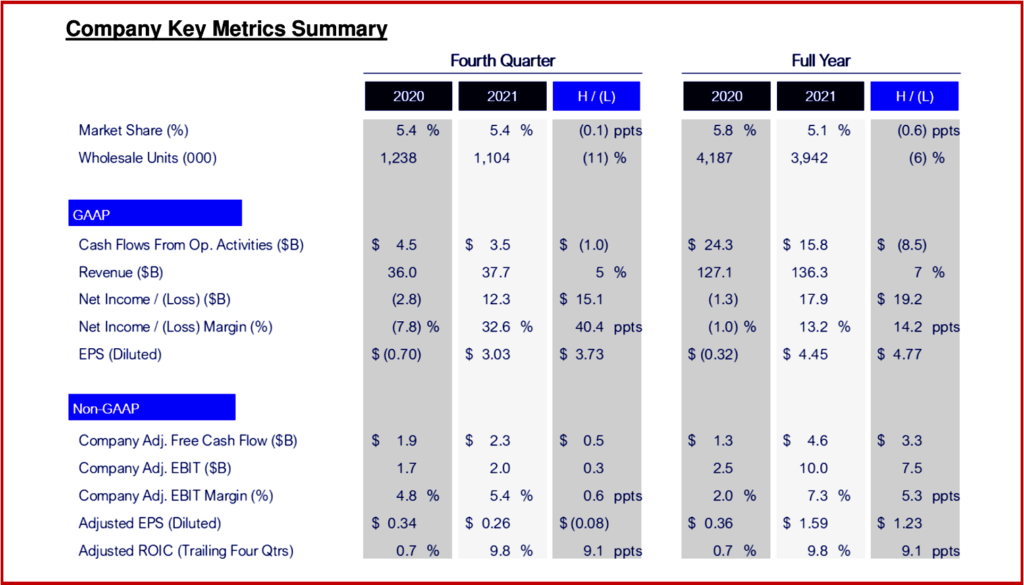

Ford Motor has posted Q4 and full-year operating results for 2021 that reflect continuing supply chain disruptions and ongoing but necessary design and reorganization costs. Q4 results show revenue of $37.7 billion, net income of $12.3 billion with an adjusted EBIT of $2.0 billion. Ford ended Q4 with more than $36 billion in cash and $52 billion in liquidity. Both measures included the company’s investment in Rivian, which was valued at $10.6 billion at the end of 2021. At the close of trading on Feb. 2, the value was $6.6 billion. Ford stock closed at $17.96. It was off -$1.93 (-9.70%) as of 4 February at 4:02 pm after earnings were announced, which missed forecasts of $0.45 by, ugh, 19 cents.

Full-year net income was $17.9 billion with a company adjusted EBIT of $10.0 billion after the recent reclassifying of the Q1 Rivian gain warning shareholders and the capital markets that the $8.2 billion it earned from its Rivian investment after the public offering will not be included in full-year adjusted EBIT or adjusted EPS. Ford Credit posted solid results in Q4 with full-year earnings before taxes of $4.7 billion. (read AutoInformed on Ford Motor Warns of Large FY 2021 Special Items)

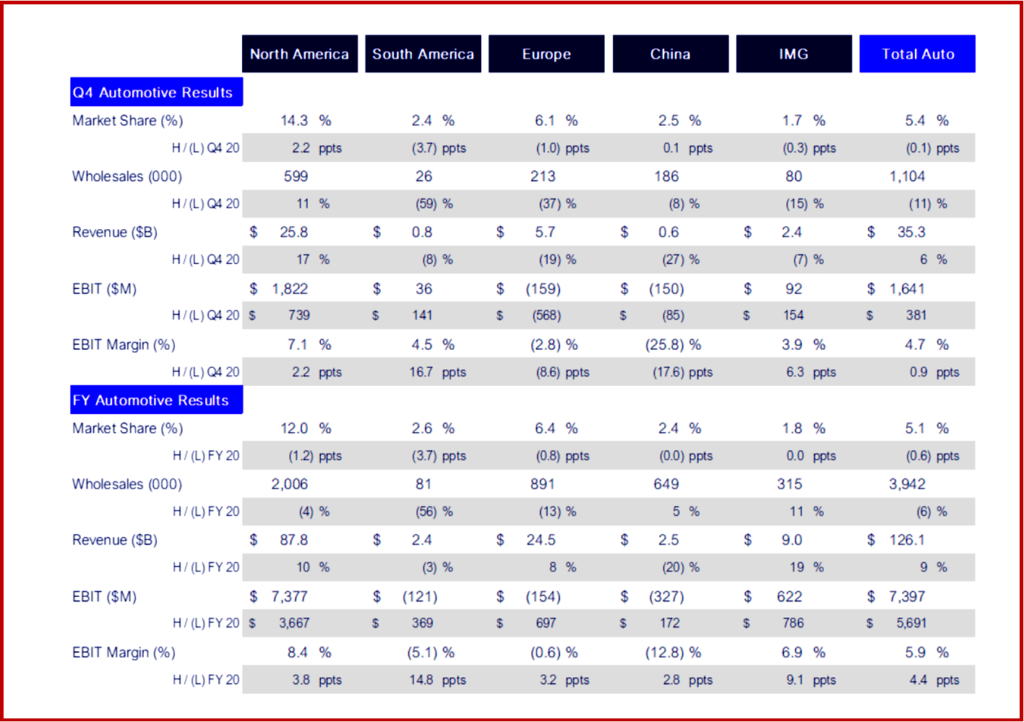

However, vehicles sold and market share, cash flow (-$8.5B) for continuing operations declined during 2021. Ford lost money in Europe and, ahem, China, which is recovering faster than other economies from the Covid crisis. In North America, Bronco, Maverick, Mustang Mach-E contributed to a two-point U.S. share gain, to 15%. During Q4 Ford reinstated a regular dividend of 10 cents per share.

Outlook

CFO John Lawler said Ford expects full-year 2022 adjusted EBIT to be stronger – $11.5 billion to $12.5 billion, an increase of 15% to 25% over 2021. The high end of the adjusted EBIT range equates to a margin of 8% which, if achieved, would be one year earlier than the company’s previous target. Adjusted free cash flow for the year is expected to be $5.5 billion to $6.5 billion.

Underlying Assumptions for 2022:

- Significantly higher profits in North America, along with collective profitability in the rest of the world as the company benefits from its extensive global redesign.

- Continued variability in supplies of key components, with full-year vehicle wholesales nonetheless being up about 10% to 15%, with a high single- to low double-digit decline in Q1, reflecting supplier shortages related to COVID shutdowns and semiconductors.

- A strong pricing environment, though with a dynamic relationship between vehicle volumes and pricing.

- Increased commodity costs, with possible inflationary effects on a broad range of other expenses.

- EBT from Ford Credit that remains strong, but lower than in 2021.

- Ongoing investment in the Ford+ plan.

Pingback: Ford Motor Structure Threatens Viability. Vast Reorg Coming | AutoInformed