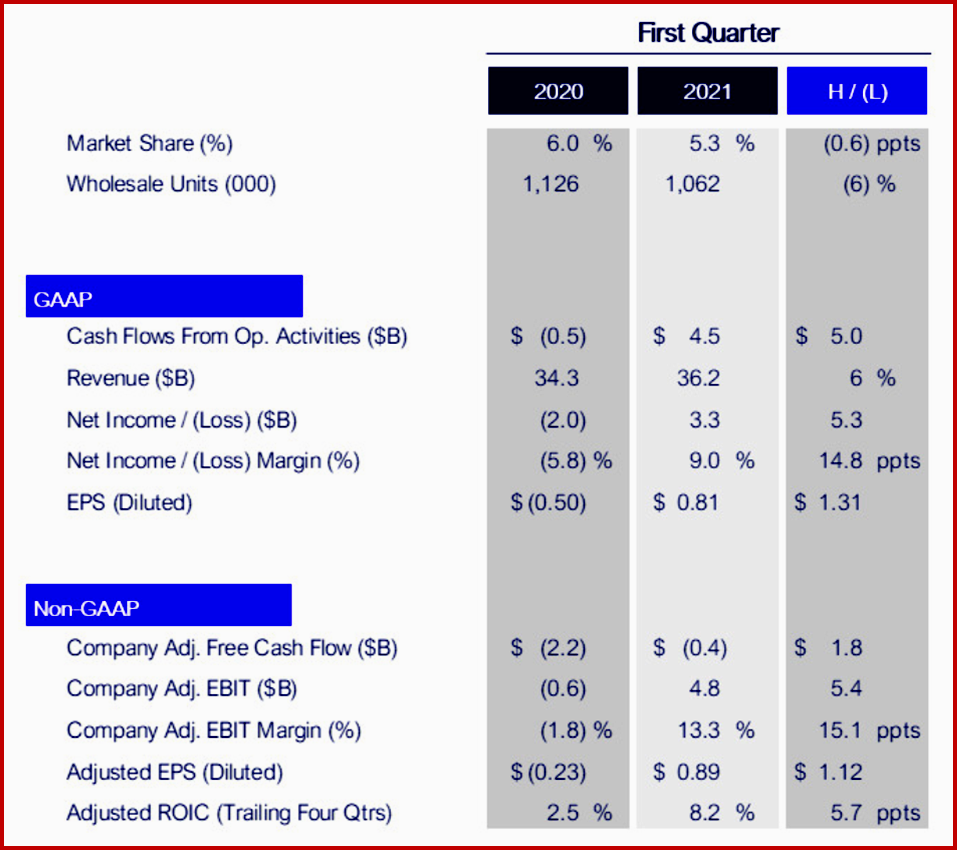

Ford Motor Company posted Q1 revenue increases to $36.2 billion, producing net income of $3.3 billion, which was the best since 2011, and a record adjusted EBIT of $4.8 billion. Global sales were 1,062,000 vehicles. However, semi-conductor problems loom. All told, Ford CFO John Lawyer said the company now expects to lose about 1.1 million units of production this year due to the semiconductor shortage.

Ford Motor Company posted Q1 revenue increases to $36.2 billion, producing net income of $3.3 billion, which was the best since 2011, and a record adjusted EBIT of $4.8 billion. Global sales were 1,062,000 vehicles. However, semi-conductor problems loom. All told, Ford CFO John Lawyer said the company now expects to lose about 1.1 million units of production this year due to the semiconductor shortage.

The company anticipates full-year 2021 adjusted EBIT to be between $5.5 billion and $6.5 billion, including an adverse effect of about $2.5 billion from the semiconductor supply issue. Adjusted free cash flow for the full year is projected to be $500 million to $1.5 billion, a large range reflecting the uncertainty in a global economy still reeling from the Covid pandemic.

“There’s no question we’re becoming a stronger, more resilient company,” claimed Farley, Ford’s president and CEO. The popularity of evolving, truck dependent lineup – including Mustang Mach-E, 2021 F-150 and Bronco Sport – helped profitable growth in North America. Total automotive EBIT outside North America was $454 million, $980 million better than same quarter a year ago as the business improved from world-class awful results.

