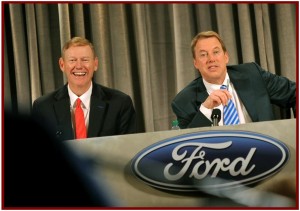

Ford Motor Company [NYSE: F] paid Alan Mulally, president and CEO, $2,000,000 in salary and $5,460,000 in cash bonus in 2011. Mulally’s total compensation, including the value of long-term stock options and other performance-based equity awards, was $29,497,572, an almost $3 million increase from 2010.

Ford earned $8.8 billion in pre-tax operating profit during 2011, an increase of $464 million over 2010. Operating margins declined to 5.4%. The numbers include a hugely favorable one-time, non-cash special item of $12.4 billion.

Gains in North America and Ford Credit offset large losses in Europe -$190 million, and Asia -$83 million. Moreover, Ford’s debt rating remains at the junk level by at the three rating agencies. Ford began paying a dividend to shareholders in the first quarter of 2012.

- Bill Ford, executive chairman, earned $2,000,000 in salary and $1,560,000 in cash bonus in 2011. Bill Ford’s total compensation was $14,458,146.

- Mark Fields, Ford executive vice president and president, had total compensation of $8,840,183.

- Lewis Booth, Ford executive vice president and chief financial officer, earned $7,731,816.

- Joe Hinrichs, Ford group vice president and president of Asia Pacific and Africa, earned $5,302,360.

- UAW members each received profit sharing of about $6,200.

Included in the Ford Motor proxy are three company and three shareholder proposals requiring the votes of shareholders. These three shareholder proposals are potentially troublesome to management and the Ford family.

- A proposal related to disclosure of the Company’s political contributions.

- A proposal related to consideration of a recapitalization plan to provide that all of the Company’s outstanding stock have one vote per share. (The Ford family gets 16 votes per share. Common stockholders one per share.)

- A proposal requesting the Board to allow holders of 10% of outstanding common stock to call special meetings of shareholders.

Not surprisingly, Ford management is opposed to all three.