“The 2014 business environment suggests improving business conditions across many markets. After growing about 2% in 2013, we expect global GDP for 2014 to improve 2.5% to 3% based on leading economic indicators.”

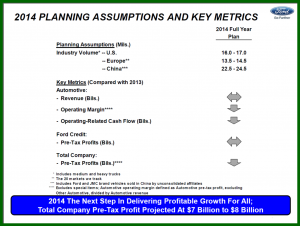

In Dearborn this morning, Ford Motor said that 2014 earnings would be lower than originally forecast – projected at $7 – $8 billion, due in part to an ambitious launch schedule with $7.5 billion in capital expenditures. This will follow projected 2013 results of about $8.5 billion, one of the best years in FMC history, with strong revenue growth but lower than projected margins, improved market share in all regions except Europe, and despite recalls and warranty expenses on some of its bestselling models, including the Escape.

In a sense, this is an investment year that will hurt 2014 earnings short term, but is necessary to keep Ford competitive going forward. Overall, FMC will launch 23 new vehicles globally, with 16 launches in North America, it’s only solidly profitable region. Since these North American freshenings will cover a significant percentage of the region’s volume, Ford said that it now expects sales next year to be lower, even as the region grows by roughly one million units or more in total. This means that revenue and net pricing will be “slightly unfavorable” as it runs out prior models and confronts the resurging Japanese companies in key growing car and sport utility segments (Holiday Shoppers Boost November U.S. Auto Sales). The revised Ford products also add costs of course. The earnigns warning also might be part of a plan to ease the way for the replacement of CEO Alan Mulally, who is expected to leave Ford next year. This way there is nowhere to go but up under a changing of the guard if it happens.

In Europe, Ford continues to lose money, and it will incur restructuring costs of about $400 million because of accelerated depreciation of assets by closing Genk, and production relocations. Worse, FMC expects special item charges in Europe in 2014 of $400 million to $500 million, mainly related to personnel separations; these charges will not be reported in operating results.

Ford’s operations in Asia Pacific region, particularly China, the world’s largest and fastest growing auto market, after decades of neglect have required intense injections of capital during the past several years. The result has been a tiny but record market share in 2013 and a profitable business ($309 million through Q3 2013), including what is expected to be a record full-year result this year.

During 2014, Ford predicts no increase in profits, though. Ford has six major facilities under construction across the region, with two facilities in China starting production next year and two more in 2015. In India, the two facilities under construction now also will start production in 2015. Adding to Ford’s woes in the region, is a more competitive pricing environment from the Japanese, and unfavorable results in Australia as Ford shuts down manufacturing and reflects the effects of a weakening Australian dollar as well as its own product line when compared to the Japanese ones (2015 Mustang Goes Global with RHD models. Confirmation Coming in August at Jim Farley Australian Press Bash).

Beyond 2014, Bon Shanks Ford CFO said the company “remains on track” remains on track to achieve its mid-decade outlook. However, its targeted global Automotive-operating margin of 8-9% is “at risk.” Shanks said this is because of the severe European contraction (EU November Cars Sales Up Slightly), and conditions in South America, especially in Venezuela, that were not anticipated at the time the forecast was provided in mid-2011. The company, however, expects its results over the mid-decade period to be strong and improving.”