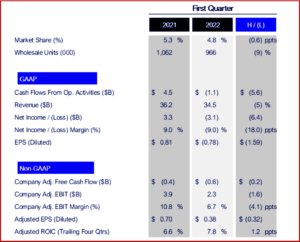

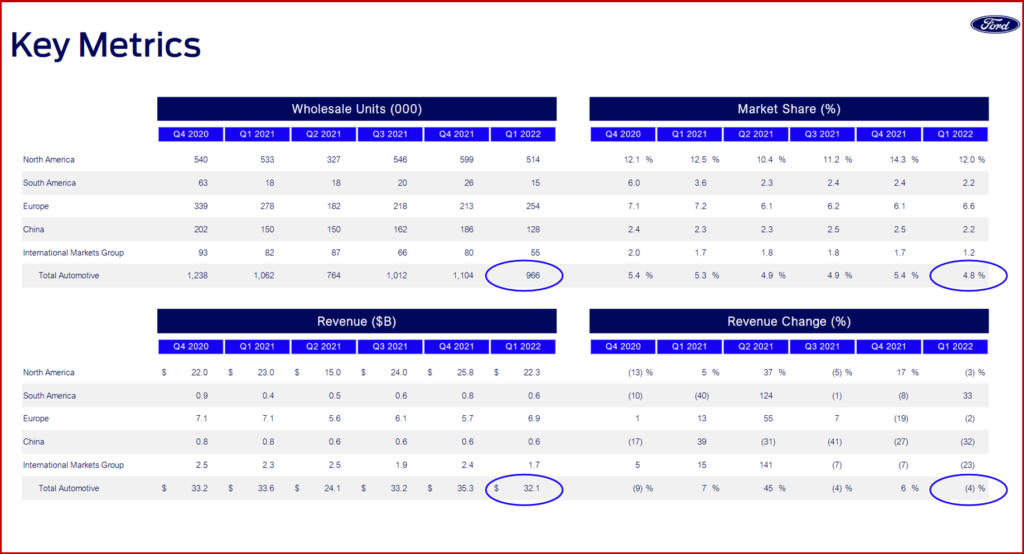

Ford Motor Company (NYSE:F) today reported its 2022 Q1 financial results, which showed $34.5 billion in revenue on shipments of ~969,000 vehicles. This resulted in a net loss of $3.1 billion and adjusted earnings before interest and taxes of $2.3 billion with an adjusted EBIT margin of a mere 6.7%. Sales, market share, cash flow, income and earnings per share were all down when compared year-over-year.

As with GM yesterday, Ford was battered by supply chain disruptions mostly beyond its control, as well as self-created costs from the valuation of its investment in Rivian with a mark-to-market loss of $5.4 billion on the company’s investment down from $10.6 billion at the end of 2021. Strong customer demand from the ongoing Biden Administration recovery wasn’t helped by Ford’s popular vehicles because of persistent supply chain issues that Ford was unable to adjust for.

“The appeal of these products – Bronco, Bronco Sport, Maverick, Mustang Mach-E, E-Transit and now the F-150 Lightning – is undeniable,” said CEO Jim Farley. Ford aspires to a global EV manufacturing capacity of at least 600,000 by the end of 2023, for which it’s ramping up battery supplies, on the way to making more than two million EVs annually by the end of 2026. In the most recent quarter, the continuing global shortage of semiconductors held down Ford’s January and February production and shipments, though Ford claimed manufacturing rates were “significantly improved” during March.

In North America, Ford generated $1.6 billion in EBIT. The company said first-quarter supply disruptions limited the fundamental revenue and earnings of the regional business.

Collectively, the company’s Europe, South America, China and International Markets Group business units – all of which have been restructured and refocused more than once during the past several years – produced EBIT of $300 million.

Ford in Europe generated positive EBIT despite supply related lower volumes. The company sustained its seven-year standing as the region’s No. 1 brand of commercial vehicles. The FORDLiive connected-uptime system, introduced in Europe a year ago, collectively provided customers with about 66,000 more days of uptime from their vehicles in the first quarter of 2022 alone. Ford claimed this is an example of the “powerful services value Ford Pro will deliver to enterprises in markets around the world.”

Ford’s business in South America, aka SA Light, reflected the benefits of its restructuring into a lower-risk, asset-light business, posted the third straight quarter of meager profitability. Introductions of the Maverick and Ranger FX4 pickup trucks are expected to be highly popular with existing and new customers in the region Ford claimed.

In China, Ford continues to establish the Lincoln brand with buyers of luxury vehicles in the strategically important market because it is the world’s largest. The brand’s in-country customer experience and dealer network are being modernized and expanded in preparation for Lincoln’s “all-electric future.”

IMG remained profitable with a 33% decrease in first-quarter wholesales that was mostly because of restructuring in India and the effects of semiconductor and other supply constraints on production elsewhere in the business. The next-generation Ranger pickup launches later this year.

Ford Credit posted a trong quarter, with earnings before taxes of $928 million. “During the quarter, same-day approval and pre-arranged financing options for smaller commercial customers were introduced to the unit’s evolving range of services,” Ford said.

Ford CFO John Lawler said that a strong demand and pricing for existing and new vehicles support the company maintaining its full-year outlook for $11.5 billion to $12.5 billion in adjusted EBIT. Adjusted free cash flow for the year is expected to be $5.5 billion to $6.5 billion.

The Two-Handed Economist Assumptions Involve:

- Improved semiconductor availability during the second half of the year.

- Full-year vehicle wholesale volumes increasing 10% to 15% from 2021.

- Continued strong pricing, though with a dynamic relationship between prices and vehicle volumes.

- Commodity costs up about $4 billion year-over-year, along with inflationary effects on a range of other expenses.

- EBIT from Ford Credit that remains strong, but is lower than in 2021.

- Ongoing investment in the Ford+ plan for growth and value creation.

- Ford also assumes that disruptions in the supply chain and local vehicle manufacturing operations resulting from renewed COVID-related health concerns and lockdowns in China do not further deteriorate.

Pingback: Ford June US Sales Up 31%, YTD -8% | AutoInformed

Pingback: Adopt a Charger, Rivian Installing EV Chargers in MI Parks | AutoInformed