Ford’s Q1 revenue in North America increased 5% to $23.0 billion, helped by customer demand for Mustang Mach-E, the all-new 2021 F-150 and Bronco Sport and tight vehicle inventories related to semiconductor-related production declines. SUVs and pickups both accounted for increased shares of regional sales. EBIT rose to $2.9 billion.

The semiconductor shortage has prompted Ford – it claims – to accelerate modernization of its sales processes by incorporating new ordering capabilities “to make them more appealing to customers, raise inventory turn rates, and reduce and maintain inventories below traditional levels.”

Mustang Mach-E supporting data: 70% of customers who purchased the battery-electric SUV are new to Ford, whose showrooms are usual baron of early-adapters. So far, 66% of reservations for the all-electric hatchback have been converted to orders. Further enhancements to the online shopping process – developed in collaboration with dealers – went “live” in March. The reservations-to-orders rate is similar for the all-new Bronco, sales of which are expected to start this summer.

Ford also claims it is “making good on its commitment to lead the electrification revolution in transportation,” an area where it is still clearly lagging. The Dearborn-based company this week announced formation of a new global battery center of excellence, Ford Ion Park, to accelerate research and development of battery and battery-cell technology and include future battery manufacturing. (Ford Ion Park – New Global Battery R&D Site in Michigan)

In Europe, Ford generated $7.1 billion in revenue, up 13%, and $341 million in EBIT, reversing a year-ago loss; and posted an EBIT margin of 4.8%. The company introduced the new FORDLiive (sic – marketing babble – editor) uptime system for commercial customers while increasing its share of the regional commercial-vehicles market to a record level. Also during the quarter, Ford Otosan, the company’s joint venture in Turkey, was confirmed as the source for a next- generation one-ton commercial van. The van will be sold as part of Ford’s Transit lineup and by Volkswagen through a strategic alliance between the two companies. (Volkswagen and Ford Announce Alliance Without Cross Equity)

During the quarter, Ford began shipping the Mustang Mach-E to customers in Europe and announced plans to spend $1 billion to create the Ford Cologne Electrification Center to manufacture EVs. The company expects 100% of its passenger vehicles to be all-electric – and two-thirds of its commercial vehicles to be all-electric or plug-in hybrids – in Europe by 2030.

Best-ever first-quarter retail sales of Lincoln-brand vehicles in China – 90% of which are now locally built – helped Ford to “nearly break-even EBIT.” The first quarter was the fourth straight quarter of year-over-year EBIT improvement. Volumes of higher-end Ford SUVs and commercial vehicles were also strong. Light trucks, vans, buses and pickups accounted for 48% of the company’s China sales.

At last week’s Shanghai Auto Show, Ford introduced the Escape plug-in hybrid SUV; a localized version of the all-electric Mustang Mach-E; and the fully networked EVOS, the first product from Ford’s China 2.0 plan. With Q1 China sales of 140,000 – including affiliates – in the world’s largest vehicle market, China remains a hobby in AutoInformed’s view.

Ford claimed it continued to turn around its business in South America, where an EBIT loss of $73 million represented a sixth consecutive quarter of better year-over-year results. “A significant restructuring of Ford’s operations in the region, announced in January, is proceeding as planned, with structural costs in the period down one-third. Competitively, the company had strong quarterly sales of the Ranger pickup, gaining more than two points of share for the flagship product.” (Brazil – A Ford Motor South American Nightmare, Ford Exits Heavy Truck Business in South America, Ford Exits Heavy Truck Business in South America)

The International Markets Group turned in its highest quarterly EBIT to date with 18% lower structural costs and was profitable in all markets except India. Shares for the Ranger and the Everest SUV both were up and exceeded 14%. In February, Ford said it will spend more than $1 billion to update and boost production capacity at the plant in Silverton, South Africa, where IMG manufactures Ranger. The project represents one of the largest-ever investments in the South Africa automotive industry. (Ford to Upgrade, Expand South African Plant for 2022 Ranger)

Within Ford Mobility, Argo AI and Ford are now simulating ride-hail and delivery operations during daily fleet testing in six U.S. cities, ahead of multiple customer pilot programs that are scheduled to begin later this year. Ford AV LLC marked its third anniversary in Miami with a new command center. Ford’s Spin subsidiary continues to progress, improving per-trip economics more than 60% from first-quarter 2020 – it’s claimed.

