Click for more.

Ford predicted (hoped?) for full-year 2024 adjusted EBIT unchanged at $10 billion to $12 billion; adjusted free cash flow outlook raised $1 billion, to between $7.5 billion and $8.5 billion and is now adding a third North America assembly plant to assemble the trucks. Beginning in 2026, the company’s Oakville Assembly Complex in Ontario, Canada will initially add capacity of up to 100,000 Super Duty trucks – and, in the future, a version with multi-energy technology (translation a hybrid that Ford currently lacks to its detriment) – to volumes already being added at the Kentucky Truck and Ohio Assembly plants.

“The capabilities we’re developing in electric vehicles and software-enabled and physical services are wide competitive moats between Ford Pro and other companies,” claimed Farley. “For customers, from small businesses to the largest enterprises, they’re bridges to transforming their organizations at the same time we’re remaking ours. Over time, we’ll build out those same kinds of benefits for Ford Blue [the old traditional internal combustion engine lines] and Ford Model e customers [EVs and at some point hybrids?] and further distinguish us from other automakers, traditional and new ones,” Farley claimed.

When pressed by skeptical analysts about the ongoing quality problems and what recalls lurk in the shadows, Vice Chair and CFO John Lawler said, “The largest one coming through is on a rear axle bolt for vehicles that were engineered for the 2021 model year was when they were introduced. And if these things come through at a higher time in service, we’re made aware of them, we need to take care of our customers, we go out to fix them. And we have several of those types of things popping up on our older models. We got a failed oil pump issue that’s popping up on 2016 launched vehicles. And so it’s clear that we had a period of time where the robustness wasn’t what it needed to be, and that’s showing up. And it is hard to predict on some of these units that have been out in the field for quite a while that one of these issues is going to show up, these longer-term durability, and quality issues, but we need to work through that. And we do believe that overall, as we improve our near-term quality and that starts to show up in the field, that will allow us to, based on the rules that we have around how we do our accruals, bring down that overall accrual level so these types of issues, if they pop up will have less of an impact overall because our run rate on quality will be improving.”

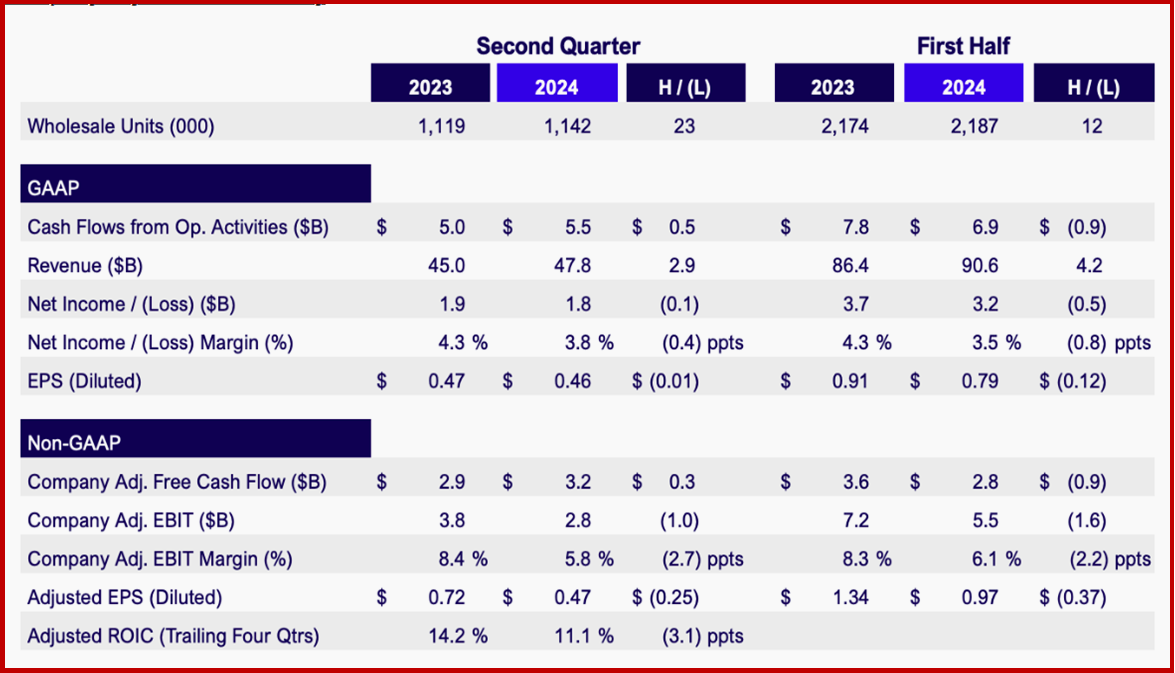

With Ford+, Lawler claimed in tandem with Farley, that the company is laying a foundation for profitable, long-term growth and, in the meantime, is on course for a solid full-year 2024 operating performance. Ford’s guidance range for adjusted EBIT remains $10 billion to $12 billion and expectations for adjusted FCF (free cash flow) have been raised by $1 billion to between $7.5 billion and $8.5 billion. Capital expenditures for the year are still anticipated to be between $8.0 billion and $9.0 billion, with an enterprise-wide objective for the lower end of the range. Outlooks for full-year EBIT are up for Ford Pro, to $9.0 billion to $10.0 billion, on further growth and favorable product mix, and down for Ford Blue, to $6.0 billion to $6.5 billion, reflecting higher warranty costs than originally planned. An anticipated full-year loss of $5.0 billion to $5.5 billion for Ford Model e is unchanged, with continued pricing pressure and investments in next-generation electric vehicles. Earnings before taxes from Ford Credit are expected to be about $1.5 billion, a double-digit percentage increase from 2023.