Click for more information.

You can sell EVs, but you can’t service them to the customer’s satisfaction. That’s the bottom line of the results in J.D. Power 2023 U.S. Customer Service Index (CSI) Study,SM released today. The growing volume of battery electric vehicles (BEVs) being serviced at dealerships is having a negative effect on overall customer service satisfaction, resulting in a year-over-year decline in score for the first time in 28 years. Satisfaction with the service experience declines 2 points to 846 (on a 1,000-point scale) in this year’s study. This is not necessarily statistically significant, AutoInformed observes, but it could become a worrisome trend.The J.D. Power auto shopping tool can be found at JDPower.com

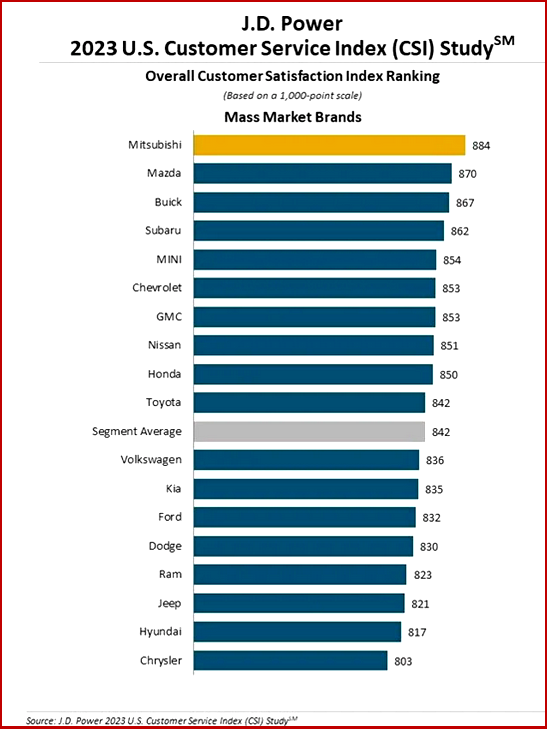

Key Observations – J.D. Power 2023 CSI study

• Vehicle recalls drive satisfaction declines: Satisfaction declines 23 points when an owner must bring their vehicle in for a recall repair rather than for traditional maintenance or repair. Recall repair visits also have a negative effect on Net Promoter Score® (NPS)1ratings, a vital metric for owners who share positive recommendations about a business. This is most evident with premium brands as the servicing dealership NPS declines 13 points when customers experience a recall.

• Service departments getting the (text) message: In the 2019 CSI Study, 34% of owners expressed the desire to receive updates through simple text messages rather than phone calls, but only 9% actually did receive texts from dealerships. Now, dealerships have gotten the figurative message, and, as measured in the 2023 study, are now sending simple text messages 21% of the time to update customers vs. making a phone call (17%). The go-to communication method for service departments is now text messaging, as more than half (54%) of Generation X,2Y and Z customers say they prefer it.

• Owners wait even longer for an appointment: Since the 2021 study, the number of days that owners wait for an appointment has increased 1.9 days for premium vehicles and 1.3 days for mass market vehicles. Appointment wait times are now 5.6 days for premium vehicles and 4.8 days for mass market vehicles. Labor, loaner vehicle availability and parts shortages continue to be the catalyst for the increasing amount of time it takes to get a vehicle serviced.

• Owners’ service preferences differ: Owners provide higher trust ratings for franchise dealerships than for aftermarket service facilities for complex repairs (6.14 on a 7-point scale) vs. 5.75 for aftermarket full-service maintenance and repair facilities. When ease of doing business is the primary driver, trust preference swings to aftermarket facilities for maintenance (6.18 vs. 6.11 for dealerships). These findings are based on a battery of similar questions asked both in the CSI Study and in the J.D. Power Aftermarket Service Index (ASI) Study. SM