Ford Took a $400 million increase in warranty reserves for field service actions, which include safety recalls and other product campaign related to 2008 through 2013 models as well as expense for 2001 through 2005 model vehicles. The ongoing Ford quality problems remain troublesome.

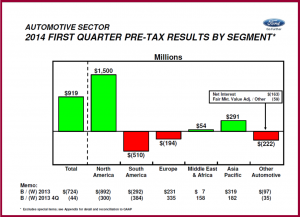

Ford Motor Company today posted decidedly mixed results as its warranty costs, older products, increased competition and special items led to a Q1 pre-tax profit of $1.4 billion, a decrease of $765 million compared with a year ago. Q1 net income is $989 million, or 24 cents per share, a decrease of $622 million compared with a year ago, including pre-tax special item charges of $122 million.

Ford Motor Global vehicle sales were 1,589,000 during the quarter, compared to GM at 2,416,028. Toyota reported production of 2,634,195 vehicles during the same period, but has not released financial results yet.

Ford Motor CEO Alan Mulally stayed on a carefully scripted message – delivered awkwardly – that implies he will be with the company for the balance of 2014 in spite of recent press speculation otherwise.

Ford Motor wholesale sales volume and revenue both increased from a year ago, with continued market share gains in Asia Pacific, with a record market share in China. As a result, Asia Pacific reported a record profit for any quarter. However, North America and Middle East & Africa though profitable were not particularly strong. Europe reduced its loss by more than half, though, and South America incurred a much larger loss compared with a year ago.

Predictably, the stock market sold off Ford stock. In early trading, Ford common shares were down to $15.78, off from at yesterday’s close of $16.32 and closed at $15:81.

Ford confirmed its full-year pre-tax profit guidance of $7 billion to $8 billion as it launches 23 new global vehicles, the most in a single year in its history. Automotive revenue will be about the same as last year. Launch costs mean automotive operating margin will be lower. Automotive operating-related cash flow although positive will be substantially lower than 2013.