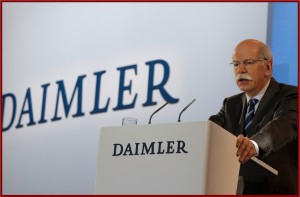

“Daimler is now in the middle of the most comprehensive growth offensive in its history. To these ends, we are investing large amounts in products, technologies and markets, which, in combination with the generally weak markets, led to a moderate start,” said Dieter Zetsche.

Daimler AG [DAI] posted a significant drop in Q1 earnings largely because of the ongoing economic slowdown in Western Europe where sales are running at a 20-year low. The Q1 EBIT of €917 million was less than half of Q1 2012 at €2,098 million. Net profit at €564 million compared to Q1 2012 at €1,425 million. Earnings per share amounted to €0.50 compared to Q1 2012 at €1.26.

The German vehicle-making conglomerate sold 501,600 cars and trucks, about the same as last year. Because of the weak quarter, Daimler said that EBIT in 2013 would be below 2012. It did however forecast an increase in vehicle sales and revenue for full-year 2013 based on optimism for the reception of upcoming new models.

The decline in earnings in the first three months of this year contained both a shift in the regional structure of unit sales and a changed model mix at Mercedes-Benz Cars and Mercedes-Benz Vans. There was also a decrease in unit sales by Daimler Trucks. At Daimler Buses, increased sales led to an improved operating profit, while the earnings posted by Daimler Financial Services remained constant.

On the basis of the new products, the ongoing efficiency programs and our assumptions for future market developments, we expect earnings in the second half of this year to be higher than in the first half, due in particular to the launch of the new S-Class,” said Dieter Zetsche, Chairman of the Board of Management of Daimler AG.

Mercedes-Benz Cars increased sales to 341,500 units (Q1 2012: 338,300). First-quarter revenue fell by 6% to €14.1 billion. The division’s EBIT of €460 million was significantly lower than in the first quarter of last year (Q1 2012: €1,230 million). Return on sales was 3.3% (Q1 2012: 8.2%). Earnings reflect a shift in the regional sale structure and a changed model mix. Furthermore, EBIT was reduced by expenses for product improvement and capacity expansion, as well as advance expenditure for new technologies and vehicles. Exchange-rate effects were slightly positive.

Unit sales by Daimler Trucks decreased by 6% in the first quarter to 101,400 vehicles and revenue amounted to €7.0 billion (-5%). The division’s EBIT of €116 million was lower than in the prior-year period (Q1 2012: €376 million). Return on sales was 1.7% (Q1 2012: 5.1%). Earnings were affected by the overall negative development of unit sales and revenue, resulting from weak demand in some core markets. Earnings were reduced also by expenses for the development of business in India and China, product adjustments especially in the NAFTA region and Europe, and higher warranty costs.

Unit sales by Mercedes-Benz Vans increased slightly in the first quarter of 2013 to 52,600 vehicles (Q1 2012: 51,200). Revenue decreased slightly to €2.0 billion (Q1 2012: € 2.1 billion). The division achieved EBIT of €81 million (Q1 2012: €167 million) and its return on sales fell accordingly to 4.1%, from 8.0% in the first quarter of last year. Earnings decreased significantly, mainly due to changes in the product mix and the regional sales structure. Advance expenditure for new products, including the launch of the Sprinter Classic in Russia, also reduced earnings.

In the first quarter of 2013, Daimler Buses increased its worldwide unit sales by 23% to 6,000 buses and chassis because of rising demand for bus chassis in Latin America. The business with complete buses in Western Europe was below the prior-year level. Revenue rose by 3% to €751 million; however, the changed model mix following the repositioning of the North American business system had a negative effect on revenue growth. The division’s EBIT amounted to -€31 million (Q1 2012: -€105 million) and its return on sales was -4.1% (Q1 2012: -14.4%).

Compared with the previous year, EBIT rose because of increased unit sales. Daimler Buses achieved significantly higher shipments of bus chassis, especially in Latin America. Business in Europe developed disparately: demand for city buses recovered somewhat, but Daimler Buses recorded lower unit sales of coaches. Exchange-rate effects and the initiated efficiency measures had a positive impact on earnings. Expenditure for the repositioning of the European business system decreased substantially to €4 million (Q1 2012: €36 million).

Daimler Financial Services wrote 253,000 new leasing and financing contracts with a total value of €8.6 billion, representing growth of 4% compared with the first quarter of 2012. Total contract volume of €81.7 billion at the end of the first quarter was 2% higher than at the end of 2012. Adjusted for the effects of currency translation, contract volume increased by 1%. The division’s EBIT of €314 million was lower than in the first quarter of last year (Q1 2012: €344 million). This was primarily due to lower interest margins and normalizing credit risk costs. The increased contract volume helped earnings.