GM CEO Mary Barra (L to R), President Dan Ammann and Product Development Chief Mark Reuss celebrate Chevrolet’s sweep of the 2014 North American Car and Truck of the Year awards.

In a Securities Exchange Commission filing just released, General Motors president Daniel Ammann has sold 10,000 shares of GM stock that he owned for $350,000. GM stock has been languishing as investors, apparently, aren’t bullish on the so far healthy comeback from what was a bankrupt auto company GM went public once again at a share price of $33 late in 2010.

Robert C. Shrosbree, Attorney-In-Fact for Mr. Ammann signed the SEC filing. (See AutoInformed on U.S. Taxpayers Get $13.5 Billion from GM IPO. Still Own 33%)

While GM execs have been trying to talk up the stock price, the trading record is much less optimistic then they are. The range of share prices peaked at more than $40 per share in December of 2013, but has been languishing in the $35 range recently. Analysts apparently don’t think GM can survive the next recession. AutoInformed would bet on GM any day rather than Tesla, the ongoing darling of investors even though it hasn’t ever turned a profit.

During 2015 GM had revenue of $152.4 billion, but it remains dependent on truck sales in the US and its Chinese joint ventures. General Motors posted a record 2015 calendar-year net income attributable to common stockholders of $9.7 billion, or $5.91 per diluted www.cheaptopamaxbuy.com share, up from $2.8 billion, or $1.65 per diluted share in 2014. Earnings per share (EPS) adjusted for special items was $5.02, up 65% compared to $3.05 in 2014. It’s not as strong as it looks – $1.9 billion of the $9.7 billion was a result of tax benefits. North American and GM Finance operating results were also factors.

During 2015 GM had revenue of $152.4 billion, but it remains dependent on truck sales in the US and its Chinese joint ventures. General Motors posted a record 2015 calendar-year net income attributable to common stockholders of $9.7 billion, or $5.91 per diluted www.cheaptopamaxbuy.com share, up from $2.8 billion, or $1.65 per diluted share in 2014. Earnings per share (EPS) adjusted for special items was $5.02, up 65% compared to $3.05 in 2014. It’s not as strong as it looks – $1.9 billion of the $9.7 billion was a result of tax benefits. North American and GM Finance operating results were also factors.

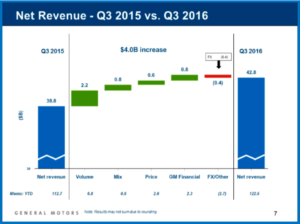

The latest GM results show that virtually all of the 2016 Q3 earnings came from North America and China (General Motors Sets Q3 Net Earnings Record of $42.8 Billion). GM posted record third-quarter earnings and revenue because of profitable U.S. retail sales, strong sales in China, growth in wholesale volume and cost controls. Consolidated EBIT-adjusted improved to a Q3 record $3.5 billion, up $400 million Y-O-Y. Consolidated EBIT-adjusted margin improved to a Q3 record of 8.3%.

This now makes for five consecutive record EBIT-adjusted quarters going back to Q3 2015. Consolidated vehicle wholesales for Q3 increased 78,000 units, primarily based on strong truck and SUV demand in North America. This was partially offset by International Operations.

So, GM’s record is good, but investors remain skeptical. Analysts are concerned about GM’s almost complete reliance on the sales of trucks and SUVs in North America to make money. The Brexit mess is also expected to hurt GM’s earnings following the collapse of the British pound – it’s now an ounce trading at $1.27 – and the Euro is at $1.07 following the vote for the UK to exit the EU. (‘Bloody Hell,’ What Does Brexit do to Automakers?)