Marchionne said recently that Fiat’s wish to purchase the remaining 41.5% of Chrysler owned by the United Auto Workers was on hold.

Chrysler will file the paperwork necessary with the SEC for an IPO to return to public trading this week, CEO Sergio Marchionne told the Financial Times in an interview published this morning. As AutoInformed readers are aware, Fiat has been embroiled in a battle all year with the UAW Healthcare Trust or VEBA over the value of the balance of Chrysler stock the Trust holds at 41.5%. Fiat is the majority holder of Chrysler stock at 58.5%. Fiat wants to buy the stock back as part of a plan to merge Chrysler and Fiat into one automaker.

The UAW says the stock is worth $10.3 billion; Fiat says it is worth $4.2 billion. Fiat, of course, saved Chrysler from oblivion in 2009 as part of a controversial U.S. Treasury financed bankruptcy proceeding that essentially handed over Chrysler to Fiat for Fiat’s promise to save UAW jobs and reinvest in the company, but no cash. Fiat has since then repaid the U.S. Treasury loan.

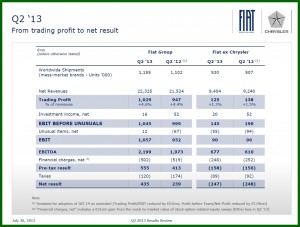

Fiat SpA [F.MI] posted a Q2 profit of €142 million or ~$188 million largely because of the contribution of Chrysler Group. The northern Italian company would have lost €247 million without Chrysler Group because its European sales dropped 5% during the period. Q2 revenues increased 4% to €22 billion. (Fiat SpA Q2 Profit at $188 Million – all from Chrysler)

Marchionne said the only way to determine the value is to turn to the public markets. “Let the market talk,” Marchionne told the FT about an IPO.

On the Q2 earnings call at the end of July with analysts and media Marchionne said that on hold for the moment is Fiat’s wish to purchase the remaining 41.5% of Chrysler owned by the United Auto Workers for former Chrysler workers. It appears he is now moving ahead, but if the market values the stock the same way it is currently valuing Tesla, it could be a very expensive foray, one that could saddle Fiat with a lot of debt.