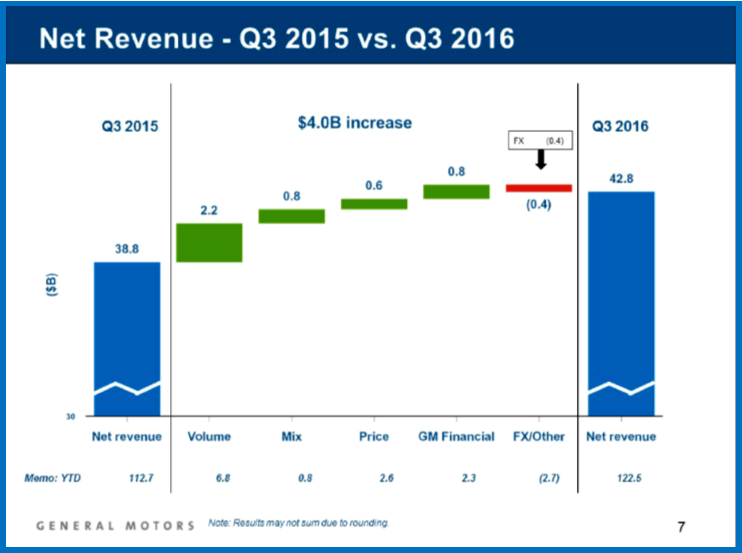

General Motors Co. (NYSE: GM) today announced record third-quarter earnings and revenue because of profitable U.S. retail sales, strong sales in China, growth in wholesale volume and cost controls. Consolidated EBIT-adjusted improved to a Q3 record $3.5 billion, up $400 million Y-O-Y. Consolidated EBIT-adjusted margin improved to a Q3 record of 8.3%.

General Motors Co. (NYSE: GM) today announced record third-quarter earnings and revenue because of profitable U.S. retail sales, strong sales in China, growth in wholesale volume and cost controls. Consolidated EBIT-adjusted improved to a Q3 record $3.5 billion, up $400 million Y-O-Y. Consolidated EBIT-adjusted margin improved to a Q3 record of 8.3%.

This now makes for five consecutive record EBIT-adjusted quarters going back to Q3 2015. Consolidated vehicle wholesales for Q3 increased 78,000 units, primarily based on strong truck and SUV demand in North America. This was partially offset by International Operations.

GM EPS-diluted was a Q3 record of $1.76 per share. Q3 2016 diluted weighted-average share count was 1.57 billion shares – down nearly 44 million shares. Y-O-Y, as GM completed the previously announced initial $5 billion in share repurchases one quarter ahead of schedule.

In the U.S., Q3 average transaction prices across all models and brands were up ~$1,500 per unit Y-O-Y. Notably this includes the impact of increased incentive spending. Market share in the U.S. was 17% during Q3, essentially flat. Retail market share increased 40 basis points because of the successful launches of the Chevrolet Malibu and Cruze.

GM in China had flat equity income is flat Y-O-Y at $0.5 billion. Retail sales were up 134,000 units due to a strong market and the strength of the Baojun, Buick and Cadillac brands. SUVs and luxury vehicles continue to be strong, offset by weakness in demand for small passenger and mini-commercial vehicles.

GM said it expects significant carryover pricing pressure in China of approximately -5% for the year, partially offset by improved mix due to the launch of the Cadillac CT6 andXT5 and the Baojun 560, as well as the continued success of the Buick Envision. As a result pricing troubles will continue to reduce margins.

Overall consolidated international operations results were flat Y-O-Y as macro-economic difficulties in GM’s Middle East Operations continue because of low global oil prices, which isn’t hurting it’s strong and extremely profitable North American truck sales. Wholesales volumes were flat too Y-O-Y. GM said that economic conditions in GM’s Consolidated International Operations are “expected to remain difficult.”

“Strong bottom line performance this year puts us solidly on track to deliver on our annual earnings outlook, and our cash generation has allowed us to complete our initial share buyback ahead of schedule,” said Chuck Stevens, Executive Vice President and CFO. GM expects full-year earnings per diluted adjusted share at the high end of its previously-stated range of $5.50 – $6.00. GM remains on track to deliver approximately $6 billion in adjusted automotive free cash flow for the year.