Pre-tax special charges included $856 million for separations, primarily in Europe, and $594 million for the completed U.S. salaried retiree voluntary lump sum buyout.

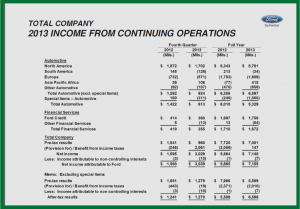

Ford Motor Company [NYSE: F] today reported that Q4 pre-tax profit was $1.3 billion, a decrease of $402 million compared with 2012. However, Q4 earnings per share at 31 cents were the same as a year ago. Ford has posted a pre-tax profit for 18 consecutive quarters. Fourth quarter net income was $3 billion, or 74 cents per share. Ford generated positive Automotive operating cash flow of $500 million in Q4, the 15th consecutive quarter of positive performance — and record positive Automotive cash flow of $6.1 billion for the full year.

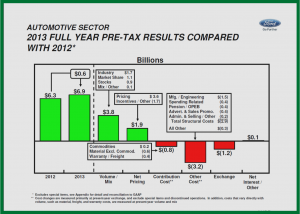

Full year 2013 full pre-tax profits are $8.6 billion, an increase of $603 million compared with a year ago. Full year earnings of $1.62 per share were an increase of 21 cents. Net income of $7.2 billion, or $1.76 per share, was higher than a year ago, including pre-tax special item charges of $1.6 billion and favorable tax special items of $2.2 billion. Ford sold 6.33 million vehicles globally during 2013.

The pre-tax special item charges included $856 million for separation-related actions, primarily in Europe to support the company’s transformation plan, and $594 million associated with Ford’s completed U.S. salaried retiree voluntary lump sum payout program as part of its pension strategy.

Because of Ford’s 2013 financial performance, the company will make record profit-sharing payments to 47,000 U.S. hourly employees. As part of the UAW-Ford collective bargaining agreement, Ford North America pre-tax profits of $8.8 billion will generate profit-sharing payments of ~$8,800 per employee on a full year basis. Individual profit sharing payments may differ based on employee compensated hours.

Ford warned though that its 2014 outlook unchanged. Automotive revenue will be about equal to 2013; Automotive operating margin to be lower and Automotive operating cash flow will be positive, but substantially lower. Total Ford Motor pre-tax profit is forecast to range from $7 billion to $8 billion.

The launch of the all-new, aluminum F-Series pickup truck next year will require 13 weeks of downtime at two plants for what is far and away Ford’s best selling product in the U.S., which is far and away Ford’s most profitable market.