Click for more information.

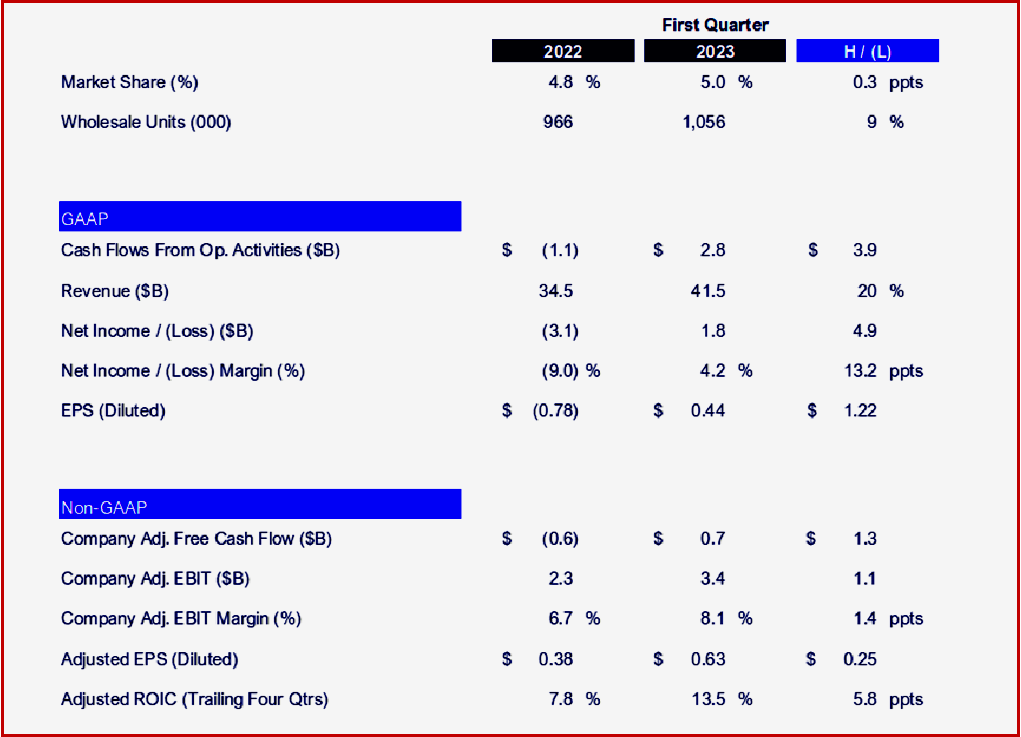

“The first quarter of organizing around and running the company on behalf of distinct customer groups produced solid operating results and a glimpse of the promise of its Ford+ growth plan,” said Ford CEO Jim Farley. Ford reaffirmed guidance for full-year 2023 adjusted EBIT of $9 billion to $11 billion. Profitability in Q1 was enhanced by a favorable mix of products, higher net pricing and increased volume and was broadly based geographically. However its EV business is still hemorrhaging money, posting a loss of $722 million.

Ford Credit’s earnings before taxes of $303 million were down from last year because of a lower financing margin, increased credit losses and a decline in leasing income. The company’s credit-loss performance remains below its historical average but is “trending upward toward more normal levels.” Auction values remain strong, though down from their peak in the first half of 2022.