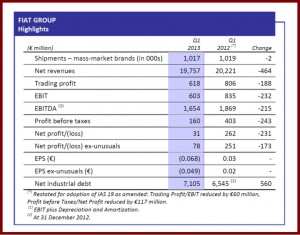

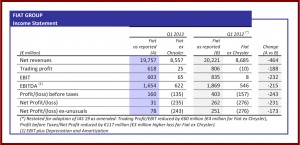

The Fiat Group in Turin today posted Q1 profits of €31 million or about $40 million with revenues of €20 billion from worldwide shipments of more than 1 million vehicles. Sales were roughly even with Q1 of 2012. However, the profit difference year-over-year, a -88% decline, was telling.

The ongoing Eurozone crisis, and a depression in the Italian market where sales are running at 1980 levels, caused a loss of -€111 million in Europe. Vehicle sales fell -6%.

Luxury and Performance brands were up 4% over Q1 2012 to €0.7 billion in revenue – all from Ferrari.

The results showed how dependent Fiat Group is on Chrysler to prop it up. Chrysler Group net income in the first quarter of 2013 was $166 million, versus $473 million compared to Q1 2012. Nonetheless, Fiat Group CEO Sergio Marchionne stuck by earlier forecasts that Chrysler would earn $2.2 billion for the full year on revenue of $72 billion. This forecast was regarded as extremely optimistic based on questioning by analysts during a conference call.

Fiat Group trading profit for the quarter totaled €618 million compared to €806 million for Q1 2012. The year-over-year decrease in Fiat Group revenues was primarily attributable to a ~€200 million decrease in NAFTA revenue due to lower volumes, as well the launch costs of the new 2014 Jeep Grand Cherokee and 2013 Ram Heavy Duty truck line, and preparation for the Q2 2013 production launch of the 2014 Jeep Cherokee.

For the full year of 2013, Fiat predicts revenues of €88-92 billion, and trading profit between €4.0 and €4.5 billion, with net industrial debt of about €7 billion euros.

Marchionne has long wanted to merge Chrysler and Fiat and take the new company public, but he can’t do so without buying the 41.5% of Chrysler stock held by the UAW health care trust to finance retiree medical plans. The UAW and Chrysler are currently in court in Delaware over how to value the stock under the terms of the bailout. There is a about a $6 billion difference in opinion between what the UAW is asking and Fiat is offering. There is also a $2 billion loan outstanding, which forbids an IPO until it is paid back.