Ford Credit’s operating performance and its balance sheet were good. Earnings before taxes of $1.0 billion – higher than in the fourth quarter of 2020 and significantly ahead of the year-ago quarter, when results were held down by anticipated pandemic-related effects on the unit’s activities.

Outlook

Ford CFO John Lawler said semiconductor availability, which was exacerbated by a fire at a supplier plant in Japan in March, will get worse before it gets better. Currently, the company believes that the issue will bottom out during the second quarter, with improvement through the remainder of the year.

Lawler said the company’s attention is on managing the supply chain every day and enhancing execution in Ford’s underlying business. As examples, he pointed to recent high-quality launches of the Mustang Mach-E SUV, all-new 2021 F-150 pickup and Bronco Sport SUV. First-quarter warranty costs improved by more than $400 million from a year ago.

Lawler said Ford was among the first automakers to identify the potential for a 10% to 20% adverse effect on manufacturing volumes from increasing constraints on global semiconductor supplies entering 2021. In early February, the company said the risk had the potential to reduce Ford’s full-year adjusted EBIT by $1 billion to $2.5 billion.

Ford has updated its 2021 outlook to account for expanded consequences from the semiconductor shortage, made worse by the recent supplier fire in Japan. While the issue is a significant headwind to the company, Lawler said Ford is taking definitive actions to address a range of possible outcomes. Largely because of the additional effect of the supplier fire, Ford now expects to lose about 50% of its planned second-quarter production, up from 17% in the first quarter – again, implying that Q2 will be the trough of the issue.

Ford anticipates the flow of semiconductors from the Japan supplier to resume by the end of the second quarter – but, like many others in the industry, that the broader global semiconductor shortage may not be fully resolved until 2022. The company now assumes that it will lose 10% of planned second-half 2021 production.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Ford Posts Q1 Income of $3.3B. Semiconductors Still Difficult

The company anticipates full-year 2021 adjusted EBIT to be between $5.5 billion and $6.5 billion, including an adverse effect of about $2.5 billion from the semiconductor supply issue. Adjusted free cash flow for the full year is projected to be $500 million to $1.5 billion, a large range reflecting the uncertainty in a global economy still reeling from the Covid pandemic.

“There’s no question we’re becoming a stronger, more resilient company,” claimed Farley, Ford’s president and CEO. The popularity of evolving, truck dependent lineup – including Mustang Mach-E, 2021 F-150 and Bronco Sport – helped profitable growth in North America. Total automotive EBIT outside North America was $454 million, $980 million better than same quarter a year ago as the business improved from world-class awful results.

Ford’s Q1 revenue in North America increased 5% to $23.0 billion, helped by customer demand for Mustang Mach-E, the all-new 2021 F-150 and Bronco Sport and tight vehicle inventories related to semiconductor-related production declines. SUVs and pickups both accounted for increased shares of regional sales. EBIT rose to $2.9 billion.

The semiconductor shortage has prompted Ford – it claims – to accelerate modernization of its sales processes by incorporating new ordering capabilities “to make them more appealing to customers, raise inventory turn rates, and reduce and maintain inventories below traditional levels.”

Mustang Mach-E supporting data: 70% of customers who purchased the battery-electric SUV are new to Ford, whose showrooms are usual baron of early-adapters. So far, 66% of reservations for the all-electric hatchback have been converted to orders. Further enhancements to the online shopping process – developed in collaboration with dealers – went “live” in March. The reservations-to-orders rate is similar for the all-new Bronco, sales of which are expected to start this summer.

Ford also claims it is “making good on its commitment to lead the electrification revolution in transportation,” an area where it is still clearly lagging. The Dearborn-based company this week announced formation of a new global battery center of excellence, Ford Ion Park, to accelerate research and development of battery and battery-cell technology and include future battery manufacturing. (Ford Ion Park – New Global Battery R&D Site in Michigan)

In Europe, Ford generated $7.1 billion in revenue, up 13%, and $341 million in EBIT, reversing a year-ago loss; and posted an EBIT margin of 4.8%. The company introduced the new FORDLiive (sic – marketing babble – editor) uptime system for commercial customers while increasing its share of the regional commercial-vehicles market to a record level. Also during the quarter, Ford Otosan, the company’s joint venture in Turkey, was confirmed as the source for a next- generation one-ton commercial van. The van will be sold as part of Ford’s Transit lineup and by Volkswagen through a strategic alliance between the two companies. (Volkswagen and Ford Announce Alliance Without Cross Equity)

During the quarter, Ford began shipping the Mustang Mach-E to customers in Europe and announced plans to spend $1 billion to create the Ford Cologne Electrification Center to manufacture EVs. The company expects 100% of its passenger vehicles to be all-electric – and two-thirds of its commercial vehicles to be all-electric or plug-in hybrids – in Europe by 2030.

