There remains a troublesome unresolved issue surrounding the sale of some or all of the Chrysler stock (41.5%) held by the VEBA trust, the health care plan for UAW retirees. Ultimately, more than €2 billion in value is disputed.

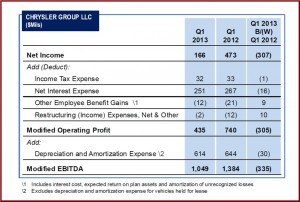

Chrysler Group today reported 2013 Q1 profits of $166 million on revenue of $15.4 billion, off 6% from $16.4 billion one year ago.

Global shipments of 574,000 vehicles decreased from 607,000 a year ago largely because of the cancellation of Jeep Liberty production to make way for a new Cherokee. Auto companies under a debatable U.S. accounting practice book revenues on shipments to dealers not sales. So even though Group worldwide sales for Q1 at 563,000 increased 8% from a year ago, it is not reflected on the balance sheet. Virtually all of this increase came from a 12% gain in U.S. retail sales, where the Group remains heavily dependent on SUV, truck and minivan sales. Ultimately, shipping and selling rates need to be reconciled. What matters is retail demand and share not propped up by aggressive shipments or fleet sales. Here Chrysler is holding steady.

How the UAW held securities are valued and ultimately sold, publicly or privately, could drastically affect Fiat’s balance sheet, and its capital expenditure options in the future.

The drag on earnings also came from launch costs of the 2013 Ram Heavy Duty trucks and the 2014 Jeep Grand Cherokee, as well as preparation for the Q2 launch of the 2014 Jeep Cherokee, which replaces the Liberty. The Cherokee plant is ultimately capable of producing more than 250,000 units a year. As AutoInformed previously stated, Cherokee will sell at twice the rate of Liberty because of the availability for the first time of front-wheel-drive version.

It was the Fiat-controlled Company’s seventh consecutive quarter of positive net income, even though net revenue for the quarter was down to $15.4 billion, compared with $16.4 billion a year ago. This will negatively affect Fiat Group results when it reports later today.

“While the task ahead this year is daunting, we remain committed to our overall targets, including a minimum shipment increase of 8% and a Modified Operating Profit of $3.8 billion,” said CEO Sergio Marchionne, who has his hands full on the Fiat side of the business because of the ongoing Eurozone crisis. Fiat Group lost more than €1 billion during 2012 without Chrysler’s contribution tallied in.

There also remains a troublesome unresolved issue surrounding the disposition of a large amount of stock – 41.5% of Chrysler – sitting in the so-called VEBA or the health care plan that the UAW owns. The UAW wants to have an IPO and take the recovering company public, and thinks the stock should be valued on Chrysler’s performance not Fiat’s. Fiat asserts that the securities should be valued on Fiat Group’s overall performance.

In January, Chrysler Group said that it had received a request from the UAW VEBA seeking a shelf registration of approximately 16.6% of Chrysler Group’s outstanding equity interests currently owned by the VEBA so that it could quickly sell the stock. Fiat wants to purchase this stock, but according to Marchionne only at a ‘realistic” value as he again reiterated on a conference call this morning.

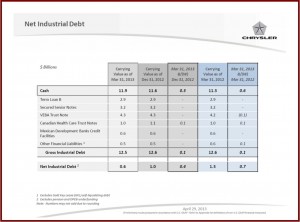

The valuation matter is in front of a Delaware court for clarification. There appears to be about a $6 billion difference in opinion. Simply put VEBA is claiming that the value of Chrysler Group should be calculated without counting a $4.5 billion note issued to it by the company after the bankruptcy to end all future health care payments. Fiat protests since the note reduces the value of Chrysler by about $4.5 billion.

How these securities are valued and sold, publicly or privately, could drastically affect Fiat’s balance sheet, and its capital expenditure options in the future. And the dispute is only about 40% of the stock the drastically underfunded VEBA holds. To put it politely, Fiat Group does not have unrestricted access to cash on the open markets, and it does not own enough of Chrysler for a full takeover at this time, even that is Marchionne’s long standing desire.

Marchionne confirmed previously announced 2013 goals:

- Worldwide vehicle shipments of 2.6-2.7 million

- Net revenue of $72-$75 billion

- Modified Operating Profit of ~$3.8 billion

- Net income of ~$2.2 billion

- Free Cash Flow of ≥$1 billion

Read AutoInformed.com on Chrysler Group Posts 2012 Net Income of $1.7 Billion