General Motors Co. (NYSE: GM) today posted Q3 net income for common stockholders of $1.4 billion or $0.84 per diluted share, compared to $1.4 billion or $0.81 per diluted share a year ago. Special items continue to ravage GM’s balance sheet. Net income to common stockholders includes a net loss from special items of $1.5 billion before tax, or $0.66 per diluted share for the quarter.

General Motors Co. (NYSE: GM) today posted Q3 net income for common stockholders of $1.4 billion or $0.84 per diluted share, compared to $1.4 billion or $0.81 per diluted share a year ago. Special items continue to ravage GM’s balance sheet. Net income to common stockholders includes a net loss from special items of $1.5 billion before tax, or $0.66 per diluted share for the quarter.

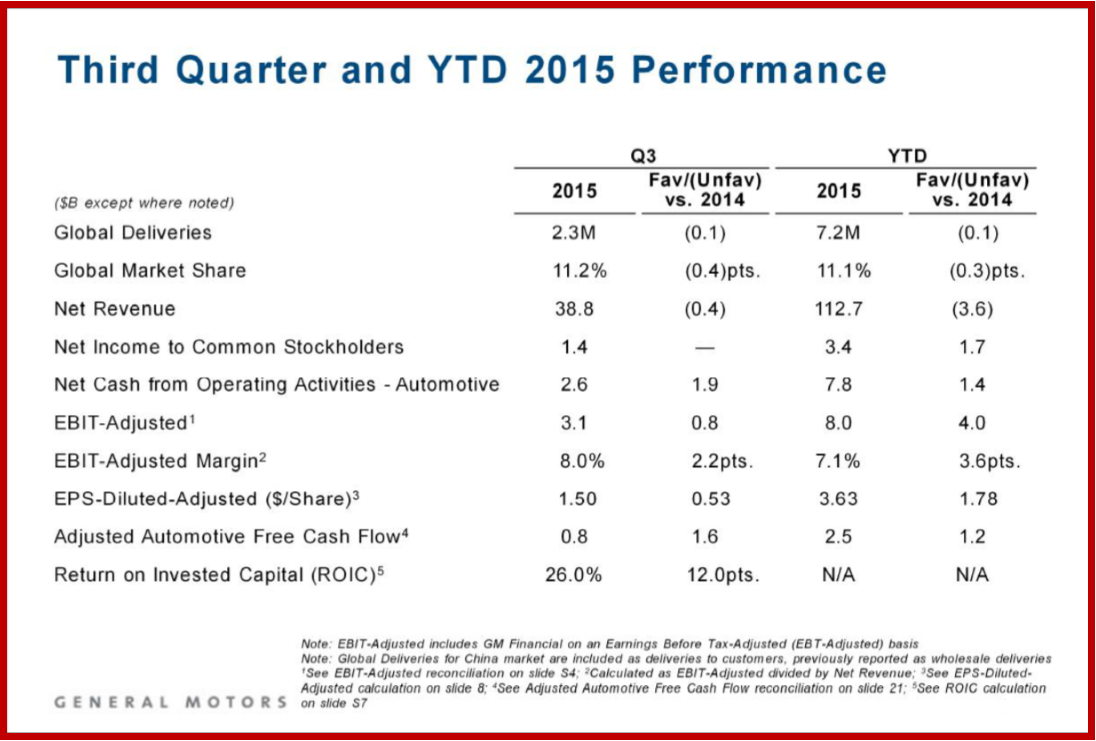

Third quarter GM earnings before interest and tax (EBIT) adjusted of $3.1 billion and EBIT-adjusted margin of 8% were both records for any quarter. These GM earnings compare to EBIT-adjusted of $2.3 billion and an EBIT-adjusted margin of 5.8% in the third quarter of 2014.

However, past management decisions, positions in offshore markets, a $1.1 billion charge for a Department of Justice fine and litigation over the ignition switch debacle, as well as currency fluctuations continued to severely hurt shareholders. In total with some credits back, special items of $1.1 billion negatively affected GM earnings.

The travails of a global company – somewhat beyond management control – were evident in foreign currency translation. During Q3 the value the Euro, British Pound, Russian Ruble, Brazilian Real, Colombian Peso, Venezuela Bolivar, Australian Dollar, Korean Won, South African Rand, Canadian Dollar and Mexican Peso all hurt GM earnings.

Consolidated sales of vehicles during Q3 increased a mere 18,000 units, with increased

U.S. volume, partially offset by Brazil. Global market share decreased Y-O-Y driven primarily by South America and lower overall share in North America due to previously announced reduction in fleet sales.

GM Regional Results

• GM North America reported record levels for EBIT-adjusted of $3.3 billion, EBIT-adjusted margin of 11.8% and net revenue of $27.8 billion. This compares with EBIT-adjusted of $2.5 billion and EBIT-adjusted margin of 9.5% a year ago.

• GM Europe reported EBIT-adjusted of $(0.2) billion compared with $(0.4) billion in the third quarter of 2014.

• GM International Operations reported EBIT-adjusted of $0.3 billion, about equal to a year ago. Results included China equity income of $0.5 billion, which generated a 9.8% net income margin.

• GM South America reported EBIT-adjusted of $(0.2) billion compared with approximately break-even results in the third quarter of 2014.

• GM Financial reported earnings before tax of $0.2 billion, about equal to a year ago, and posted record net revenue of $1.7 billion.