During 2015, Ford completed 14 of 16 planned new vehicle launches. During 2014, Ford had a record 24 global launches. However, competition remains relentless, well funded and with strong returns on investment. Ford’s capital spending needed to survive going forward is a drag on earnings.

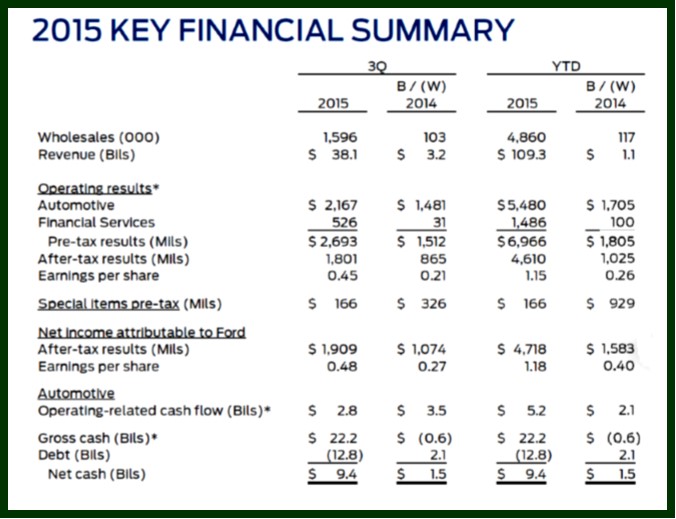

Ford Motor Company has posted Q3 after-tax financial results, excluding special items of $1.8 billion net income or $0.45 per share based on sales of 1,596 million vehicles. The results were from North America with its pretax earnings of $2.7 billion. All of Ford’s operating regions except Asia Pacific at +$20 million posted losses: -$163 million in South America, – $163 million in Europe, – $15 million in Middle East & Africa. Ford’s results mirrored those of GM, which a week ago posted strong earnings in North America.

These Ford Motor results did not meet analyst expectations and Ford stock is languishing in the range of less than $15 per share range, down from a high of $32.60 per share in December 2008. Thus far, Ford has distributed $600 million in Q3 and $1.9 billion year-to-date in dividends to common stock holders.

The question remains whether this is a breakthrough year at Ford as the company claims or just business as usual with the F-Series – $42,000 transaction price and strong sales leadership in the U.S. being the jewels in the crown. A redesigned Super Duty version of the F-Series comes in 2016, but the pickup line continues face threats from GM and FCA with its Ram brand.

Ford reconfirmed its 2015 pre-tax profit guidance of $8.5 billion to $9.5 billion, excluding special items, with higher automotive revenue, operating margin and operating-related cash flow compared with 2014.