The Board of Directors of Ford Motor Company declared a Q1 2014 dividend of $0.125 per share on the company’s family-controlled Class B and common stock. This is a 25% increase from the dividend paid in each quarter of 2013. The Q1 dividend is payable on 3 March 2014 to shareholders of record at the close of business on at the end of this month.

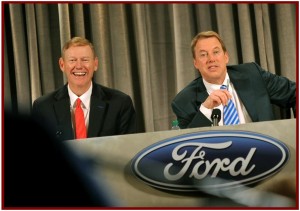

Ford said its dividend reflects “strong 2013 results.” Recently, Ford issued a profit warning for 2014 saying that it would not match 2013 performance levels. CEO Alan Mulally, 68, told the Associated Press yesterday that he would stay at Ford for the balance of 2014, thereby halting rumors that for months had him going to Microsoft. Both issues hurt the value of Ford stock, which has been trading under $16. (Ford Cuts 2014 Earnings Outlook. Warranty Costs Hurt 2013)

“Our capital strategy continues to be focused on financing our One Ford plan, further strengthening our balance sheet and providing attractive returns to our shareholders,” said Bob Shanks, chief financial officer, FMC. “This increase in the dividend provides our shareholders with a regular, growing dividend that we believe is sustainable over an economic or business cycle.”

This is the second quarterly dividend increase in the past two years. After restoring its quarterly dividend at $0.05 per share beginning Q1 of 2012, Ford increased its quarterly dividend to $0.10 per share beginning with Q1 of 2013.

Through the first three quarters of 2013, Ford increased its liquidity by $3 billion. Ford has also posted 14 consecutive quarters of positive Automotive operating-related cash flow.

However, last December Ford Motor said that 2014 earnings would be lower than originally forecast – projected at $7 to $8 billion, due in part to an ambitious launch schedule with $7.5 billion in capital expenditures. This will follow projected 2013 results of about $8.5 billion, one of the best years in FMC history, with strong revenue growth but lower than projected margins, improved market share in all regions except Europe, and despite recalls and warranty expenses on some of its bestselling models, including the Escape.