Click for more information.

Other Cox Observations

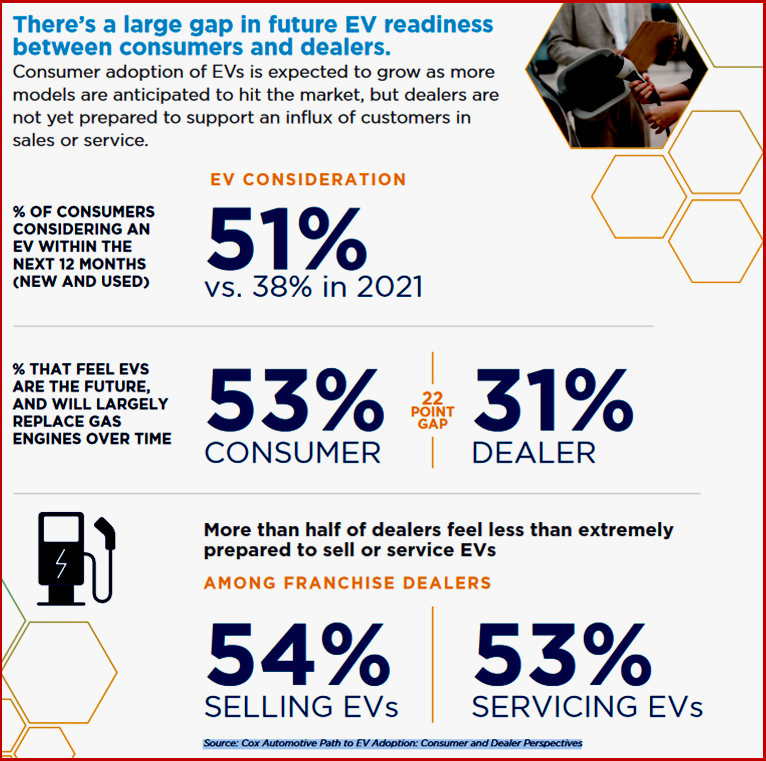

• EV Consideration Grows Rapidly, Sales More Slowly: 51% of consumers are now considering either a new or used EV, up from 38% in 2021. While interest in EVs rapidly increases, the gap between consideration and sales remains wide. EVs will account for less than 8% of total new-vehicle sales in 2023. On the used side, EV share of the total market remains ~1%. In many parts of the country, new EV inventory levels are increasing, as products arrive more quickly than consumers buy. In June, EV days of supply, measuring US inventory levels in the U.S. – was approaching 100 days, nearly twice the industry-wide average. EV consideration is well ahead of sales.

• Affordability continues to the top obstacle for EV buyers, with 43% of intenders noting EVs are too expensive, up slightly from the level in 2021. Other barriers, however, are diminishing. In 2021, 40% of intenders cited a lack of charging stations as a top roadblock. That number is now 32%.

• Future EV Readiness Gap: There is a significant gap in readiness between consumers and dealers in terms of embracing electric vehicles. According to the survey, 53% of consumers feel EVs are the future and will largely replace gas engines over time, compared to only 31% of dealers. [This is not surprising to AutoInformed since the dealer population has a large number of Republicans, the party that says Global Warming is a hoax, and has significant funding and dark money from the fossil fuel industry. Looming here is another elephant direct selling to consumers. – AutoCrat.]

• Nearly half (45%) of dealers surveyed feel that EVs still need to prove themselves in the marketplace. While consumer adoption of EVs is expected to soar as more models hit the market, dealerships are not prepared regarding sales and service capabilities, raising concerns about the overall customer experience and satisfaction. According to the survey, 82% of dealers are required by their OEM to make an EV investment. This should help dealers build the infrastructure needed to support EV growth.

• OEM Support Needed: Despite concerns, dealers see electric vehicles as important to the growth of their dealerships, both in selling (55%) and servicing (57%) EVs. However, the study reveals (claims?) that dealerships need more support and guidance from automakers, which they view as their preferred source of EV information. Dealers want comprehensive and up-to-date information to ensure they become the go-to resource for customers, specifically in areas of charging infrastructure and battery technology. According to the study, areas where dealers need to learn more about EVs include the battery lifecycle, battery health and overall servicing of an electric vehicle. According to the survey, this is consistent with EV owners, who also showed an interest in learning more about battery health.

Cox Automotive says it is the world’s largest automotive services and technology provider. It gathers data based on 2.3 billion online interactions annually. Cox Automotive can help car shoppers, automakers, dealers, retailers, lenders and fleet owners. The company has 25,000+ employees on five continents and a family of brands that include: Autotrader®, Dealertrack®, Kelley Blue Book®, Manheim®, NextGear Capital™ and vAuto®. Cox Automotive is a subsidiary of Cox Enterprises Inc., a privately-owned, Atlanta-based company with $22 billion in annual revenue. Visit coxautoinc.com or connect via @CoxAutomotive on Twitter, CoxAutoInc on Facebook or Cox-Automotive-Inc on LinkedIn.