GM is getting closer to losing the negative moniker ‘Government Motors’ as Treasury sell its shares and GM buys its stock from the UAW VEBA.

GM announced today that it will repurchase 120 million shares of its preferred stock from the UAW Retiree Medical Benefits Trust, aka VEBA, for $3.2 billion or $27 per share. The deal is based on GM’s ability to borrow the money to finance the transaction before the end of September, which will not be a problem. GM also announced that it was offering unsecured notes in 5-, 10- and 30-year durations to secure the funds.

The VEBA currently holds 260 million shares of Preferred Stock, and Canada GEN Investment Corporation holds another 16 million shares. Until the ownership of these shares transfer back to GM or other independent buyers, the slur “Government Motors” still applies since these shares were part of a controversial – but effective – bankruptcy reorganization that Canadian and U.S. taxpayers subsidized in 2009. The U.S. Treasury Department has now diminished its stake in General Motors to 7.3%, and appears to be poised to end its direct ownership of the automaker, although it will likely lose $10 billion on the deal.

Each share of GM Series A Preferred Stock has – on paper – a liquidation price of $25 per share and accrues dividends at a 9% annual rate. GM is paying a slight premium here of ~8% per share in order to get from under the interest payments and put the past behind it.

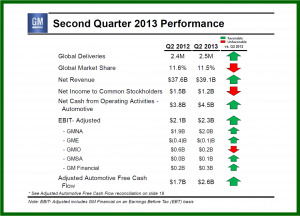

GM posted Q2 net income of $1.2 billion, or $0.75 per common share. While this was down from the second quarter of 2012 when GM’s net income was $1.5 billion, or $0.90 per fully diluted share, part of the decline was due to a loss from special items, including an expensive recall in India for deliberately falsifying an emissions certification on more than 100,000 new vehicles that reduced income by $0.2 billion, or $0.09 per share There was also a tax increase at $0.29 per share, compared to the second quarter of 2012. (GM Earns $1.2 Billion in Q2 or 75 Cents a Share)

Virtually all of the profits came from GM vehicle sales and financing in North America – a market that is recovering and one where GM leads. The launch of the new Silverado and Sierra pickup trucks resulted in a $300 million charge in Q2, but now that production is increasing and the trucks are selling well, GM will be printing money. Globally GM sold 2.492 million vehicles in the quarter (+4%) with a market share of 11.5%, which was flat year-over-year, but given a leaner GM, the company is poised for growth and increasing profits.

GM is as healthy as it has been for decades. Automotive cash flow from operating activities was $4.5 billion and automotive free cash flow adjusted was impressive at $2.6 billion during Q2. GM ended the quarter with very strong total automotive liquidity of $34.8 billion. Automotive cash and marketable securities were $24.2 billion compared with $24.3 billion for the first quarter of 2013.

CEO Dan Akerson maintains that GM has no plans to pay a dividend on common stock. Instead, GM will redeem the very expensive VEBA preferred stock and continue to strengthen its balance sheet. GM also has unfunded pension liabilities of $24 billion. However, it is just a question of time before GM pays a dividend on common stock.