as separate,” Marchionne said on a conference call this morning. “We started constructing a future together in 2009 and the connection is now irreversible.” He said as “soon as I can afford it,” the organizations would be merged, “the faster we do it the better I’ll feel.” He he can do this is the question.

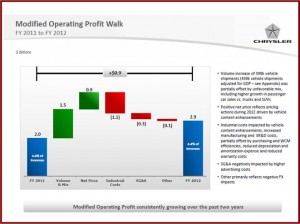

Chrysler Group’s so-called Modified Operating Profit was $2.9 billion for the year, or 4.4% of revenue, up 47% from $2.0 billion reported in the prior year (1). The increase resulted from strong sales and pricing, partially offset by an increase in the proportion of sales from less profitable passenger cars, including the Dodge Dart and Fiat 500, compared to trucks and SUVs. There was also increased research-and-development costs for future models as well as increased spending on advertising.

Worrisome is Group pension plan funding, a problem that also exists at Ford Motor (Ford Makes $8 Billion in 2012 – Almost all in North America). During 2012, because of decreases in the Canadian and U.S. discount rates, Chrysler Group now has $8.9 billion in unfunded pension obligations, an increase of more than $2.2 billion, with $7.7 billion of that potentially affecting U.S. retirees.

Cash at year’s end was $11.6 billion compared with $9.6 billion a year ago and $11.9 billion on 30 September. Free Cash Flow for the year was $2.2 billion compared with $1.9 billion a year ago. Debt was $1.0 billion year-end, an improvement of $1.9 billion from a year ago.

(See also Chrysler Group Posts Q3 Profit of $381 Million and Fiat Group Doubles Q3 Profit to €286 Million. Revenue €951 Million)

(1) Modified Operating Profit is computed by starting with net income, and then adjusting the amount to add back income tax expense and exclude income tax benefits, add back net interest expense [excluding interest expense related to financing activities from Gold Key Leases], add back all pension and other post-retirement benefit obligations.