Click to Enlarge.

The Covid-19 plague has severely hurt economic activity and employment in the U.S. economy. This is a result of the necessary, though belated and misguided public health policies put in place to mitigate and control the spread of the virus. Real gross domestic product (GDP) declined at a 5% annual rate in Q1 of 2020. GDP will – without doubt – continue to contract at an unprecedented pace in the second quarter. (US Q1 GDP Estimates – Negative Growth as Economy Retracts, Trade to Plunge as COVID-19 Upends Global Economy)

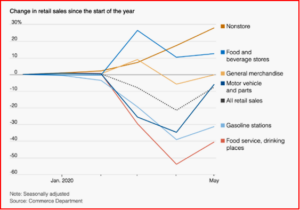

Recently some indicators suggest a stabilization or even a tiny rebound in some segments of the economy, such as retail merchandise and motor vehicle sales. Employment rose in many sectors of the economy in May and the unemployment edged down as some workers returned to their jobs from temporary layoffs.

“Activity in many parts of the economy has yet to pick up, however, and overall, that put us far below earlier levels. Moreover, despite the improvements seen in the May jobs report, unemployment remains historically high. Weak demand, especially in sectors most affected by the pandemic, is holding down consumer prices,” said Jerome Powell, chair of the Federal Reserve Board of Governors.

With the controversial and likely self-defeating easing of social distancing restrictions across the country as new Covid cases are rising to record levels, people are increasingly moving about. Many businesses are resuming operations to some degree. At the same time, some households have been receiving stimulus payments and unemployment benefits which are supporting incomes and spending.

“As a result, inflation has fallen well below our symmetric 2% objective. Indicators of longer-term inflation expectations have been fairly steady. The extent of the downturn and the pace of recovery remain extraordinarily uncertain and will depend in large part on our success in containing the virus. We all want to get back to normal, but a full recovery is unlikely to occur until people are confident that it is safe to reengage in a broad range of activities,” Powell warned today after a meeting of the board of governors.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Fed – May Retail Sales Far Below Earlier Levels

Click to Enlarge.

The Covid-19 plague has severely hurt economic activity and employment in the U.S. economy. This is a result of the necessary, though belated and misguided public health policies put in place to mitigate and control the spread of the virus. Real gross domestic product (GDP) declined at a 5% annual rate in Q1 of 2020. GDP will – without doubt – continue to contract at an unprecedented pace in the second quarter. (US Q1 GDP Estimates – Negative Growth as Economy Retracts, Trade to Plunge as COVID-19 Upends Global Economy)

Recently some indicators suggest a stabilization or even a tiny rebound in some segments of the economy, such as retail merchandise and motor vehicle sales. Employment rose in many sectors of the economy in May and the unemployment edged down as some workers returned to their jobs from temporary layoffs.

“Activity in many parts of the economy has yet to pick up, however, and overall, that put us far below earlier levels. Moreover, despite the improvements seen in the May jobs report, unemployment remains historically high. Weak demand, especially in sectors most affected by the pandemic, is holding down consumer prices,” said Jerome Powell, chair of the Federal Reserve Board of Governors.

With the controversial and likely self-defeating easing of social distancing restrictions across the country as new Covid cases are rising to record levels, people are increasingly moving about. Many businesses are resuming operations to some degree. At the same time, some households have been receiving stimulus payments and unemployment benefits which are supporting incomes and spending.

“As a result, inflation has fallen well below our symmetric 2% objective. Indicators of longer-term inflation expectations have been fairly steady. The extent of the downturn and the pace of recovery remain extraordinarily uncertain and will depend in large part on our success in containing the virus. We all want to get back to normal, but a full recovery is unlikely to occur until people are confident that it is safe to reengage in a broad range of activities,” Powell warned today after a meeting of the board of governors.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.