Best-ever first-quarter retail sales of Lincoln-brand vehicles in China – 90% of which are now locally built – helped Ford to “nearly break-even EBIT.” The first quarter was the fourth straight quarter of year-over-year EBIT improvement. Volumes of higher-end Ford SUVs and commercial vehicles were also strong. Light trucks, vans, buses and pickups accounted for 48% of the company’s China sales.

At last week’s Shanghai Auto Show, Ford introduced the Escape plug-in hybrid SUV; a localized version of the all-electric Mustang Mach-E; and the fully networked EVOS, the first product from Ford’s China 2.0 plan. With Q1 China sales of 140,000 – including affiliates – in the world’s largest vehicle market, China remains a hobby in AutoInformed’s view.

Ford claimed it continued to turn around its business in South America, where an EBIT loss of $73 million represented a sixth consecutive quarter of better year-over-year results. “A significant restructuring of Ford’s operations in the region, announced in January, is proceeding as planned, with structural costs in the period down one-third. Competitively, the company had strong quarterly sales of the Ranger pickup, gaining more than two points of share for the flagship product.” (Brazil – A Ford Motor South American Nightmare, Ford Exits Heavy Truck Business in South America, Ford Exits Heavy Truck Business in South America)

The International Markets Group turned in its highest quarterly EBIT to date with 18% lower structural costs and was profitable in all markets except India. Shares for the Ranger and the Everest SUV both were up and exceeded 14%. In February, Ford said it will spend more than $1 billion to update and boost production capacity at the plant in Silverton, South Africa, where IMG manufactures Ranger. The project represents one of the largest-ever investments in the South Africa automotive industry. (Ford to Upgrade, Expand South African Plant for 2022 Ranger)

Within Ford Mobility, Argo AI and Ford are now simulating ride-hail and delivery operations during daily fleet testing in six U.S. cities, ahead of multiple customer pilot programs that are scheduled to begin later this year. Ford AV LLC marked its third anniversary in Miami with a new command center. Ford’s Spin subsidiary continues to progress, improving per-trip economics more than 60% from first-quarter 2020 – it’s claimed.

Ford Credit’s operating performance and its balance sheet were good. Earnings before taxes of $1.0 billion – higher than in the fourth quarter of 2020 and significantly ahead of the year-ago quarter, when results were held down by anticipated pandemic-related effects on the unit’s activities.

Outlook

Ford CFO John Lawler said semiconductor availability, which was exacerbated by a fire at a supplier plant in Japan in March, will get worse before it gets better. Currently, the company believes that the issue will bottom out during the second quarter, with improvement through the remainder of the year.

Lawler said the company’s attention is on managing the supply chain every day and enhancing execution in Ford’s underlying business. As examples, he pointed to recent high-quality launches of the Mustang Mach-E SUV, all-new 2021 F-150 pickup and Bronco Sport SUV. First-quarter warranty costs improved by more than $400 million from a year ago.

Lawler said Ford was among the first automakers to identify the potential for a 10% to 20% adverse effect on manufacturing volumes from increasing constraints on global semiconductor supplies entering 2021. In early February, the company said the risk had the potential to reduce Ford’s full-year adjusted EBIT by $1 billion to $2.5 billion.

Ford has updated its 2021 outlook to account for expanded consequences from the semiconductor shortage, made worse by the recent supplier fire in Japan. While the issue is a significant headwind to the company, Lawler said Ford is taking definitive actions to address a range of possible outcomes. Largely because of the additional effect of the supplier fire, Ford now expects to lose about 50% of its planned second-quarter production, up from 17% in the first quarter – again, implying that Q2 will be the trough of the issue.

Ford anticipates the flow of semiconductors from the Japan supplier to resume by the end of the second quarter – but, like many others in the industry, that the broader global semiconductor shortage may not be fully resolved until 2022. The company now assumes that it will lose 10% of planned second-half 2021 production.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.