“We’ve changed the conversation at Chrysler Group,” said Marchionne, who now has his hands full at Fiat.

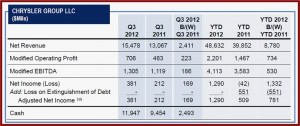

Chrysler Group today reported a Q3 profit of $381 million, an increase of 80% from Q3 a year ago, based on revenue of $15.5 billion, up 18% from $13.1 billion. For the first nine months of the year, Chrysler Group (1) posted net revenue of $48.6 billion, up 22% from the same period a year ago, as its recovery from bankruptcy continues. Cash at quarter-end was $11.9 billion compared with $9.5 billion a year ago and $12.1 billion on 30 June 2012. Cash flow for the quarter was a -$65 million compared with -$699 million a year ago because of new product actions. For the first nine months of 2012, cash flow was $2.5 billion.

Worldwide, Chrysler Group vehicle sales for the third quarter totaled 556,000, up12% from 2011. The Group’s U.S. market share was 11.3% during Q3, which included a 16% increase in U.S. retail sales; market share in Canada was 14.3%.

“We are confirming guidance for the year, and expect free cash flow to be well in excess of $1 billion,” said Sergio Marchionne, Chrysler Group Chairman and Chief Executive Officer. Fiat, which controls Chrysler, reports earnings, or at least financial results, tomorrow as the Eurozone crisis deepens.

The Group, largely a North American truck, minivan and Jeep business, recorded a Modified Operating Profit (2) of $706 million, or 4.6% of revenue, in Q3, up 46% from $483 million reported in the prior year. The increase was attributable to increased sales and lower interest costs.

The guidance or targets for 2012 that Marchionne referred to are:

- Worldwide vehicle shipments of 2.3 to 2.4 million

- Net revenue of ~ $65 billion

- Modified Operating Profit of ≥ $3.0 billion (2)

- Net income of ~ $1.5 billion

- Free Cash Flow of > $1 billion

Cash as of 30 September 2012 declined slightly to $11.9 billion from $12.1 billion as of 30 June 2012, but increased from $9.5 billion as of 30 September 2011. Total liquidity was $13.2 billion, including $1.3 billion available under a revolving credit agreement.

See:

- September EU Vehicle Sales Drop 11%. Eurozone Crisis Unabated

- NHTSA Prompts Recall of Dodge Ram Pickups for Axle Lockups

- Chrysler Group Reports September 2012 U.S. Sales Increase of 12%

- CAW Members Approve New Chrysler Two-Tier Labor Contract

- Canadian Auto Workers Have Tentative Deal at GM. Fiat Holds Out

- Chrysler Moves Forward on Eliminating Printed Owner’s Manuals

- Chrysler Group Q2 2012 Profit Totals $755 million

(1) Chrysler Group LLC was formed in 2009 with Canadian and U.S. taxpayer loans, which resulted in controlling interest going to Fiat S.p.A., the only auto company interested in attempting to revive it while preserving some jobs. Chrysler Group now produces Chrysler, Jeep, Dodge, Ram, Mopar, SRT and Fiat vehicles and products.

(2) Modified Operating Profit is computed starting with net income and then adjusting the amount to add back income tax expense and exclude income tax benefits, add back net interest expense [excluding interest expense related to financing activities from Gold Key Leases], add back all pension and other post-retirement benefit obligations.